Bitcoin surge to $100,000 in the coming months. After experiencing significant volatility throughout 2024 and early 2025, Bitcoin has demonstrated remarkable resilience, consolidating above key support levels while institutional interest reaches unprecedented heights. Multiple factors are converging to create what experts describe as a “perfect storm” for Bitcoin’s next major rally. From favourable regulatory developments to increasing institutional adoption and macroeconomic conditions that favour alternative assets, the groundwork for a Bitcoin surge to $100,000 appears stronger than ever. In this comprehensive analysis, we’ll explore the technical indicators, fundamental catalysts, and expert opinions that suggest Bitcoin could soon reclaim its position as the best-performing asset class of the decade.

Bitcoin’s Current Market Position

Bitcoin’s journey toward the $100,000 milestone has been marked by cycles of explosive growth followed by periods of consolidation. Currently trading in a range that many technical analysts consider a “re-accumulation zone,” Bitcoin has built a solid foundation for its next upward move. The cryptocurrency has weathered numerous challenges, including regulatory uncertainty, exchange collapses, and macroeconomic headwinds, yet it continues to attract both retail and institutional investors.

Historical Price Patterns and Cycle Analysis

Bitcoin operates in approximately four-year cycles, heavily influenced by its halving events. The most recent halving occurred in April 2024, reducing the block reward from 6.25 BTC to 3.125 BTC. Historically, Bitcoin has experienced significant price appreciation 12-18 months following each halving event. This pattern stems from the reduced supply of new Bitcoin entering the market, combined with steady or increasing demand.

The 2020-2021 cycle saw Bitcoin rally from around $10,000 to nearly $69,000, representing a remarkable 590% increase. While past performance doesn’t guarantee future results, the structural similarities between previous cycles and the current market environment provide compelling evidence for another substantial rally. Technical analysts point to the logarithmic growth curves that have accurately predicted Bitcoin’s long-term price trajectory since its inception.

Key Catalysts Driving the Bitcoin Surge to $100,000

Institutional Adoption Reaches Critical Mass

One of the most significant developments supporting a Bitcoin surge to $100,000 is the unprecedented level of institutional adoption. Major financial institutions that once dismissed cryptocurrency as a speculative bubble have now integrated Bitcoin into their offerings. The approval of spot Bitcoin ETFs in the United States marked a watershed moment, providing traditional investors with regulated, accessible exposure to Bitcoin.

These ETFs have attracted billions in assets under management, creating consistent buying pressure. BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC) have become some of the fastest-growing ETFs in history. This institutional infrastructure removes barriers to entry and legitimises Bitcoin as an investment vehicle for pension funds, endowments, and wealth management firms.

Major corporations continue expanding their Bitcoin holdings. Companies like MicroStrategy have accumulated substantial positions, treating Bitcoin as a treasury reserve asset. This corporate adoption trend signals a fundamental shift in how businesses view cryptocurrency – not as a speculative tool, but as a strategic long-term asset.

Macroeconomic Factors Favouring Alternative Assets

The global macroeconomic landscape increasingly favours assets like Bitcoin that serve as hedges against currency debasement and inflation. Central banks worldwide have engaged in unprecedented monetary expansion, increasing the money supply to levels that concern economists and investors alike. While inflation rates have moderated from their 2022 peaks, structural inflationary pressures remain embedded in the global economy.

Bitcoin’s fixed supply of 21 million coins stands in stark contrast to fiat currencies that can be printed without limit. This scarcity, combined with growing demand, creates fundamental conditions for price appreciation. As sovereign debt levels reach historically elevated levels and geopolitical tensions increase, investors are diversifying into alternative stores of value.

The weakening correlation between Bitcoin and traditional risk assets also enhances its appeal. During periods when stocks and bonds decline simultaneously, Bitcoin has increasingly demonstrated independent price action, functioning as a genuine portfolio diversifier rather than merely another risk-on asset.

Technical Analysis: Chart Patterns Supporting $100,000 Target

Support and Resistance Levels

Technical analysts examining Bitcoin’s price charts identify several key levels that support a Bitcoin surge to $100,000. The cryptocurrency has established strong support around the $60,000-$65,000 range, which previously served as resistance before Bitcoin’s 2021 all-time high. This role reversal – where former resistance becomes new support – is a classic bullish indicator in technical analysis.

The $100,000 level represents a psychological barrier and d round number that typically attracts significant attention. However, technical analysts note that once Bitcoin breaks through major psychological levels, it often experiences accelerated price discovery as resistance diminishes. Similar patterns occurred when Bitcoin surpassed $10,000, $20,000, and $50,000 in previous cycles.

