Crypto markets are known for volatility, but sudden downturns often trigger panic. Whether the decline is fueled by macroeconomic pressures, regulatory uncertainty, liquidation cascades, or whale movements, understanding the core reasons behind the dip is essential before making emotional decisions. In this in-depth guide, we break down what’s happening with leading cryptocurrencies like Bitcoin, Ethereum, XRP, and Dogecoin, and examine whether this is a temporary correction or a deeper bearish trend.

What Is Happening in the Crypto Market Today

Why Crypto Is Falling Today

This section addresses the main focus keyword directly.

Macroeconomic Pressure and Interest Rate Fears

Cryptocurrency markets react strongly to global economic signals. If central banks signal tighter monetary policies, risk assets typically decline. Investors shift funds toward safer assets like bonds or the US dollar.

When interest rates rise, liquidity shrinks. Since crypto thrives in high-liquidity environments, tighter policies can cause price drops. This macro backdrop often explains why investors are searching why crypto is falling today during economic announcements.

Bitcoin Leading the Decline

Ethereum Network Factors

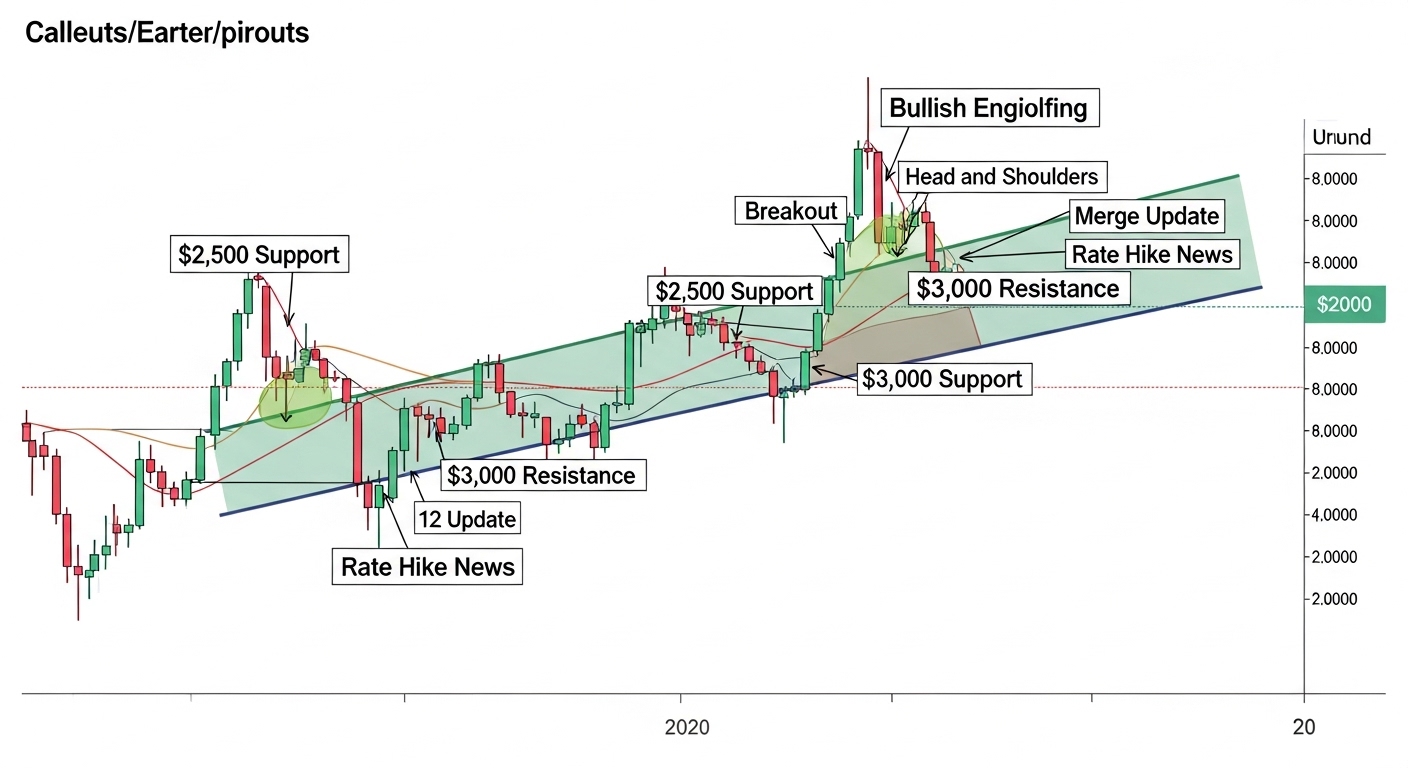

Ethereum’s price action is influenced by both macro factors and internal network developments. Changes in gas fees, staking rewards, or network upgrades can influence short-term investor behavior. When traders search Ethereum price drop today or ETH technical analysis, they often look at on-chain data and derivatives markets. A spike in short positions can accelerate downside momentum.

Technical Indicators

Bitcoin’s Relative Strength Index (RSI) often signals whether the asset is overbought or oversold. When RSI dips below 30, it may indicate oversold conditions. Traders analyzing Bitcoin technical analysis frequently watch these signals during market dips.

Moving averages are also critical. A break below the 50-day or 200-day moving average can trigger bearish sentiment.

Market Sentiment

The Crypto Fear and Greed Index frequently drops into “Fear” territory during corrections. Fear-driven markets tend to overreact, leading to sharp but sometimes temporary drops.

Long-Term Outlook

Despite short-term volatility, Bitcoin historically recovers over longer cycles. Institutional adoption, ETF developments, and blockchain innovation continue to support long-term bullish narratives.

Ethereum Price Analysis

Regulatory Impact and Market Sentiment

Dogecoin Analysis

Liquidations and Leverage

