Crypto whale BTC ETH longs position worth $55 million has captured the attention of traders worldwide. This whale, who accurately predicted and profited from the October market crash, has now taken a massive bullish stance on both Bitcoin and Ethereum. The timing of these crypto whale BTC ETH longs raises critical questions about market direction and whether this legendary trader has identified another pivotal moment in the digital asset space. As institutional and retail investors closely monitor whale movements, this substantial position could signal a significant shift in market sentiment and potentially mark the beginning of a new bullish cycle.

Who Is This Crypto Whale and Why Does Their Trade Matter?

The crypto whale BTC ETH longs story begins with an anonymous trader who gained notoriety for their exceptional market timing during October’s turbulent period. This particular whale demonstrated remarkable foresight by successfully shorting the market before the crash, generating substantial profits while most traders suffered losses. Their track record has earned them legendary status within the cryptocurrency trading community, making every subsequent move worthy of analysis.

Track Record of Accurate Market Predictions

This whale’s credibility stems from multiple successful predictions throughout 2024. Before opening these massive positions, they correctly anticipated several major market movements, including the spring correction and summer consolidation phases. Their October short positions were executed at nearly optimal timing, capturing the majority of the downward movement before the market stabilized.

The whale’s methodology appears to combine on-chain analysis, macroeconomic indicators, and technical chart patterns. Unlike many traders who rely solely on one analytical approach, this investor synthesizes multiple data sources to form high-conviction trades. Their willingness to deploy $55 million into suggests extraordinary confidence in their current market thesis.

Whale Psychology and Market Impact

Whale movements carry significant weight in cryptocurrency markets due to their ability to influence price action and sentiment. When a proven whale opens substantial , it often triggers a cascade effect as other traders interpret this as a bullish signal. The psychological impact extends beyond immediate price movements, potentially shifting market narratives and attracting additional capital inflows.