Momentum Indicators and Market Sentiment

On-chain metrics provide deeper insights into Bitcoin’s price trajectory. The Relative Strength Index (RSI) on longer timeframes suggests Bitcoin is neither overbought nor oversold, indicating room for substantial upward movement. Moving Average Convergence Divergence (MACD) indicators on weekly and monthly charts show bullish crossovers that historically preceded major rallies.

Hash rate – the computational power securing the Bitcoin network – continues reaching all-time highs, demonstrating miner confidence in future price appreciation. Miners, who invest substantial capital in equipment and operations, typically increase capacity when they anticipate higher Bitcoin prices that justify their investments.

The stock-to-flow model, while controversial, continues to suggest Bitcoin is undervalued relative to its scarcity. This model, which compares Bitcoin’s existing supply to new supply production, has historically correlated with major price movements, though critics argue its predictive power may diminish over time.

Expert Predictions and Analysis

What Leading Analysts Are Saying

Prominent cryptocurrency analysts and financial experts have issued bullish forecasts supporting a Bitcoin surge to $100,000. Michael Saylor, Executive Chairman of MicroStrategy and one of Bitcoin’s most vocal institutional advocates, has consistently argued that Bitcoin represents the best long-term store of value in an increasingly digital economy. His company’s continued accumulation of Bitcoin demonstrates conviction in substantially higher prices.

Cathie Wood, CEO of ARK Invest, has set even more ambitious targets, suggesting Bitcoin could reach $1 million per coin by 2030 under bullish scenarios. While such predictions span longer timeframes, they underscore the asymmetric risk-reward profile that attracts investors to Bitcoin. Even conservative projections from traditional financial analysts increasingly include six-figure Bitcoin prices within their base case scenarios.

Technical analysts like Peter Brandt, a veteran trader with decades of experience, have identified chart patterns suggesting Bitcoin is in the early stages of a major bull market. Brandt’s analysis of logarithmic charts and long-term trends indicates that $100,000 represents a conservative near-term target rather than an optimistic ceiling.

Institutional Forecasts and Price Models

Investment banks that previously avoided cryptocurrency coverage now publish regular research reports on Bitcoin. JPMorgan’s analysts have suggested that increased institutional allocation to Bitcoin could drive prices significantly higher, particularly if Bitcoin captures even a small percentage of gold’s market share as a store of value asset.

Standard Chartered, a major international bank, published research projecting Bitcoin could reach $100,000 by the end of 2025, citing increased institutional adoption and favourable regulatory developments. Their analysis emphasises supply-demand dynamics as Bitcoin’s issuance rate continues declining while adoption accelerates.

Quantitative models incorporating network effects, adoption curves, and monetary velocity suggest Bitcoin is following growth patterns similar to transformative technologies like the internet and mobile phones. These models, while imperfect, provide frameworks suggesting that Bitcoin’s market capitalisation could expand several multiples from current levels as adoption progresses from early majority to late majority phases.

Regulatory Developments Creating Favourable Conditions

Global Regulatory Clarity Emerges

Regulatory uncertainty has historically suppressed Bitcoin prices as investors grappled with potential government restrictions or adverse legal frameworks. However, the regulatory landscape has evolved dramatically, with many jurisdictions establishing clear frameworks for cryptocurrency trading, custody, and taxation.

The United States, long criticised for regulatory ambiguity, has made substantial progress. The approval of spot Bitcoin ETFs represented a major regulatory milestone, while Congressional efforts to establish comprehensive cryptocurrency legislation suggest a maturing regulatory approach. Rather than attempting to ban or severely restrict cryptocurrency, regulators increasingly focus on consumer protection, anti-money laundering compliance, and market integrity.

Europe’s Markets in Crypto-Assets (MiCA) regulation provides comprehensive legal clarity for cryptocurrency operations within the European Union. This regulatory certainty enables traditional financial institutions to offer cryptocurrency services without fear of sudden regulatory changes, accelerating Bitcoin adoption across European markets.

Central Bank Digital Currencies and Bitcoin

Paradoxically, the development of Central Bank Digital Currencies (CBDCs) may enhance rather than compete with Bitcoin. As governments digitise their monetary systems, they simultaneously educate populations about digital currencies and blockchain technology. This education reduces barriers to Bitcoin adoption by making digital asset concepts mainstream.

