Pakistan takes major step toward blockchain-based finance at a time when the global financial system is undergoing rapid digital transformation. For years, blockchain technology and cryptocurrencies have challenged traditional banking models, offering faster transactions, enhanced transparency, and decentralized financial solutions. While many countries struggled to adapt to this disruption, Pakistan’s latest move suggests a growing recognition that blockchain-based finance is no longer optional but essential for long-term economic competitiveness.

The decision marks a critical shift in how policymakers view blockchain technology, digital assets, and financial innovation. Previously, Pakistan approached these technologies with caution, often citing concerns over financial stability, consumer protection, and regulatory capacity. However, increasing global adoption, rising domestic demand, and the success of blockchain initiatives in neighboring countries have encouraged authorities to rethink their stance.

By taking a major step toward blockchain-based finance, Pakistan is signaling its intention to modernize financial infrastructure, expand financial inclusion, and align with global digital finance trends. This article explores the significance of this move, its economic and technological implications, and what it means for businesses, investors, and everyday citizens.

Blockchain-Based Finance

What Is Blockchain-Based Finance?

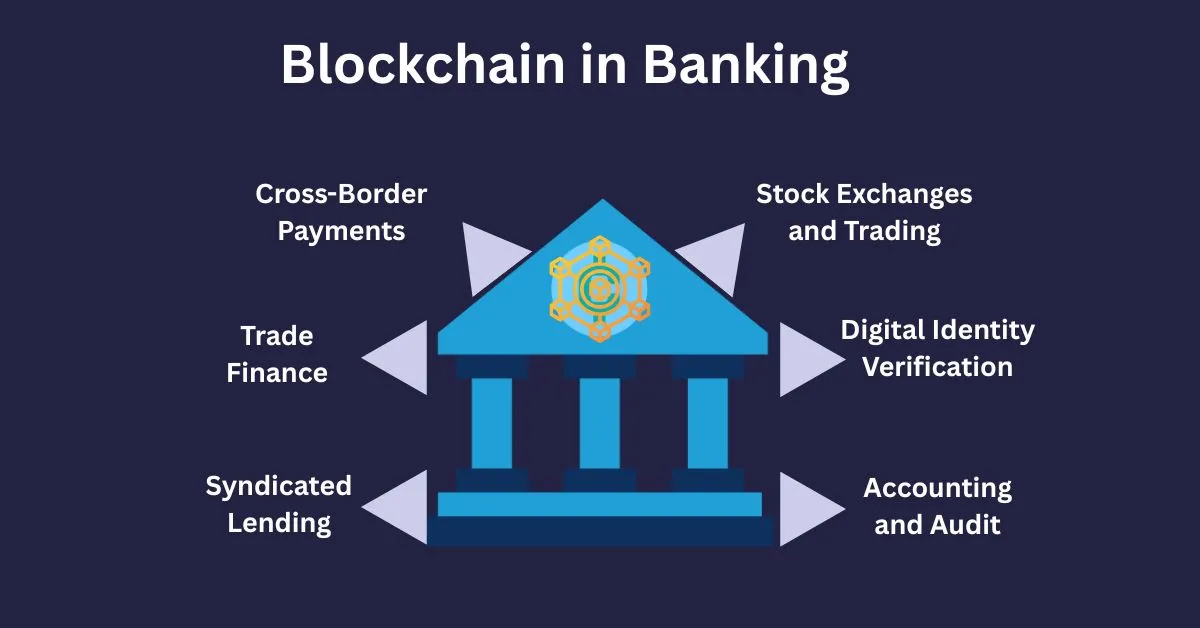

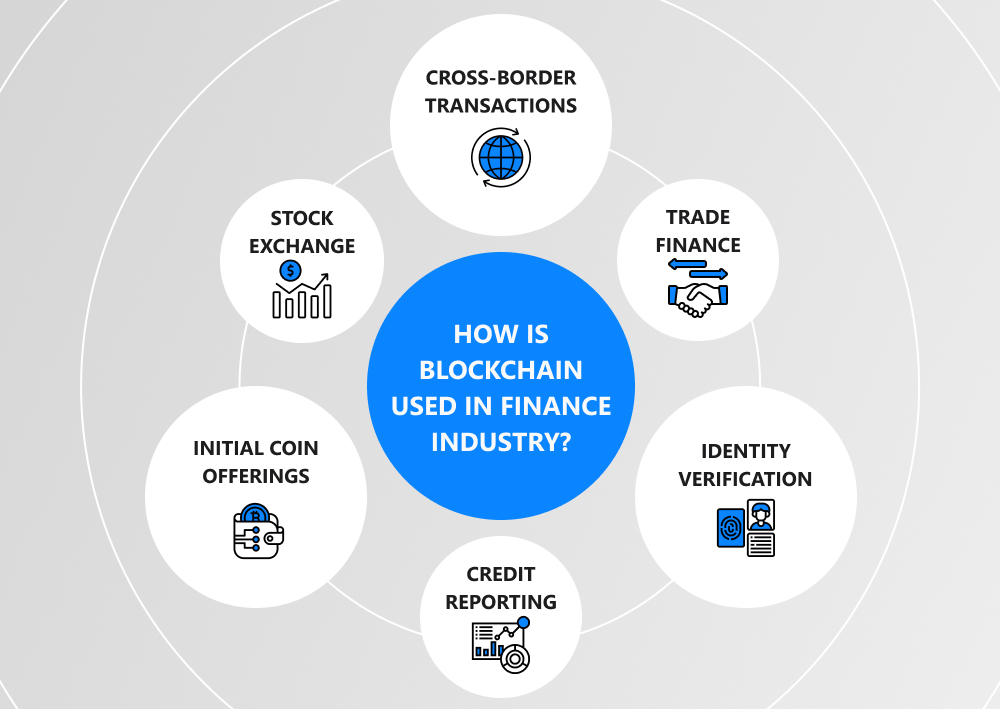

Blockchain-based finance refers to financial systems and services built on distributed ledger technology. Unlike traditional centralized systems, blockchain records transactions across a decentralized network, ensuring transparency, security, and immutability. This foundation enables a wide range of applications, including cryptocurrencies, smart contracts, decentralized finance platforms, and tokenized assets.

When Pakistan takes major step toward blockchain-based finance, it is acknowledging the potential of these systems to reduce inefficiencies, lower transaction costs, and improve trust within the financial ecosystem. Blockchain-based finance is not limited to cryptocurrencies; it extends to digital identity verification, cross-border payments, and supply chain financing.

Why Blockchain Matters for Emerging Economies

For emerging economies like Pakistan, blockchain-based finance offers unique advantages. It can bypass outdated infrastructure, reduce reliance on intermediaries, and provide access to financial services for unbanked populations. By embracing distributed ledger technology, Pakistan can leapfrog traditional development stages and integrate directly into the global digital economy.

