The cryptocurrency world has once again felt the ripple effects of U.S. monetary policy, with the Federal Reserve’s 25 basis point rate cut sparking renewed attention on Bitcoin and the broader digital asset landscape. This latest policy shift, confirmed in December 2025, marks a notable pivot in the central bank’s approach to economic management, and traders are watching closely to see how Bitcoin price reacts in both the short and long term. Unlike traditional markets, crypto assets often exhibit heightened sensitivity to macroeconomic events, especially changes in liquidity conditions and interest rate expectations. The impact of this Fed decision is already evident across trading desks, price charts, and investor sentiment.

In this article, we’ll dive deep into how Bitcoin and the broader cryptocurrency market are responding to the cut, what this means for market volatility and liquidity, and why understanding macro influences is crucial in today’s dynamic digital asset environment. We’ll also explore how traders and long-term holders alike are adjusting their strategies in response to the evolving monetary landscape.

Federal Reserve’s 25 BPS Rate Cut

When the U.S. Federal Reserve often simply called the Fed decides to lower interest rates, it does more than adjust borrowing costs for banks. By trimming the federal funds rate by 25 basis points, the Fed aims to influence everything from consumer lending to business investment. This decision carries implications that extend into risk assets, including stocks, commodities, and cryptocurrencies like Bitcoin and Ethereum.

This recent rate reduction brought the federal funds rate into a lower range for the first time in months, reflecting a shift toward more accommodative monetary policy designed to address economic uncertainties and cooling labor markets. In doing so, the Fed made it clear that it is willing to balance inflation concerns with the need to support growth, liquidity, and broader financial stability. The move also weakens the U.S. dollar, creating conditions that have historically supported risk-on assets.

Why a 25 BPS Cut Matters for Bitcoin and Crypto

A 25 bps cut might seem small on paper, but in financial markets it can signal a substantial shift in investor expectations. By lowering the cost of borrowing just 0.25%, the Fed can inject liquidity into the system, encouraging capital flow into assets with higher expected returns. For risk assets such as Bitcoin, this often translates into enhanced investor interest, increased trading volumes, and heightened speculative activity.

When liquidity increases and yields on safer assets become less attractive, many investors turn toward alternatives with higher growth potential. Cryptocurrencies, particularly Bitcoin with its fixed supply and decentralized nature, become appealing in such environments. The perception that money is cheaper and liquidity is more available tends to reduce the opportunity cost of holding non-yielding assets a key reason why Bitcoin price reacts notably after Fed rate decisions.