Furthermore, concerns about government surveillance and control associated with CBDCs drive some individuals toward decentralised alternatives like Bitcoin that offer privacy and censorship resistance. As CBDCs roll out globally, Bitcoin’s value proposition as a neutral, decentralised monetary network becomes increasingly apparent to users wary of government-controlled digital money.

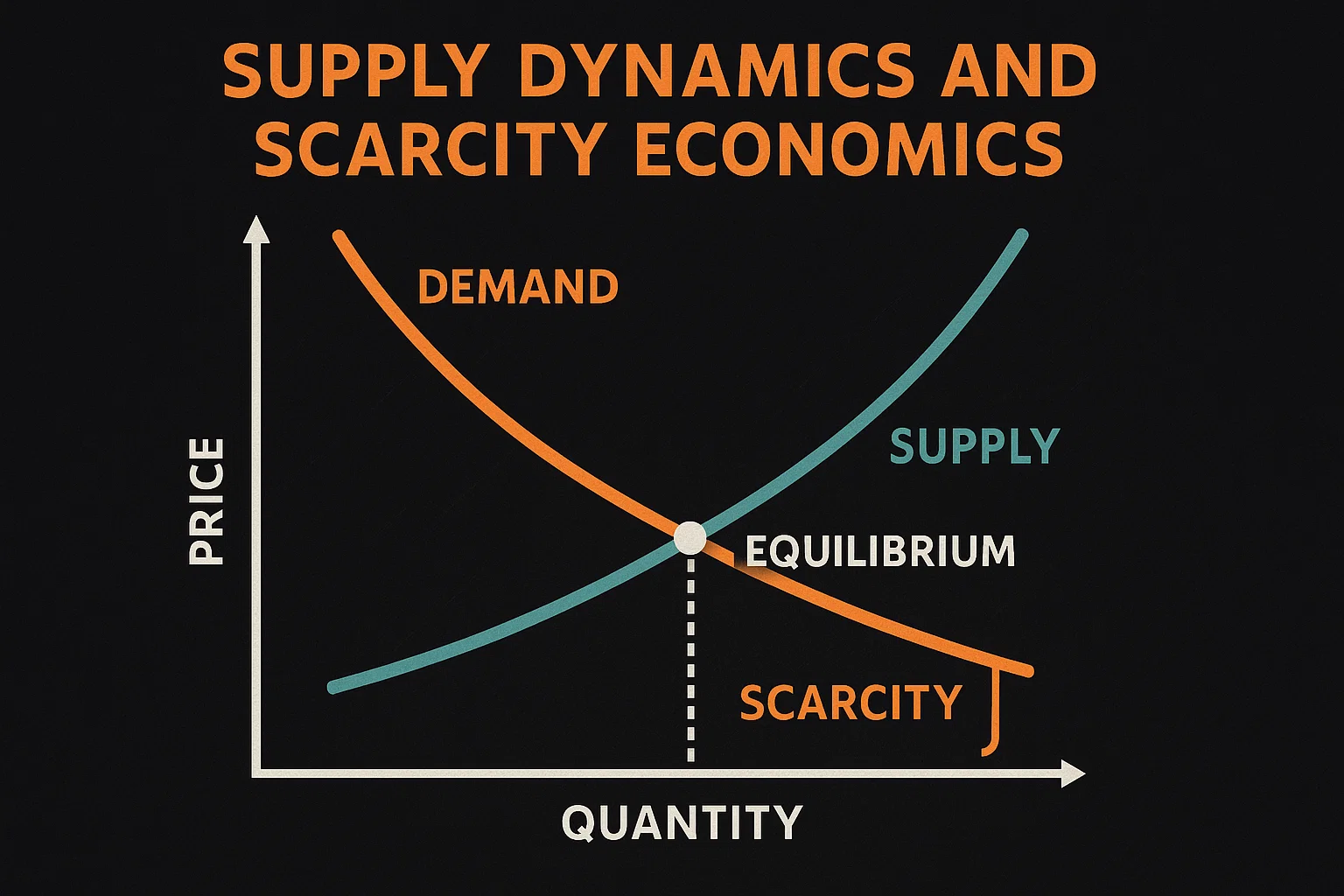

Supply Dynamics and Scarcity Economics

The Halving Effect on Bitcoin Supply

Bitcoin’s programmatic supply reduction through halving events creates predictable scarcity that underpins long-term price appreciation. With only approximately 1.5 million Bitcoin remaining to be mined over the next century, new supply continues to diminish while lost coins permanently reduce the available supply.

