Bitcoin price predictions 2026–2030 have become one of the most discussed topics in the digital finance space as cryptocurrencies continue to mature beyond speculative assets into real economic infrastructure. Bitcoin’s journey from an experimental peer-to-peer currency to a globally recognized financial asset has reshaped how people think about money, salaries, savings, and cross-border payments. As we move deeper into the next decade, investors, professionals, and policymakers alike are asking what lies ahead for Bitcoin’s price trajectory and how its evolution will affect crypto salaries and stablecoins.

Between 2026 and 2030, Bitcoin is expected to face a radically different environment compared to its early years. Institutional adoption, regulatory clarity, technological upgrades, and macroeconomic shifts will all play decisive roles in shaping Bitcoin’s long-term value. At the same time, the rise of crypto salaries, stablecoin payments, and blockchain-based payroll systems is changing how people earn and store value globally. These trends are deeply interconnected, as Bitcoin’s price stability and market perception directly influence how confidently businesses and workers embrace digital assets.

This in-depth analysis explores Bitcoin price predictions from 2026 to 2030 while examining the broader implications for crypto salaries and stablecoins. By understanding the forces driving Bitcoin’s future, readers can better anticipate how the digital economy may evolve in the years ahead.

Foundations of long-term Bitcoin price predictions

Bitcoin price predictions over long time horizons require more than technical analysis or short-term market sentiment. They depend on structural trends that shape demand, supply, and utility.

Bitcoin’s fixed supply and long-term scarcity

At the core of Bitcoin’s value proposition is its fixed supply of 21 million coins. This built-in scarcity distinguishes Bitcoin from fiat currencies, which can be expanded through monetary policy. As adoption increases between 2026 and 2030, scarcity is expected to become more pronounced, especially if demand from institutions and governments continues to rise. This scarcity narrative remains a key driver behind optimistic Bitcoin price predictions.

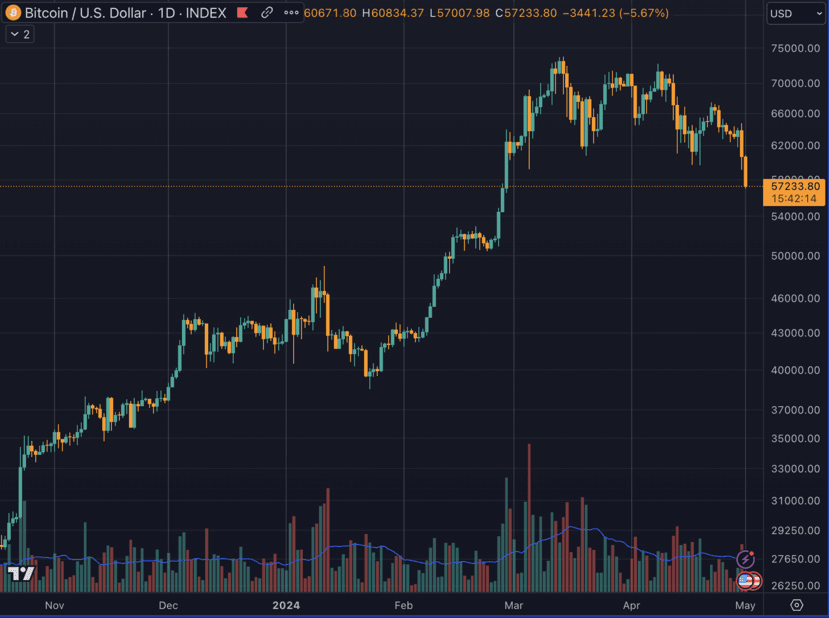

The role of halving cycles beyond 2024

Bitcoin halvings reduce the rate at which new coins enter circulation. By the time the market reaches 2026–2030, at least one additional halving cycle will have occurred, tightening supply further. Historically, these events have preceded major bull markets, although returns tend to moderate as Bitcoin’s market capitalization grows. Still, reduced issuance remains a powerful long-term catalyst.

