The promise of blockchain technology has always been rooted in decentralization—a revolutionary concept that eliminates intermediaries and distributes power among network participants. Yet, as the cryptocurrency ecosystem matures, a paradox emerges: centralized control in blockchain governance threatens the very principles upon which this technology was built. From Bitcoin’s mining pool concentration to Ethereum’s core developer influence, the struggle between decentralization ideals and practical governance realities creates a fascinating tug-of-war that shapes the future of digital assets.

Understanding centralized control in blockchain governance isn’t just an academic exercise—it’s crucial for investors, developers, and users who stake their financial futures on these networks. As blockchain projects evolve from experimental protocols to multi-billion-dollar ecosystems, the question of who holds power and how decisions are made becomes increasingly critical. This comprehensive exploration examines the mechanisms, implications, and controversies surrounding governance centralization in blockchain networks.

Blockchain Governance Fundamentals

What Is Blockchain Governance?

Blockchain governance refers to the decision-making processes that determine how protocols evolve, upgrade, and respond to challenges. Unlike traditional corporate structures with clear hierarchies, blockchain governance operates in a decentralized environment where stakeholders include developers, miners, validators, token holders, and users.

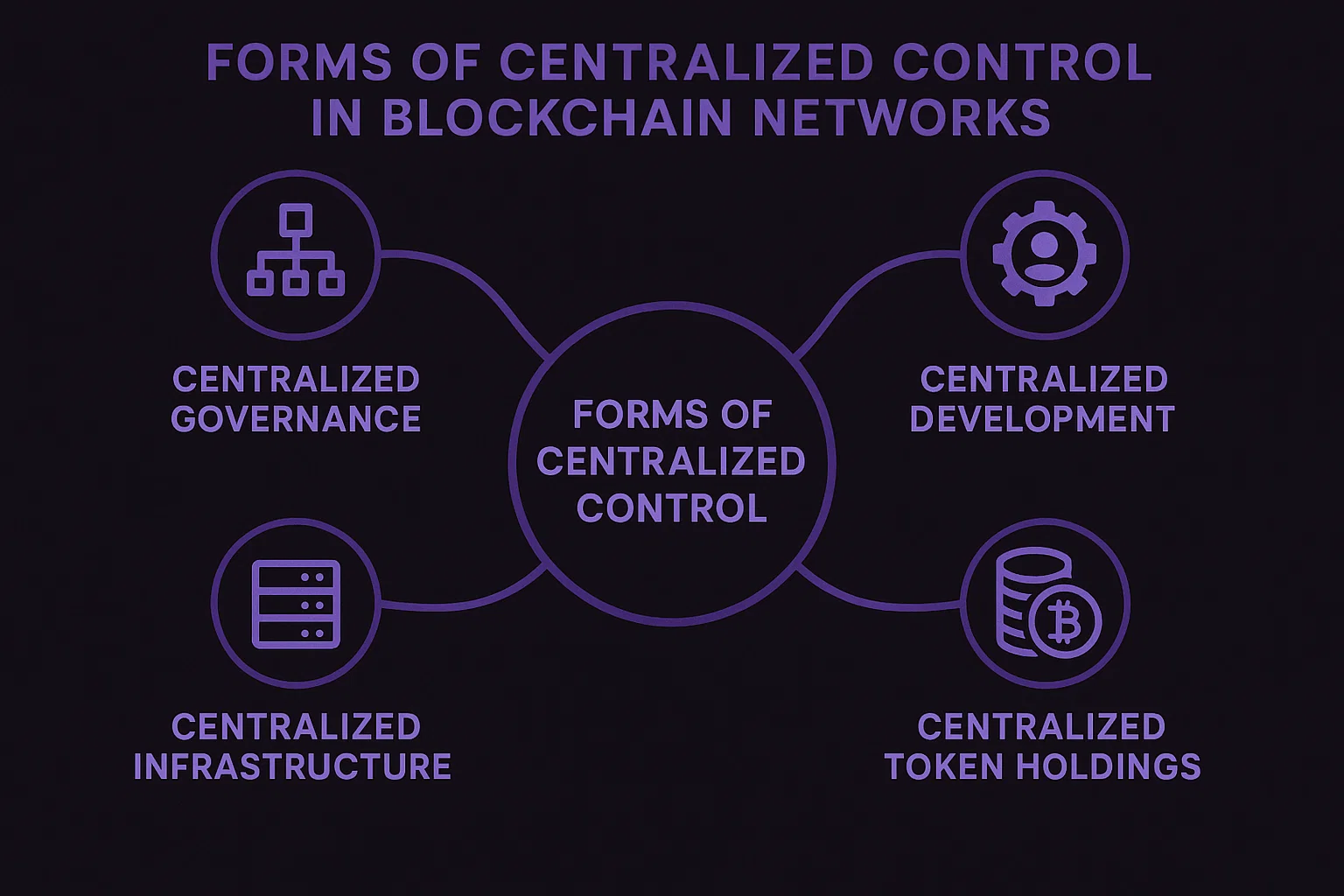

Centralized control in blockchain governance manifests when decision-making power concentrates in the hands of a few entities rather than being distributed across the entire network. This concentration can occur through various mechanisms: ownership of significant token supplies, control over development resources, influence over mining operations, or dominance in validator nodes.

The Decentralization Spectrum

Not all blockchains operate with the same degree of decentralization. The spectrum ranges from completely decentralized networks with no identifiable leadership to permissioned blockchains controlled by consortia or single organizations.

Bitcoin represents one end of the spectrum, attempting maximum decentralization through its proof-of-work consensus mechanism and lack of formal governance structure. However, even Bitcoin faces centralized blockchain control concerns with mining pool concentration and core developer influence. Meanwhile, enterprise blockchains like Hyperledger embrace centralized governance as a feature rather than a flaw, arguing that it enables faster decision-making and regulatory compliance.

Peter Brandt Reveals Possibility for Bitcoin as BTC Price Drops Below $113,000

Developer Centralization and Core Teams

One of the most significant forms of centralized control in blockchain governance emerges through developer influence. Core development teams often possess deep technical knowledge that creates information asymmetries between them and ordinary network participants.