Current estimates suggest 3-4 million Bitcoins are permanently lost due to forgotten passwords, discarded hard drives, and deceased holders without estate planning. This means the actual circulating supply available for purchase is significantly lower than the nominal supply, intensifying scarcity dynamics that support a Bitcoin surge to $100,000.

The stock-to-flow ratio – comparing existing Bitcoin supply to new annual production – now exceeds that of gold, traditionally considered the ultimate scarce asset. As Bitcoin’s issuance continues declining, this ratio will increase further, potentially driving substantial price appreciation if demand remains constant or increases.

Exchange Supply Depletion

A critical on-chain metric supporting bullish Bitcoin price projections is the declining balance of Bitcoin held on exchanges. When investors transfer Bitcoin from exchanges to personal wallets, it typically indicates intent to hold rather than sell, reducing available supply for purchase. Exchange balances have declined significantly over the past year, reaching multi-year lows.

This supply squeeze means that relatively modest demand increases can generate disproportionate price impacts. With institutional buyers seeking to accumulate substantial positions and the available exchange supply limited, the path to $100,000 may involve rapid price appreciation as buyers compete for scarce Bitcoin.

Long-term holders – addresses that haven’t moved Bitcoin in over 155 days – continue accumulating, demonstrating conviction among experienced investors. These “diamond hands” remove supply from circulation, creating the foundation for explosive price moves when new demand enters the market.

Potential Risks and Challenges

Regulatory Risks Remain

Despite improving regulatory clarity, risks persist. Government actions targeting cryptocurrency exchanges, privacy features, or mining operations could temporarily suppress Bitcoin prices. China’s 2021 mining ban demonstrated that government crackdowns can impact price, though Bitcoin ultimately recovered and demonstrated resilience.

Proposals for restrictive regulations, particularly those limiting self-custody or imposing onerous reporting requirements, could create headwinds for Bitcoin adoption. However, the decentralised nature of Bitcoin makes comprehensive prohibition difficult to enforce, limiting the long-term impact of adverse regulatory developments.

Macroeconomic Uncertainty

While macroeconomic conditions generally favour alternative assets, sudden changes in monetary policy or unexpected economic developments could impact Bitcoin prices. If central banks dramatically tighten monetary policy or if economic conditions improve substantially, reducing the appeal of inflation hedges, Bitcoin could experience temporary setbacks.

Traditional market crashes that trigger margin calls and forced liquidations across all asset classes can create selling pressure on Bitcoin despite its long-term value proposition. The 2022 bear market demonstrated that Bitcoin isn’t immune to broader financial market stress, though it recovered alongside improved market conditions.

Technical and Infrastructure Challenges

Bitcoin’s network must continue scaling to accommodate growing adoption without compromising decentralisation or security. Layer-2 solutions like the Lightning Network show promise for enabling faster, cheaper transactions, but widespread implementation remains ongoing. Scaling challenges or technical vulnerabilities could undermine confidence and delay the Bitcoin surge to $100,000.

Competition from alternative cryptocurrencies that offer different features or capabilities represents another consideration. While Bitcoin maintains a dominant market share and network effects, technological innovations in other blockchain networks could potentially redirect some capital that might otherwise flow to Bitcoin.

Investment Strategies for the Expected Rally

Accumulation Strategies for Investors

Investors anticipating a Bitcoin surge to $100,000 employ various accumulation strategies. Dollar-cost averaging (DCA) involves purchasing fixed dollar amounts at regular intervals regardless of price, reducing the impact of volatility and avoiding the psychological challenge of timing the market. This approach has historically yielded favourable results for long-term Bitcoin investors.

Strategic buying during pullbacks allows investors to accumulate Bitcoin when short-term fear drives prices below fair value. Identifying key support levels and maintaining discipline to purchase during temporary declines requires emotional fortitude but can significantly improve average cost basis.

For sophisticated investors, options and derivatives markets offer leveraged exposure to Bitcoin price movements. However, these instruments carry substantial risk and require expertise to navigate successfully. Most financial advisors recommend that cryptocurrency allocations remain proportional to risk tolerance, typically suggesting 1-5% of portfolios for conservative investors.

Security and Custody Considerations

As Bitcoin holdings become more valuable, security becomes paramount. Self-custody using hardware wallets provides maximum security and control, eliminating counterparty risk associated with exchanges or custodians. However, self-custody requires understanding backup procedures and protecting recovery phrases from loss or theft.

For larger allocations or less technically sophisticated investors, regulated custodians offer institutional-grade security with insurance coverage. Companies like Coinbase Custody, Fidelity Digital Assets, and BitGo provide enterprise solutions that balance security with convenience.