Pakistan’s Financial Landscape Before Blockchain Adoption

Traditional Banking Challenges

Pakistan’s banking sector has long faced structural challenges, including limited branch networks, high transaction costs, and low financial inclusion rates. Millions of citizens remain outside the formal financial system, relying on cash-based transactions that limit economic growth and transparency.

These challenges created a gap that blockchain-based finance can potentially fill. When Pakistan takes major step toward blockchain-based finance, it opens doors to digital wallets, mobile payments, and decentralized financial services that are more accessible and cost-effective.

Regulatory Hesitation and Policy Evolution

Historically, regulators approached blockchain and crypto with skepticism. Concerns over money laundering, fraud, and capital flight dominated policy discussions. However, as global regulatory frameworks matured and technology advanced, Pakistan began reassessing its position.

This evolution reflects a broader understanding that outright resistance to blockchain innovation may hinder economic progress rather than protect it.

Drivers Behind Pakistan’s Shift Toward Blockchain-Based Finance

Growing Digital Adoption

Pakistan has one of the fastest-growing internet and smartphone user bases in South Asia. This digital penetration has created fertile ground for blockchain-based solutions. As more citizens adopt mobile banking and digital payments, the transition to blockchain-based finance becomes more practical and scalable.

When Pakistan takes major step toward blockchain-based finance, it is building on existing digital momentum rather than starting from scratch.

Global Pressure and Regional Competition

Countries across Asia and the Middle East are actively integrating blockchain into their financial systems. From central bank digital currency pilots to regulated crypto exchanges, regional competitors are leveraging blockchain to attract investment and talent.

Pakistan’s move reflects an understanding that staying competitive requires participation in this technological shift.

Role of Government and Regulatory Authorities

Policy Direction and Strategic Vision

A major step toward blockchain-based finance requires clear policy direction. Pakistani authorities are increasingly focusing on creating frameworks that encourage innovation while managing risks. This includes exploring regulatory sandboxes, licensing requirements, and compliance standards for blockchain-based businesses.

By providing a strategic vision, the government aims to foster trust and encourage both local and international investment.

