Global financial markets are once again reflecting a sharp contrast in investor behavior. Headlines such as crypto prices again muted as gold surges to new record, U.S. stocks advance clearly show how capital is flowing differently across asset classes. While gold is breaking historical records and U.S. equity markets continue to climb, the cryptocurrency market appears stuck in a phase of hesitation, marked by limited price movement and cautious trading activity.

This divergence is not random. It is deeply connected to inflation trends, interest rate expectations, geopolitical risks, and broader macroeconomic uncertainty. Traditionally, investors rotate between assets depending on perceived risk and return. In the current environment, safe-haven assets like gold are regaining prominence, U.S. stocks are benefiting from economic resilience, and crypto assets are struggling to attract strong momentum.

In this in-depth article, we explore why crypto prices again muted as gold surges to new record, U.S. stocks advance, what it means for investors, and how these market movements reflect deeper shifts in global financial sentiment. We will analyze gold’s rally, the resilience of U.S. equities, and the challenges facing digital assets, while also examining what the future may hold.

Global Market Overview and Investor Sentiment

A Shift Toward Caution and Stability

Investor sentiment across global markets has shifted noticeably toward caution. After years of aggressive risk-taking fueled by low interest rates and abundant liquidity, markets are now adapting to tighter financial conditions. In such environments, investors typically favor stability over speculation.

This shift explains why crypto prices again muted as gold surges to new record, U.S. stocks advance has become a defining narrative. Gold, known as a safe-haven asset, thrives when uncertainty rises. Meanwhile, cryptocurrencies, often viewed as high-risk investments, are seeing reduced inflows as traders wait for clearer signals.

The Role of Macroeconomic Uncertainty

Persistent inflation concerns, central bank policies, and slowing global growth have created a complex macroeconomic backdrop. Investors are increasingly selective, prioritizing assets with proven track records. This cautious mindset has directly influenced capital allocation across markets.

Why Gold Is Surging to a New Record

Gold’s Role as a Safe-Haven Asset

Gold has long been considered a reliable store of value during times of economic stress. As uncertainty grows, demand for gold typically increases. This demand surge has recently pushed gold prices to new all-time highs.

The fact that gold surges to new record while crypto remains subdued suggests that many investors still view gold as a more dependable hedge against inflation and economic instability. Unlike cryptocurrencies, gold has centuries of historical credibility behind it.

Inflation, Currency Risk, and Central Bank Demand

Rising inflation and concerns about currency depreciation have also played a major role in gold’s rally. Central banks around the world have increased their gold reserves, further supporting prices. This institutional demand reinforces gold’s position as a cornerstone of global financial stability.

Why Crypto Prices Are Again Muted

Low Volatility and Reduced Trading Activity

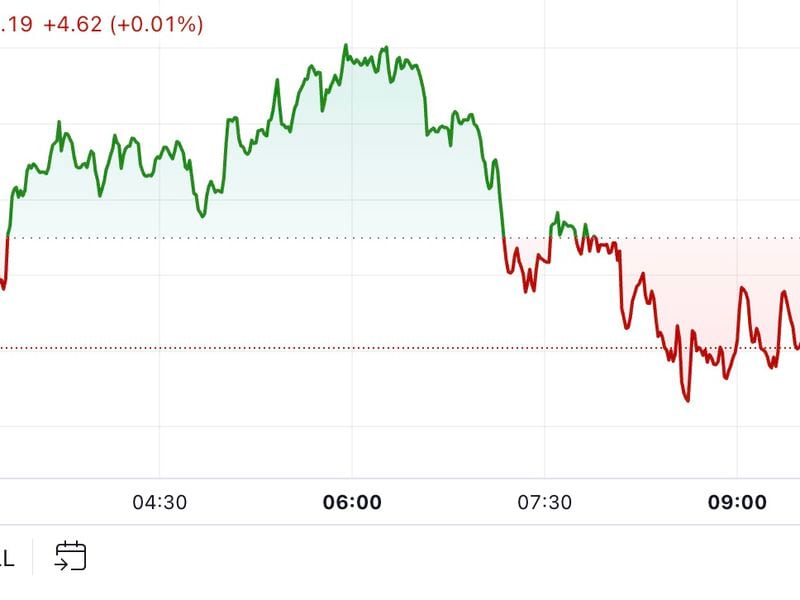

Despite occasional short-term rallies, the broader cryptocurrency market has experienced relatively low volatility. Major assets like Bitcoin and Ethereum have been trading within narrow ranges, signaling indecision among market participants.

The phrase crypto prices again muted as gold surges to new record, U.S. stocks advance highlights how crypto has temporarily lost its appeal as a high-growth asset. Many investors are choosing to wait on the sidelines rather than commit capital amid uncertainty.