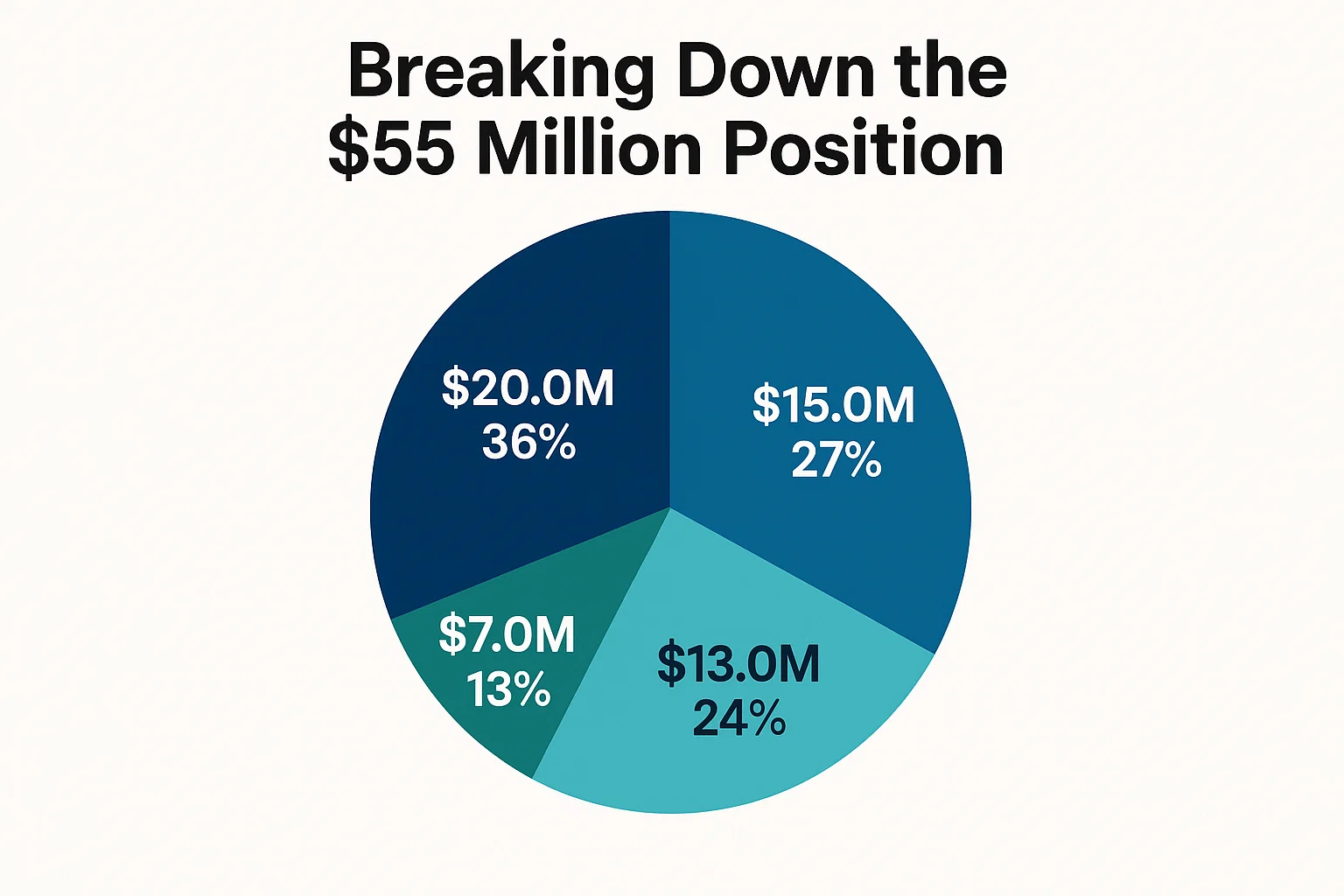

Breaking Down the $55 Million Position

The magnitude of these crypto whale BTC ETH longs deserves detailed examination. A $55 million leveraged position represents enormous conviction and risk tolerance, especially following a period of market turbulence. Understanding the structure and implications of this trade provides valuable insights for other market participants.

Bitcoin Long Position Analysis

The Bitcoin component of these reportedly constitutes approximately $35 million of the total position. This allocation reflects Bitcoin’s status as the primary cryptocurrency and its perceived role as digital gold. The whale likely recognizes Bitcoin’s strengthening fundamentals, including increasing institutional adoption, improving regulatory clarity in major markets, and technical indicators suggesting a potential breakout.

Entry timing appears strategic, with the position opened during a consolidation phase rather than chasing momentum. This disciplined approach aligns with the whale’s historical pattern of entering positions during periods of reduced volatility, maximizing potential reward-to-risk ratios. The Bitcoin long also benefits from upcoming catalysts, including potential spot ETF developments and the ongoing supply dynamics created by previous halving events.

Ethereum Long Position Breakdown

The Ethereum allocation within these crypto whale BTC ETH longs represents approximately $20 million, reflecting confidence in Ethereum’s evolving ecosystem. Ethereum’s transition to proof-of-stake, ongoing layer-2 scaling solutions, and dominant position in decentralized finance (DeFi) make it an attractive investment thesis for sophisticated traders.

The whale’s Ethereum position may be particularly astute given the network’s deflationary tokenomics and increasing real-world applications. Enterprise adoption continues growing, with major corporations exploring Ethereum-based solutions for supply chain management, tokenization, and smart contract implementations. These fundamental developments support the bullish case embedded in the crypto whale BTC ETH longs strategy.

Technical Analysis Supporting the Bullish Thesis

The decision to open massive crypto whale BTC ETH longs isn’t based solely on intuition. Multiple technical indicators across various timeframes suggest favorable risk-reward setups for both assets.

Bitcoin Technical Indicators

Bitcoin’s chart structure shows several compelling bullish patterns that likely influenced the decision. The asset has formed a higher low compared to previous correction cycles, suggesting strengthening demand at lower price levels. The 200-day moving average has begun flattening after a prolonged decline, historically a precursor to trend reversals.

Relative Strength Index (RSI) readings on weekly timeframes indicate Bitcoin is neither overbought nor oversold, providing room for upward movement. The Moving Average Convergence Divergence (MACD) shows early signs of a bullish crossover, a signal that has preceded significant rallies in previous cycles. Volume analysis reveals accumulation patterns, with large transactions increasing during price dips—a classic whale behavior that aligns with these crypto whale BTC ETH longs positions.

Ethereum Technical Setup

Ethereum’s technical picture complements the Bitcoin analysis, supporting the combined crypto whale BTC ETH longs strategy. The ETH/BTC ratio has been consolidating near historical support levels, suggesting Ethereum may be undervalued relative to Bitcoin. This creates potential for outperformance if market conditions improve.