The Immediate Reaction: Bitcoin Price Movements

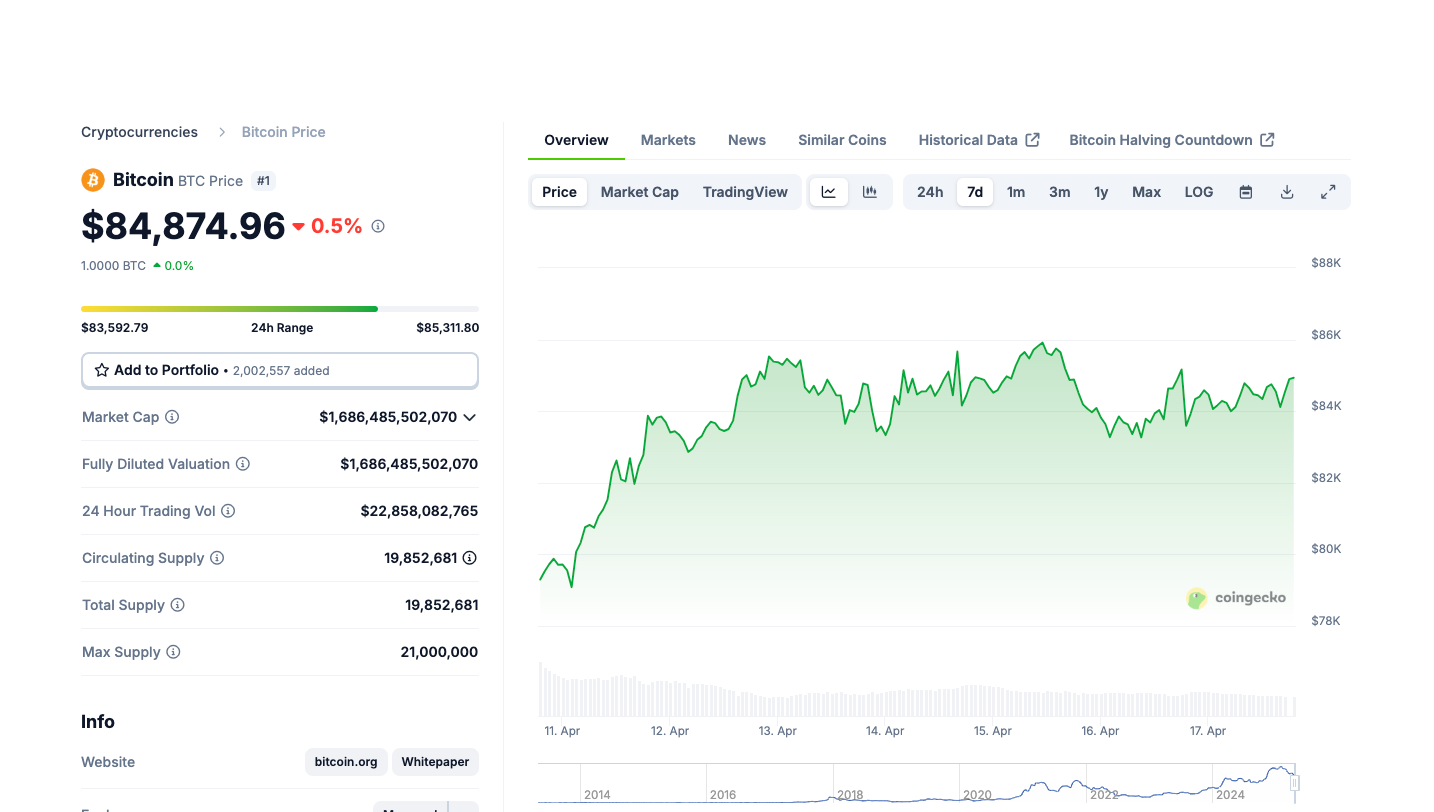

The first hours and days after a rate cut are often the most volatile, as markets process both the announcement and the Fed’s forward guidance. In the case of this latest 25 bps rate cut, Bitcoin displayed a mixed but active price reaction.

Price Swings and Volatility

At the moment of the announcement, Bitcoin’s price experienced sharp fluctuations. Traders witnessed a decline in certain sessions, at one point dropping by more than $2,000 within 24 hours, only to see recovery attempts as the dust settled on the news. This initial volatility reflects the market’s interpretation that the cut was largely expected and already priced in but that traders were still balancing short-term technicals with macro sentiment.

Despite selling pressure in the immediate aftermath, Bitcoin’s broader price action showed resilience, with strong support levels emerging near key psychological thresholds. For many traders, these fluctuations confirmed that while macro catalysts can move markets, crypto traders still pay close attention to sentiment and market structure. This is especially true when rate decisions come alongside mixed signals about future monetary policy.

Liquidity and Crypto Market Flows

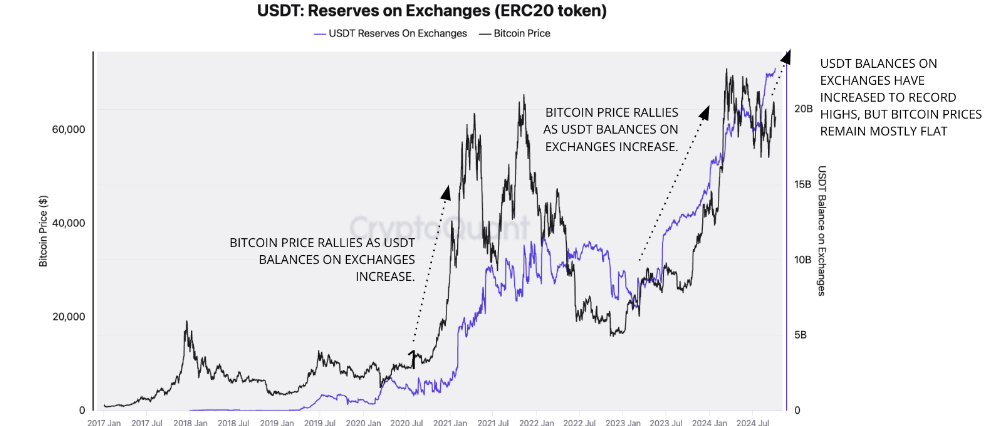

Central bank actions affect not only price but also liquidity a critical component of vibrant markets. A rate cut generally expands liquidity, making capital available for investment in riskier assets. In the hours following the decision, crypto market analysts noted increased spot trading volumes and concentrated institutional activity, particularly at key Bitcoin price levels.