Ethereum provides a compelling case study. While the network boasts thousands of validators and millions of users, critical protocol decisions often originate from the Ethereum Foundation and a relatively small group of core developers. Vitalik Buterin’s influence over Ethereum’s direction, though often beneficial, represents a form of benevolent centralization that contradicts pure decentralization principles.

The challenge intensifies when considering protocol upgrades. When developers propose changes like Ethereum’s transition to proof-of-stake, the technical complexity prevents most stakeholders from fully evaluating the implications. This knowledge gap creates a de facto centralized blockchain control where experts guide decisions that affect everyone.

Mining and Validator Concentration

Proof-of-work blockchains face centralized control in blockchain through mining pool concentration. Bitcoin, despite its decentralization ethos, has witnessed periods where three or four mining pools controlled over 51% of the network’s hash rate. This concentration creates theoretical vulnerabilities where coordinated pools could execute attacks or censor transactions.

Proof-of-stake networks aren’t immune either. Ethereum’s validator landscape shows significant concentration among exchanges and staking services. Major platforms like Coinbase, Binance, and Lido control substantial portions of staked ETH, creating blockchain governance centralization risks. If these entities colluded or faced regulatory pressure, they could influence network consensus.

Geographic concentration compounds these issues. Chinese mining operations once dominated Bitcoin mining before regulatory crackdowns redistributed hash power. Similarly, many validators cluster in specific jurisdictions, creating regulatory risk points that undermine decentralization promises.

Token Distribution and Wealth Concentration

Governance tokens that enable on-chain voting create another avenue for centralized control in blockchain systems. When token distribution is highly unequal, wealthy holders can dominate governance decisions regardless of community sentiment.

DeFi protocols frequently struggle with this challenge. Projects that allocate significant token percentages to venture capital investors, founders, and early team members create governance structures where a handful of addresses control voting outcomes. Even with one-token-one-vote mechanisms, wealth inequality translates directly into political inequality.

Compound, Uniswap, and similar protocols have witnessed governance proposals passing or failing based on votes from just a few whale addresses. This centralized blockchain control through token concentration raises questions about whether these systems genuinely empower communities or simply replace traditional corporate governance with plutocracy.