Regulatory Pressure and Market Confidence

Ongoing regulatory scrutiny continues to weigh heavily on crypto markets. Governments and financial authorities worldwide are tightening oversight, which has created uncertainty for investors and institutions alike. This lack of regulatory clarity has reduced confidence and slowed capital inflows.

U.S. Stocks Advance Despite Global Uncertainty

Strong Corporate Earnings and Economic Resilience

One of the key reasons U.S. stocks advance is the continued strength of corporate earnings. Many major companies have reported better-than-expected results, particularly in technology and consumer sectors. These earnings have reassured investors that the U.S. economy remains resilient.

Even in a high-interest-rate environment, strong balance sheets and innovation-driven growth have supported equity valuations.

Investor Confidence in the U.S. Economy

Compared to other regions, the U.S. economy has shown relative stability. Employment levels remain solid, consumer spending is steady, and productivity gains continue in certain sectors. This confidence has helped sustain the upward momentum in U.S. stock markets.

Comparing Crypto, Gold, and Stocks

Risk Versus Reward Across Asset Classes

Each asset class plays a different role in an investment portfolio. Gold offers stability and protection, stocks provide growth potential, and cryptocurrencies represent innovation and higher risk. The current scenario, where crypto prices again muted as gold surges to new record, U.S. stocks advance, reflects investors prioritizing stability and predictable returns.

This does not mean crypto has lost relevance, but rather that it is temporarily out of favor due to broader market conditions.

Portfolio Diversification in Changing Markets

Market cycles constantly evolve. Investors who maintain diversified portfolios are better positioned to weather uncertainty. The present environment underscores the importance of balancing traditional assets with emerging ones like digital assets.

The Future Outlook for Cryptocurrency Markets

Long-Term Potential of Digital Assets

Despite current price stagnation, the long-term fundamentals of crypto remain intact. Blockchain technology, decentralized finance, and increasing institutional adoption continue to drive innovation. These developments suggest that muted prices may be a phase rather than a permanent condition.

Historically, crypto markets have moved in cycles, often followed by strong recoveries after periods of consolidation.

Institutional Adoption and Market Maturity

As institutional players continue to explore crypto exposure, the market may gradually stabilize and regain momentum. Increased regulation, while challenging in the short term, could eventually enhance trust and attract more conservative investors.

How Global Economic Trends Shape Investment Decisions

Interest Rates and Liquidity Conditions

High interest rates reduce liquidity and make speculative investments less attractive. This environment naturally favors assets like gold and high-quality stocks over volatile instruments such as cryptocurrencies.

Understanding these dynamics helps explain why crypto prices again muted as gold surges to new record, U.S. stocks advance is a logical outcome of current monetary conditions.

Geopolitical Risks and Market Psychology

Geopolitical tensions and global conflicts also influence investor psychology. During uncertain times, risk appetite declines, and capital shifts toward assets perceived as safer. This behavioral pattern continues to shape market trends.

What This Means for Investors

Adapting to a Multi-Asset World

Modern investors must navigate a world where traditional and digital assets coexist. The current divergence between crypto, gold, and stocks emphasizes the need for adaptability and informed decision-making.

Rather than chasing short-term trends, investors may benefit from focusing on long-term strategies aligned with their risk tolerance.

Preparing for the Next Market Cycle

While crypto prices are muted today, future catalysts such as technological breakthroughs or policy clarity could reignite interest. Staying informed and prepared is essential in such a rapidly evolving landscape.

Conclusion

The current financial environment paints a clear picture of shifting investor priorities. Crypto prices again muted as gold surges to new record, U.S. stocks advance is more than just a headline it reflects a broader movement toward stability, resilience, and cautious optimism. Gold is reclaiming its role as a safe haven, U.S. stocks are supported by economic strength, and cryptocurrencies are navigating a period of consolidation.

For investors, this moment highlights the importance of diversification, patience, and understanding macroeconomic forces. While crypto may be subdued today, its long-term potential remains, and future market cycles could once again reshape the investment landscape.

Frequently Asked Questions (FAQs)

Q. Why are crypto prices muted right now?

Crypto prices are subdued due to high interest rates, regulatory uncertainty, and reduced risk appetite among investors.

Q. Why is gold reaching record highs?

Gold is benefiting from inflation concerns, geopolitical risks, and increased demand for safe-haven assets.

Q. What is driving U.S. stocks higher?

Strong corporate earnings, economic resilience, and investor confidence in the U.S. economy are pushing stocks upward.

Q. Does muted crypto performance mean the market is over?

No, crypto markets are cyclical. Periods of consolidation often precede renewed growth driven by innovation and adoption.

Q. How should investors respond to current market conditions?

Investors should focus on diversification, risk management, and long-term strategies rather than short-term market noise.