Some reports suggest that even though institutional flows remained steady, there were heightened fluctuations in derivative markets as traders adjusted positions based on updated Fed projections. These liquidity dynamics play a central role in how Bitcoin reacts to macroeconomic announcements, as they directly influence demand and supply in spot and futures markets alike.

Macroeconomic Context: What the Fed’s Decision Signals

To fully understand why Bitcoin price reacts to a rate cut, it is essential to look beyond the headline number and analyze the broader economic context.

Economic Growth and Labor Market Considerations

The Federal Reserve’s decision to cut rates by 25 bps did not occur in isolation. Policymakers highlighted concerns about economic growth and shifts in labor market conditions, expressing a need to balance inflationary pressures with evidence of slowing employment. While inflation remains above target, the Fed appears to be signaling confidence that price pressures are moderating even as economic headwinds appear.

This nuanced stance contributes to market interpretation that although monetary policy is easing, it might not fully embrace a prolonged cycle of aggressive rate reductions a perspective that influences Bitcoin and broader crypto sentiment.

The Dollar, Yields, and Risk Sentiment

When interest rates are cut, the U.S. dollar often weakens because lower rates reduce the return on dollar-denominated assets. This weakening can lead risk-on investors to seek returns in assets outside traditional markets, like crypto and equities. Early reactions to the Fed’s decision included a sliding dollar index, which in turn provided tailwinds for global risk assets.

Simultaneously, Treasury yields responded to the policy shift, with longer-term yields moving lower as expectations for future rate cuts increased. Lower yields typically encourage investment in higher-risk, higher-reward instruments including Bitcoin, which has historically benefited from liquidity-driven environments.

Expert Perspectives: Trader and Analyst Reactions

Market watchers and analysts offered varied takes on the Fed’s move, reflecting both optimism and caution.

Optimistic Views: Liquidity and Valuation Support

A number of analysts view the rate cut as a welcome development for digital assets. They argue that increased liquidity improves the investing landscape for Bitcoin, particularly in an environment where traditional safe havens offer limited return. By reducing borrowing costs, the Fed effectively encourages capital allocation into higher-risk assets a scenario that historically coincides with periods of bullish sentiment in the crypto markets.

Some traders interpret these developments as a long-term positive for Bitcoin, positing that accommodative monetary conditions can lead to sustained investment flows into crypto, especially if other central banks adopt similar easing measures.

Cautious Perspectives: Sell-the-News and Hawkish Signals

Not all reactions have been unequivocally bullish. A portion of traders cautioned that while rate cuts boost liquidity, the tone of the Fed’s guidance can temper enthusiasm. If the central bank signals only modest future cuts or hints at a gradual easing path, markets may interpret this as a sign that monetary accommodation is limited. This can prompt sell-the-news reactions, where assets rise on anticipation and then soften once the announcement is confirmed.

In fact, Bitcoin and other major cryptocurrencies experienced downward price pressure immediately after the Fed’s statement in some trading windows, consistent with traders reassessing long positions amid mixed expectations about future policy easing.

How Traders Are Responding to Bitcoin’s Reaction

In the wake of the Fed’s decision, trading strategies in crypto markets have adapted to the heightened uncertainty and volatility.

Adjusting Risk Management

Many traders, particularly those using leverage, have tightened risk parameters, placing greater emphasis on stop-loss orders and dynamic position sizing to protect against sudden swings. This approach reflects lessons learned from past rate-related volatility events, where unexpected policy signals resulted in sharp price movements across crypto and traditional markets alike.

Monitoring Macro Indicators

Savvy market participants are closely watching key macroeconomic indicators that may shape future Fed actions. Employment data, inflation metrics, and GDP growth figures are among the top variables traders track, as shifts in these numbers could influence the timing and magnitude of future rate changes.

In this landscape, understanding how monetary policy interacts with Bitcoin price reactions enables traders to anticipate potential trend reversals or continuation patterns more effectively.

Long-Term Implications for Bitcoin and Crypto Markets

While short-term reactions capture headlines, long-term trends reveal deeper insights into how macroeconomic shifts influence the direction of Bitcoin and digital assets.