The Paradox: Why Centralization Persists in Decentralized Systems

Efficiency Versus Ideology

Centralized control in blockchain governance often emerges because it’s efficient. Decentralized decision-making processes are slow, contentious, and sometimes lead to network paralysis. Bitcoin’s block size debate consumed years of community energy, ultimately resulting in controversial hard forks like Bitcoin Cash.

Centralized leadership can make rapid decisions, coordinate development efforts, and respond quickly to security threats. When the DAO hack threatened Ethereum in 2016, the core development team and Vitalik Buterin’s leadership enabled a swift (though controversial) hard fork that returned stolen funds. Pure decentralization might have left the community gridlocked while attackers profited.

This efficiency-ideology tension creates pragmatic pressure toward blockchain governance centralization. Projects competing for users, developers, and capital often prioritize speed over perfect decentralization, accepting governance shortcuts that accelerate growth.

The Founder Dilemma

Most blockchain projects begin with founders and core teams who possess a unique vision, technical expertise, and community credibility. These individuals naturally become focal points for decision-making, creating centralized control in blockchain systems even when protocols technically support decentralization.

Transitioning from founder-led governance to true community control proves extraordinarily difficult. Founders must relinquish power while ensuring the project doesn’t lose direction. Communities must develop governance competency without descending into mob rule or apathy.

Few projects successfully navigate this transition. Many retain strong founder influence long after launching decentralized governance mechanisms, creating hybrid systems where centralized blockchain control persists beneath democratic facades.

Technical Complexity Barriers

Blockchain technology’s complexity inherently favors expert influence, creating information-based centralized control in blockchain governance. When proposals involve cryptographic protocols, virtual machine upgrades, or consensus mechanism changes, most stakeholders lack the expertise to evaluate them independently.

This asymmetry grants disproportionate power to developers and technical experts whose opinions carry weight regardless of token holdings. Even well-intentioned community members must rely on expert analysis, creating informal blockchain governance centralization through knowledge concentration.

Educational initiatives can mitigate but never eliminate this challenge. As protocols grow more sophisticated, the technical knowledge gap widens, potentially strengthening rather than weakening centralized influences.