Key resistance levels have been tested multiple times without significant breakdowns, indicating strong support from long-term holders. The network’s on-chain metrics show declining exchange reserves, meaning fewer coins are available for immediate selling pressure. This supply dynamic, combined with technical patterns, creates favorable conditions for the crypto whale BTC ETH longs thesis to materialize.

On-Chain Metrics Validating the Trade

Beyond price charts, blockchain data provides crucial context for understanding why this whale opened such substantial crypto whale BTC ETH longs positions.

Bitcoin On-Chain Fundamentals

Bitcoin’s on-chain metrics reveal accumulation patterns consistent with early bull market phases. The number of addresses holding over 1,000 BTC has been steadily increasing, indicating that large investors are adding to positions rather than distributing. This accumulation by sophisticated players supports the rationale behind the crypto whale BTC ETH longs strategy.

Mining activity remains robust despite recent profitability challenges, demonstrating network security and long-term commitment from miners. Hash rate has recovered to near all-time highs, reducing concerns about network vulnerability. Additionally, the proportion of Bitcoin supply that hasn’t moved in over a year continues increasing, suggesting strong conviction among existing holders who are unlikely to sell during minor price fluctuations.

Ethereum Network Activity

Ethereum’s on-chain data paints an equally compelling picture for the crypto whale BTC ETH longs thesis. Daily active addresses have stabilized after the October decline, indicating user retention despite price volatility. Gas fees have normalized to reasonable levels, making the network more accessible for everyday transactions and DeFi activities.

The amount of ETH staked in the proof-of-stake consensus mechanism continues growing, now exceeding 34 million ETH. This locked supply reduces circulating tokens available for trading, creating natural scarcity that could amplify price movements when demand increases. Smart contract interactions show sustained activity in DeFi protocols, NFT marketplaces, and emerging applications, demonstrating the ecosystem’s vitality beyond speculative trading.

Macroeconomic Factors Influencing the Position

The timing of these crypto whale BTC ETH longs cannot be separated from broader macroeconomic conditions that shape cryptocurrency markets.

Federal Reserve Policy and Interest Rates

Recent signals from the Federal Reserve regarding interest rate policy have created a more favorable environment for risk assets, including cryptocurrencies. The whale likely incorporated this macroeconomic shift into their decision to open crypto whale BTC ETH longs positions. As inflation shows signs of stabilizing and economic growth remains resilient, the Fed’s previously aggressive tightening stance has moderated.

Lower interest rates historically correlate with increased cryptocurrency valuations as investors seek higher returns outside traditional fixed-income investments. The whale’s timing suggests anticipation of a sustained period of accommodative monetary policy, which could drive capital flows into Bitcoin and Ethereum as alternative stores of value and growth assets.

Global Economic Uncertainty and Safe Haven Demand

Geopolitical tensions and economic uncertainties in major regions have reinforced Bitcoin’s narrative as digital gold and a hedge against traditional financial system risks. The crypto whale BTC ETH longs strategy may reflect expectations of continued safe haven demand as investors diversify portfolios away from traditional assets facing structural challenges.

Banking sector instability earlier in 2024 highlighted vulnerabilities in conventional financial systems, driving renewed interest in decentralized alternatives. This backdrop supports the fundamental case for both Bitcoin and Ethereum, making the whale’s substantial long positions strategically positioned to benefit from ongoing systemic concerns.

Risk Factors and Potential Challenges

Despite the compelling bullish case, the crypto whale BTC ETH longs strategy faces several risks that traders should understand before following this whale’s lead.

Regulatory Uncertainty

Cryptocurrency regulation remains a significant wildcard that could impact the success of these crypto whale BTC ETH longs positions. Government actions in major markets can trigger sharp price movements, particularly if new restrictions limit institutional participation or impose burdensome compliance requirements on cryptocurrency businesses.

The whale presumably has strategies to manage regulatory risk, possibly including stop-loss orders or hedging mechanisms. However, retail traders considering similar positions should carefully evaluate their own risk tolerance and ability to withstand potential regulatory shocks that could temporarily derail bullish momentum.