Historical Patterns of Rate Cuts and BTC Performance

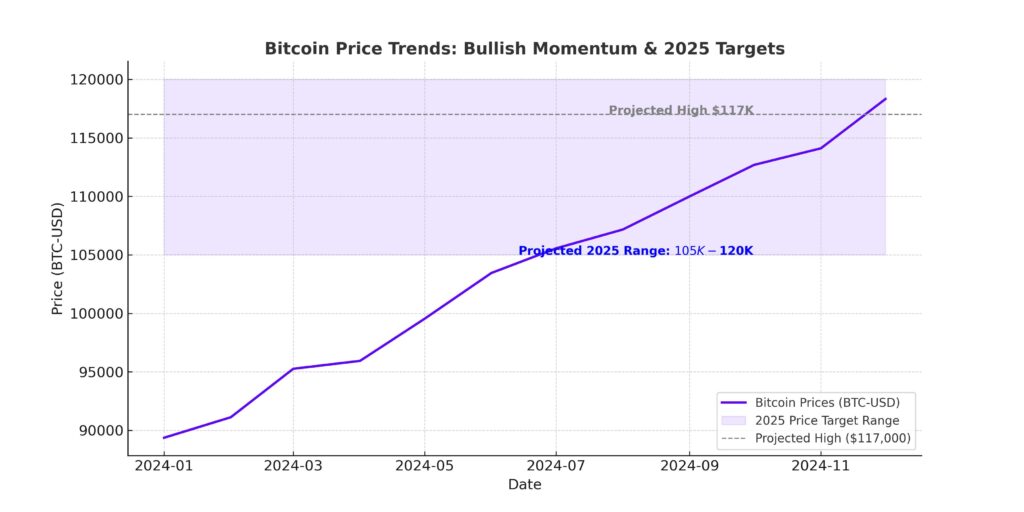

Historically, periods of loose monetary policy including rate cuts have correlated with heightened risk asset performance. For example, prolonged rate cuts and quantitative easing during economic slowdowns have in the past supported robust rallies in Bitcoin and other digital assets.

Although every cycle is unique, these historical patterns provide context for how markets respond when liquidity expands and traditional asset returns are constrained. Lower rates often reduce the opportunity cost of holding non-yielding assets like Bitcoin, making them more attractive in diversified portfolios.

Broader Adoption and Market Confidence

If continued monetary easing encourages capital allocation into alternative asset classes, one long-term benefit may be broader institutional participation in crypto markets. Greater institutional confidence — driven by a combination of macro conditions and regulatory clarity could spur increased demand, deeper liquidity, and improved market maturity.

As the crypto ecosystem continues to evolve, macroeconomic catalysts like Fed rate decisions will remain central to narrative building and adoption trends.

Conclusion

The Bitcoin price reaction to the US Federal Reserve’s recent 25 bps rate cut highlights the deep interconnection between macroeconomic policy and digital asset markets. While Bitcoin displayed short-term volatility and mixed directional moves immediately following the announcement, the broader implications of increased liquidity and shifting investor sentiment cannot be ignored. As traders and investors digest the Fed’s messaging and future guidance, the crypto market continues to balance optimism with caution.

Understanding how monetary policy influences Bitcoin and broader crypto markets is essential in today’s fast-moving financial landscape. Whether viewed as a catalyst for growth or as a source of volatility, the Federal Reserve’s policy choices will remain a critical factor shaping sentiment and asset allocation decisions across global markets.

FAQs

Q. Why does the Bitcoin price react to a US Federal Reserve rate cut?

Bitcoin’s price often reacts to rate cuts because they influence liquidity, borrowing costs, and investor appetite for risk, making non-traditional assets like crypto more attractive.

Q. Did Bitcoin immediately rise after the 25 bps cut?

In the short term, Bitcoin experienced volatility with both upward and downward price swings as traders digested the news and adjusted risk positions.

Q. What does a weaker U.S. dollar mean for Bitcoin and crypto?

A weaker dollar can reduce the opportunity cost of holding non-yield assets like Bitcoin, potentially increasing demand and supporting higher prices.

Q. Are future rate cuts expected to further impact Bitcoin?

If the Fed signals additional rate cuts or liquidity support, it could bolster risk-on sentiment and positively influence Bitcoin and other crypto assets.

Q. Should crypto investors focus on macroeconomic indicators?

Yes, macroeconomic data including inflation, employment figures, and Fed guidance plays a key role in how crypto markets price risk and set expectations.