Many traders underestimate how derivatives markets influence spot prices. When highly leveraged positions are liquidated, forced selling occurs automatically. If billions of dollars in long positions are liquidated, it can create a chain reaction. This phenomenon often explains rapid intraday crashes. Funding rates in perpetual futures contracts can signal overheating markets. When funding rates turn negative, it indicates bearish dominance.

Institutional Activity and ETF Influence

Institutional players increasingly impact crypto volatility. Large inflows or outflows from crypto ETFs can shift prices significantly. When institutional investors reduce exposure, markets feel immediate pressure. Conversely, strong ETF inflows often signal renewed bullish momentum. Retail traders monitoring crypto market news today, Bitcoin ETF inflows, and Ethereum institutional investment often react emotionally to these shifts.

Is This the Start of a Bear Market?

The question behind Why Crypto Is Falling Today often leads to deeper fear: is this the beginning of a prolonged bear market? Historically, crypto bear markets are characterized by lower highs, declining trading volume, and reduced retail participation. However, short-term corrections within bull cycles are common. On-chain metrics such as active addresses, hash rate, and long-term holder supply can help determine whether the decline is structural or temporary.

Should You Buy the Dip or Wait?

Buying during market fear can be profitable but risky. Investors should consider risk tolerance, time horizon, and portfolio allocation. Dollar-cost averaging remains a popular strategy during volatility. Instead of attempting to time the bottom, investors gradually accumulate positions. Risk management is essential. Never invest more than you can afford to lose.

Future Outlook for Bitcoin, Ethereum, XRP, and Dogecoin

The crypto market remains innovation-driven. Developments in AI integration, Web3 adoption, decentralized finance expansion, and regulatory clarity could shape future price action. Bitcoin continues to strengthen its position as digital gold. Ethereum leads smart contract innovation. XRP focuses on cross-border payments. Dogecoin maintains cultural and community-driven momentum. Volatility will likely remain a defining characteristic of crypto markets.

Conclusion

So, Why Crypto Is Falling Today? The answer lies in a combination of macroeconomic uncertainty, Bitcoin-led corrections, leveraged liquidations, institutional movements, and shifting investor sentiment. While short-term volatility can be unsettling, crypto markets have historically demonstrated resilience.

See more: Elon Musk Revives Dogecoin Moon Talk as DOGE Price Keeps Falling