Real-World Consequences of Centralized Blockchain Control

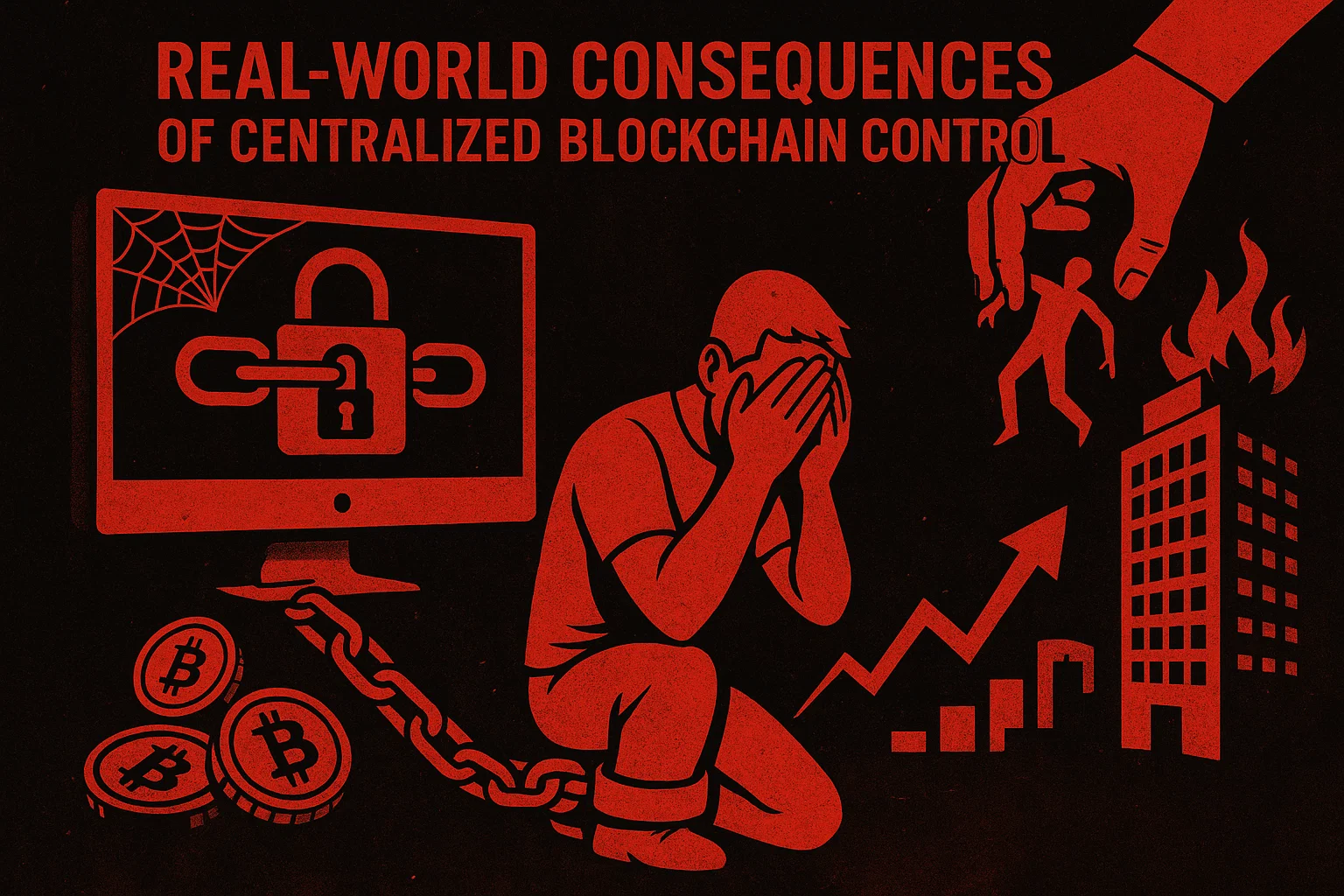

Security Vulnerabilities and Attack Vectors

Centralized control in blockchain networks creates concentrated attack surfaces. When a few entities control significant network resources, they become targets for hackers, state actors, or malicious competitors.

Mining pool concentration enabled various 51% attacks on smaller proof-of-work blockchains. Ethereum Classic, Bitcoin Gold, and Vertcoin all suffered successful attacks where concentrated mining power enabled double-spending. While larger networks like Bitcoin remain secure, the theoretical vulnerability persists wherever centralized blockchain control exists.

Validator concentration in proof-of-stake systems creates similar risks. If major staking providers faced coordinated hacking or regulatory seizure, network security could collapse despite thousands of individual validators. The centralized control in blockchain through service provider dominance represents a systemic vulnerability.

Regulatory Capture and Compliance Pressure

Governments and regulators targeting blockchain networks naturally focus pressure on identifiable control points. Centralized blockchain control creates leverage points where regulatory influence can flow into supposedly decentralized systems.

When exchanges control significant staking power, they must balance fiduciary duties to token holders against regulatory compliance demands. If regulators require transaction censorship, these validators face impossible choices between legal obligations and network principles. This blockchain governance centralization enables indirect state control over decentralized networks.

Foundation entities similarly create regulatory targets. The SEC’s actions against various cryptocurrency foundations demonstrate how centralized control in blockchain through nonprofit organizations can subject entire ecosystems to regulatory jurisdiction traditionally reserved for corporations.

Innovation Bottlenecks and Coordination Failures

While centralized control in blockchain can accelerate certain decisions, it also creates innovation bottlenecks. When core teams gate-keep protocol development, promising improvements may languish without champion support. Alternative visions struggle to gain traction against establishment preferences.

Bitcoin’s conservative development culture, partly resulting from centralized blockchain control by Bitcoin Core developers, has prevented various scaling innovations from implementation. Whether this conservatism protects security or stifles progress remains hotly debated, but it demonstrates how governance concentration shapes technical trajectories.