Market Manipulation and Liquidity Concerns

Large positions like these crypto whale BTC ETH longs can themselves become targets for counter-traders or adversarial whales seeking to trigger liquidations. Cryptocurrency markets, despite growing maturity, still experience periodic liquidity crunches that can cause exaggerated price swings. Flash crashes or coordinated selling could force premature position closures, even if the long-term thesis remains valid.

Understanding these risks is essential for anyone inspired by the crypto whale BTC ETH longs to take similar positions. Position sizing, leverage management, and clear exit strategies become critical when deploying substantial capital in volatile markets.

How Retail Traders Can Learn from This Whale

The crypto whale BTC ETH longs story offers valuable lessons for traders at all experience levels, though direct replication isn’t advisable without proper risk management.

Position Sizing and Risk Management

The most crucial lesson from these crypto whale BTC ETH longs isn’t the direction of the trade but the approach to risk management. This whale didn’t deploy their entire portfolio into these positions; instead, they likely sized the trade appropriately relative to their total capital. Retail traders should similarly never risk more than they can afford to lose, regardless of how compelling a setup appears.

Using appropriate leverage is another critical consideration. While these crypto whale BTC ETH longs may utilize leverage to amplify returns, the whale presumably has sophisticated risk controls and sufficient capital to weather adverse movements. Retail traders often over-leverage, turning winning strategies into account-destroying losses when positions move against them temporarily.

Timing and Patience

The whale’s entry timing demonstrates the value of patience. Rather than chasing price during volatile periods, they waited for consolidation phases offering better risk-reward ratios. This disciplined approach to entering crypto whale BTC ETH longs positions maximizes potential upside while minimizing downside risk.

Traders should study historical price action to identify similar setups rather than impulsively following whale moves after positions are already established. By the time news of large positions reaches the public, optimal entry points may have passed, creating unfavorable risk-reward dynamics for late followers.

Market Reaction and Price Movement Analysis

Since the crypto whale BTC ETH longs positions became public knowledge, market dynamics have shown interesting patterns worth examining.

Immediate Price Response

Bitcoin and Ethereum both experienced notable price increases following reports of these massive crypto whale BTC ETH longs positions. The immediate market reaction suggests other traders interpreted the whale’s move as a bullish signal, creating self-fulfilling momentum. This phenomenon demonstrates how influential whale actions can be in shaping short-term price trajectories.

However, experienced traders recognize that initial reactions don’t guarantee sustained trends. The true test of the crypto whale BTC ETH longs thesis will emerge over coming weeks and months as fundamental and technical factors either confirm or contradict the bullish stance. Monitoring how price action evolves relative to key support and resistance levels provides crucial information about whether the whale’s timing proves accurate.

Correlation Between BTC and ETH Movements

An interesting aspect of these crypto whale BTC ETH longs is the combined exposure to both leading cryptocurrencies. Bitcoin and Ethereum typically show strong positive correlation, meaning they tend to move in the same direction. However, the magnitude and timing of movements can differ significantly.

The whale’s dual position suggests expectations of broad-based cryptocurrency strength rather than outperformance by a single asset. This diversified approach within crypto potentially reduces idiosyncratic risk while maintaining exposure to the sector’s overall growth potential. Traders considering similar strategies should analyze historical correlation patterns to understand how Bitcoin and Ethereum movements might offset or amplify portfolio volatility.

Expert Opinions and Market Commentary

The crypto whale BTC ETH longs story has sparked extensive discussion among cryptocurrency analysts and market commentators.

Bullish Interpretations

Several prominent analysts view these crypto whale BTC ETH longs as confirmation of a developing bull market. They argue that whales with proven track records serve as smart money indicators, and their positioning suggests accumulation phases are ending. Technical analysts point to chart patterns and momentum indicators that align with the whale’s bullish thesis.

Fundamental analysts emphasize improving cryptocurrency adoption metrics, regulatory clarity in major markets, and technological advancements that support higher valuations. The combination of strong fundamentals and technical setups creates what many consider an optimal environment for the crypto whale BTC ETH longs strategy to succeed.

Cautious and Bearish Perspectives

Contrarian analysts warn against blindly following whale moves, noting that even experienced traders make mistakes. Some market observers suggest these crypto whale BTC ETH longs positions might be premature, pointing to unresolved macroeconomic risks and potential for additional market volatility.