Balancing Innovation and Risk

Regulation plays a crucial role in blockchain adoption. Overregulation can stifle innovation, while underregulation can expose users to risks. Pakistan’s approach appears to emphasize balance, allowing experimentation while gradually introducing safeguards.

This balanced strategy supports sustainable growth in blockchain-based finance.

Economic Implications of Blockchain Adoption

Boosting Financial Inclusion

One of the most significant benefits of blockchain-based finance is its ability to promote financial inclusion. Digital wallets and decentralized platforms can reach rural and underserved populations without traditional banking infrastructure.

When Pakistan takes major step toward blockchain-based finance, it creates opportunities for millions to access savings, credit, and payment services.

Enhancing Transparency and Efficiency

Blockchain’s transparent and immutable nature reduces fraud and corruption. Transactions recorded on a blockchain are easily auditable, improving trust between institutions and users.

This transparency can enhance efficiency in government payments, subsidies, and public finance management.

Impact on Remittances and Cross-Border Payments

Reducing Costs and Delays

Pakistan is one of the world’s largest recipients of remittances. Traditional remittance channels often involve high fees and long processing times. Blockchain-based finance can streamline these transfers, offering near-instant settlements at lower costs.

By embracing blockchain, Pakistan can improve the financial well-being of millions of households dependent on overseas income.

Strengthening Global Financial Integration

Blockchain-based cross-border payments connect Pakistan more directly to global financial networks. This integration supports trade, investment, and economic collaboration.

Blockchain and the Private Sector

Opportunities for Startups and Entrepreneurs

When Pakistan takes major step toward blockchain-based finance, it creates a supportive environment for startups. Entrepreneurs can build applications in decentralized finance, digital identity, and asset tokenization without fear of regulatory uncertainty.

Job Creation and Skill Development

Blockchain adoption generates demand for skilled professionals in software development, cybersecurity, compliance, and data analysis. Over time, this can contribute to workforce development and economic diversification.

Integration with Traditional Financial Institutions

Collaboration Between Banks and Blockchain Platforms

Rather than replacing banks, blockchain-based finance can complement traditional institutions. Banks can use blockchain for settlement, record-keeping, and customer verification.

This collaboration enhances efficiency while preserving financial stability.

Modernizing Payment Infrastructure

Blockchain-based payment systems can reduce reliance on cash and outdated networks. By modernizing infrastructure, Pakistan can improve transaction speed and reliability across the economy.

Challenges and Risks Ahead

Technological and Infrastructure Barriers

Despite progress, challenges remain. Limited technical expertise, cybersecurity risks, and infrastructure gaps could slow adoption. Addressing these issues requires investment in education and technology.

Regulatory and Legal Uncertainty

Clear legal definitions and enforcement mechanisms are essential. While Pakistan takes major step toward blockchain-based finance, continuous policy refinement will be necessary to address emerging risks.

Long-Term Vision for Blockchain-Based Finance in Pakistan

Toward a Digital Financial Ecosystem

The ultimate goal is a fully integrated digital financial ecosystem where blockchain-based solutions coexist with traditional systems. This ecosystem can support innovation, resilience, and inclusive growth.

Positioning Pakistan as a Regional Innovator

By embracing blockchain-based finance, Pakistan has the opportunity to position itself as a regional leader in digital finance. This reputation can attract investment, partnerships, and global recognition.

Conclusion

Pakistan takes major step toward blockchain-based finance, marking a pivotal moment in its economic and technological journey. By recognizing the potential of blockchain technology and digital finance, the country is laying the foundation for a more inclusive, transparent, and efficient financial system.

While challenges remain, the shift signals a willingness to adapt, innovate, and compete in a rapidly evolving global landscape. If implemented thoughtfully, blockchain-based finance can drive sustainable growth, empower citizens, and strengthen Pakistan’s position in the digital economy.

Frequently Asked Questions (FAQs)

Q. What does blockchain-based finance mean for Pakistan?

It refers to using blockchain technology for payments, financial services, and digital assets to improve efficiency, transparency, and inclusion.

Q. Why is Pakistan adopting blockchain-based finance now?

Growing digital adoption, global trends, and economic needs have pushed Pakistan to modernize its financial system.

Q. How will blockchain-based finance affect ordinary citizens?

It can provide easier access to financial services, lower transaction costs, and faster payments.

Q. Is blockchain-based finance the same as cryptocurrency?

No. Cryptocurrencies are one application, but blockchain-based finance also includes digital payments, smart contracts, and decentralized platforms.

Q. What challenges does Pakistan face in blockchain adoption?

Key challenges include regulatory clarity, technical expertise, cybersecurity risks, and infrastructure development.