Diversifying custody solutions – splitting holdings between self-custody and regulated custodians – can provide redundancy while maintaining appropriate security. Regardless of custody method, investors should implement robust security practices, including two-factor authentication, unique passwords, and regular security audits.

The Broader Impact of Bitcoin at $100,000

Psychological and Market Implications

A Bitcoin surge to $100,000 would represent more than a numerical milestone – it would fundamentally shift public perception of cryptocurrency. Reaching six figures would validate Bitcoin’s role as a legitimate asset class and accelerate mainstream adoption. Media coverage would intensify, attracting new investors and increasing general awareness.

The psychological impact on existing holders would reinforce conviction and potentially extend the bull market as realised gains enable further accumulation. The wealth effect from Bitcoin appreciation could stimulate spending in cryptocurrency-related businesses and technologies, creating a virtuous cycle of development and adoption.

Financial advisors who previously dismissed cryptocurrency would face increasing client pressure to incorporate Bitcoin into investment strategies. This institutional FOMO (fear of missing out) could drive substantial capital inflows, potentially pushing prices well beyond $100,000 as the bull market matures.

Global Economic Implications

Bitcoin’s rise to six figures would represent a market capitalisation exceeding $2 trillion, rivalling the world’s largest companies and approaching the market value of gold held for investment purposes. This scale would cement Bitcoin’s status as a significant component of the global financial system rather than a speculative fringe asset.

Countries with unstable currencies or restrictive capital controls would see accelerated Bitcoin adoption as citizens seek to preserve wealth and access global markets. This could challenge government monetary control and create geopolitical tensions, but also provide financial freedom to billions of people currently underserved by traditional banking systems.

The success of Bitcoin would likely stimulate innovation in blockchain technology, decentralised finance, and digital assets more broadly. Venture capital would flow toward cryptocurrency and Web3 companies, accelerating technological development and creating new business models impossible within traditional financial infrastructure.

Alternative Scenarios and Timeline Considerations

Bear Case: What Could Delay $100,000?

While substantial evidence supports a Bitcoin surge to $100,000, alternative scenarios merit consideration. Extended regulatory battles, particularly in major markets like the United States or the European Union, could create uncertainty that delays the rally. If governments implement restrictive policies that significantly impair Bitcoin’s utility or accessibility, price appreciation could stall.

Macroeconomic developments that substantially strengthen fiat currencies or resolve inflationary concerns might reduce Bitcoin’s appeal as an alternative store of value. If central banks successfully navigate monetary policy challenges and restore confidence in traditional financial systems, capital inflows to Bitcoin might moderate.

Technical failures, security breaches affecting major infrastructure, or discovery of fundamental cryptographic vulnerabilities (however unlikely) could undermine confidence and reverse bullish momentum. While Bitcoin’s technology has proven robust for over 15 years, unforeseen technical challenges remain theoretically possible.

Bull Case: Surpassing $100,000

Conversely, the bull case suggests $100,000 represents merely a waypoint rather than a destination. If institutional adoption accelerates beyond current projections or if geopolitical developments drive massive capital flight to neutral assets, Bitcoin could substantially exceed $100,000 in the current cycle.

A sovereign nation adopting Bitcoin as a strategic reserve asset – beyond El Salvador’s existing adoption as legal tender – would represent a paradigm shift driving unprecedented demand. Speculation about such possibilities increases as Bitcoin establishes itself as a legitimate store of value recognised by traditional financial institutions.

Network effects accelerating faster than anticipated could compress adoption curves, bringing forward price appreciation that models project for later years. If Bitcoin captures significant market share from gold or becomes widely used for international settlements, its market capitalisation could expand several multiples beyond current levels.

Conclusion

The confluence of factors supporting a Bitcoin surge to $100,000 appears stronger than at any previous point in cryptocurrency history. Institutional adoption provides unprecedented legitimacy and infrastructure, regulatory clarity reduces uncertainty, and macroeconomic conditions favour alternative stores of value. Technical indicators suggest Bitcoin is positioned for substantial appreciation, while supply dynamics create favourable conditions for price discovery.

However, investors must approach Bitcoin with realistic expectations and appropriate risk management. Volatility remains inherent to cryptocurrency markets, and the path to $100,000 will likely include significant pullbacks and periods of consolidation. Those who maintain conviction during inevitable corrections, supported by their fundamental understanding of Bitcoin’s value proposition, position themselves to benefit from long-term appreciation.