Bears argue that retail euphoria around whale trades often marks local tops rather than sustainable trend beginnings. They recommend waiting for additional confirmation before establishing similarly bullish positions, emphasizing the importance of independent analysis rather than purely following smart money.

Historical Context: Previous Whale Trades and Outcomes

Understanding how past crypto whale BTC ETH longs and similar large positions performed provides context for evaluating the current trade’s potential.

Successful Whale Predictions

History shows numerous instances where large whale positions preceded significant market moves. During the 2020-2021 bull market, early whale accumulation at lower prices preceded one of cryptocurrency’s most spectacular rallies. Those who recognized and followed these patterns captured substantial gains.

The current crypto whale BTC ETH longs positions may represent a similar inflection point. The whale’s October crash prediction and profitable short positions established credibility, making their current bullish stance particularly noteworthy. If history repeats, these positions could mark the early stages of a new uptrend that extends for months.

Cautionary Tales

However, not all whale trades prove successful. Markets have witnessed numerous instances where even sophisticated investors mistimed entries or misread market conditions. Some high-profile whales suffered significant losses during unexpected market reversals, demonstrating that large capital alone doesn’t guarantee success.

Retail traders should remember that whales generally have longer time horizons and deeper pockets than average investors. A whale can endure temporary drawdowns that would liquidate leveraged retail positions. This asymmetry means that while learning from strategies is valuable, direct replication without appropriate capital and risk management infrastructure can be dangerous.

Potential Catalysts That Could Drive These Positions Higher

Several upcoming events and developments could validate the thesis and drive substantial price appreciation.

Institutional Adoption Acceleration

Continued institutional investment in cryptocurrency infrastructure represents a powerful long-term catalyst. Major financial institutions expanding cryptocurrency services, launching custody solutions, and integrating blockchain technology into existing systems creates sustained demand that supports these crypto whale BTC ETH longs positions.

Recent announcements from traditional finance giants regarding cryptocurrency initiatives suggest mainstream adoption is accelerating rather than declining. This institutional involvement brings legitimacy, liquidity, and capital that could drive the multi-month rallies these whale positions appear positioned to capture.

Technological Developments and Network Upgrades

Ethereum’s ongoing development roadmap includes significant upgrades that could drive increased adoption and value accrual. Layer-2 scaling solutions continue improving, making the network more accessible and cost-effective. These technological advancements support the fundamental case underlying the crypto whale BTC ETH longs strategy.

Bitcoin’s Lightning Network and other second-layer solutions similarly enhance utility and adoption potential. As these technologies mature and gain traction, they strengthen the investment thesis for both assets, potentially validating the whale’s substantial long positions.

Trading Strategies Inspired by Crypto Whale BTC ETH Longs

While directly copying the crypto whale BTC ETH longs positions may not be appropriate for all traders, several strategic principles can be extracted and adapted.

Dollar-Cost Averaging Approach

Rather than attempting to time a single large entry like these retail investors might consider systematic accumulation through dollar-cost averaging. This approach reduces timing risk while building positions over weeks or months, capturing average prices rather than betting on perfect entry points.

This strategy acknowledges that predicting exact market bottoms is extremely difficult, even for experienced whales. By spreading purchases across multiple time periods, traders can participate in potential upside while minimizing the risk of entering at temporary local tops.

Scaling Into Positions

Another approach involves scaling into long positions as confirming signals emerge. Rather than immediately establishing full exposure, traders can start with smaller positions and add to them as technical levels break or fundamental catalysts materialize. This graduated approach to building exposure balances opportunity capture with risk management.

Scaling strategies allow traders to increase position size when their initial thesis proves correct while limiting losses if market conditions deteriorate. This flexibility is particularly valuable in volatile cryptocurrency markets where unexpected reversals can occur rapidly.

Conclusion

The emergence of massive positions following this trader’s accurate October crash prediction represents a significant market development that demands attention from all cryptocurrency participants. This $55 million bullish bet on Bitcoin and Ethereum reflects deep conviction based on technical analysis, on-chain metrics, and macroeconomic conditions that appear increasingly favorable for digital assets.

While the whale’s proven track record adds credibility to their bullish stance, traders should approach similar strategies with appropriate caution and risk management. The lessons extend beyond simply copying positions to understanding the analytical frameworks, risk controls, and patient timing that distinguish successful whale trading from reckless speculation.