Conversely, excessive decentralization without coordination mechanisms creates paralysis. Multiple competing proposals, endless debate, and governance exhaustion can prevent any progress. Finding the balance between centralized control in blockchain and productive decentralization remains an ongoing challenge.

Mechanisms for Reducing Centralized Control

Progressive Decentralization Strategies

Forward-thinking projects embrace progressive decentralization—structured transitions from founder-led governance toward community control. This approach acknowledges that centralized control in blockchain may be necessary during early development while planning explicit steps toward greater distribution.

Successful strategies include vesting schedules that gradually release founder tokens, expanding core development teams across multiple organizations, implementing transparent governance processes before formal decentralization, and establishing constitutional principles that survive leadership changes.

Uniswap’s approach of retaining significant protocol control initially while building community governance capacity demonstrates pragmatic blockchain governance centralization reduction. By moving slowly and deliberately, the protocol maintained cohesion while genuinely distributing power.

Quadratic Voting and Alternative Governance Models

Quadratic voting and similar mechanisms attempt to mitigate centralized control in blockchain through token concentration. By making additional votes progressively more expensive, these systems reduce wealthy holders’ disproportionate influence while still weighting decisions toward stakeholders.

Gitcoin’s quadratic funding model for public goods demonstrates this principle’s potential. Small contributions from many donors receive matching multipliers, privileging broad support over concentrated wealth. Applying similar logic to governance could reduce centralized blockchain control by whale voters.

Conviction voting, futarchy, and reputation-based systems offer additional alternatives. Each attempts to balance efficiency against decentralization, providing governance structures resistant to centralized control in blockchain while remaining functional.

Technical Decentralization Through Infrastructure Diversity

Reducing centralized control in blockchain networks requires infrastructure diversity. Projects can encourage validator and node distribution through:

- Geographic diversity incentives that reward operators in underrepresented regions

- Client diversity requirements are preventing single software implementation dominance

- Minimum validator thresholds that prevent excessive concentration

- Slashing penalties that discourage large validator service providers

- MEV (miner extractable value) mitigation that reduces centralization pressures

Ethereum’s multi-client philosophy, where several independent teams maintain consensus layer implementations, demonstrates technical resistance to blockchain governance centralization. If one client develops critical vulnerabilities, the network maintains security through alternatives.

The Future of Blockchain Governance

Emerging Trends and Innovations

The blockchain industry increasingly recognizes centralized control in blockchain as a critical challenge requiring innovative solutions. Recent trends suggest governance evolution toward more sophisticated hybrid models.

Layer-2 protocols and app-chains enable governance experimentation without risking base layer security. Projects can test radical governance mechanisms on smaller scales before wider adoption. This innovation space may produce breakthrough solutions to centralized blockchain control challenges.

Decentralized autonomous organizations (DAOs) continue refining on-chain governance mechanisms. While early DAOs suffered from plutocracy and low participation, newer models incorporate reputation systems, delegation mechanisms, and procedural safeguards against blockchain governance centralization.

Regulatory Frameworks and Legal Recognition

Government approaches to blockchain regulation will significantly influence centralized control in blockchain evolution. Progressive frameworks that recognize decentralized governance without imposing centralized requirements could strengthen genuinely distributed systems.

Conversely, regulations requiring identifiable responsible parties naturally pressure protocols toward centralized blockchain control. If compliance demands clear legal accountability, protocols may deliberately centralize governance to satisfy regulatory expectations, sacrificing decentralization for legitimacy.

The tension between regulatory demands and decentralization principles represents one of blockchain technology’s most significant long-term challenges. How the industry navigates this tension will determine whether centralized control in blockchain increases or decreases over the coming decades.

Conclusion

The struggle against centralized control in blockchain governance represents more than a technical challenge—it embodies fundamental questions about power, democracy, and human organization in digital systems. While perfect decentralization remains elusive, the pursuit itself drives innovation in governance mechanisms and organizational structures.

Understanding centralized control in blockchain networks empowers stakeholders to make informed decisions about which protocols to support, which governance mechanisms to implement, and which tradeoffs to accept. As blockchain technology matures from experimental infrastructure to a foundational internet layer, governance decisions will increasingly impact billions of users and trillions in value.