Bitcoin price predictions 2026–2030: Market scenarios

Bitcoin price outlook for 2026

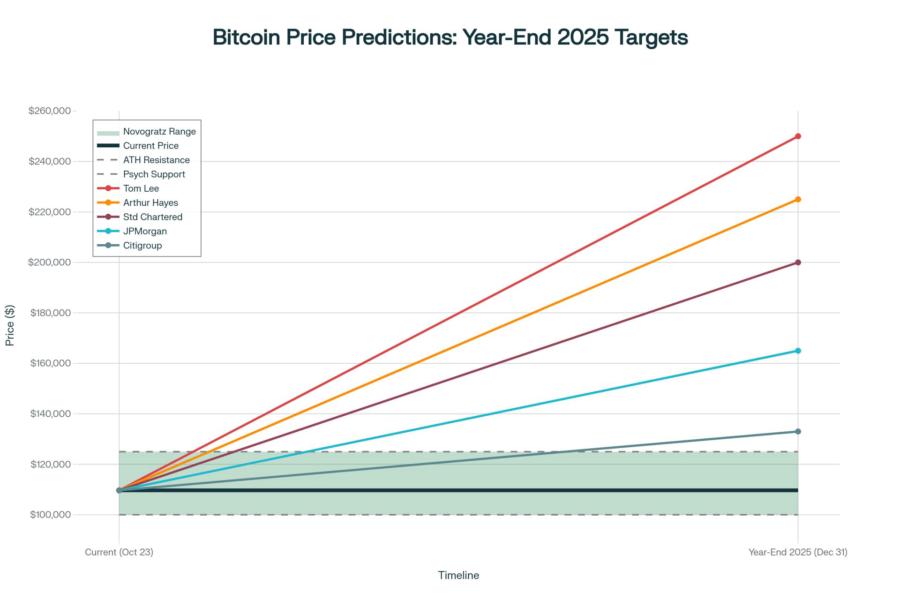

By 2026, Bitcoin is expected to be firmly embedded in institutional portfolios. Spot ETFs, pension fund exposure, and sovereign interest could push Bitcoin into a more mature asset class. Many analysts project Bitcoin prices stabilizing well above previous cycle highs, supported by growing trust and regulatory clarity. While volatility will persist, Bitcoin’s price behavior may resemble that of emerging macro assets rather than speculative tokens.

Bitcoin price expectations for 2027–2028

During this period, Bitcoin’s role as digital gold may strengthen. If global inflation concerns persist or fiat currencies face renewed pressure, Bitcoin could attract long-term capital seeking protection against monetary debasement. Adoption in emerging markets may also accelerate, especially where stable access to traditional banking remains limited. These factors contribute to bullish Bitcoin price predictions for the late 2020s.

Bitcoin price possibilities by 2029–2030

By 2030, Bitcoin may reach a point where price growth is driven less by speculation and more by utility and integration into global financial systems. If Bitcoin becomes a standard settlement layer or reserve asset, its valuation could reflect this systemic importance. Conservative projections suggest steady appreciation, while more optimistic models envision exponential growth driven by mass adoption and reduced supply.

How crypto salaries depend on Bitcoin’s long-term performance

The evolution of crypto salaries

Crypto salaries have transitioned from niche compensation models used by blockchain startups to mainstream payment options for freelancers, developers, and remote workers. As Bitcoin price predictions become more stable and predictable, employers gain confidence in offering salaries partially or fully denominated in digital assets.

Bitcoin’s long-term price trajectory directly influences whether employees view crypto salaries as viable income or speculative exposure. Greater price stability between 2026 and 2030 could encourage widespread adoption of Bitcoin-based payroll systems.

Bitcoin versus stablecoins in payroll systems

While Bitcoin offers long-term upside, its volatility makes stablecoins more practical for day-to-day salary payments. Many companies already use stablecoins pegged to fiat currencies to reduce risk for employees. However, Bitcoin often plays a role as a savings or investment component within crypto compensation packages, blending stability with growth potential.

The expanding role of stablecoins in the crypto economy

Why stablecoins matter for mass adoption

Stablecoins act as a bridge between traditional finance and decentralized systems. Pegged to fiat currencies, they offer price stability while retaining the efficiency of blockchain transactions. Between 2026 and 2030, stablecoins are expected to dominate crypto payments, remittances, and payroll solutions.

As Bitcoin price predictions influence market confidence, stablecoins provide the practical layer that enables everyday usage. This complementary relationship strengthens the overall crypto ecosystem.

Regulation and trust in stablecoins

Regulatory clarity will be crucial for stablecoins’ growth. Governments are increasingly focused on ensuring transparency and reserve backing. Clear frameworks could boost trust and adoption, making stablecoins a preferred option for salaries and international payments. Bitcoin’s decentralized nature contrasts with stablecoins’ regulatory exposure, offering users a spectrum of choices.

Bitcoin adoption and its impact on global labor markets

Remote work and crypto-based compensation

The rise of remote work has accelerated the adoption of crypto salaries. Workers across borders can receive payments instantly without relying on traditional banking infrastructure. Bitcoin and stablecoins enable this frictionless flow of value, especially in regions with limited access to financial services.

As Bitcoin price predictions become more optimistic, employees may increasingly opt to hold part of their income in Bitcoin, viewing it as a long-term wealth-building asset rather than just a payment method.

Emerging markets and financial inclusion

In emerging economies, Bitcoin and stablecoins offer alternatives to unstable local currencies. Crypto salaries paid in stablecoins or Bitcoin can protect purchasing power and provide access to global opportunities. This dynamic could significantly influence Bitcoin’s demand between 2026 and 2030.

Technological developments shaping Bitcoin’s future

Layer-2 solutions and scalability

Scalability remains a critical challenge for Bitcoin. Layer-2 solutions such as the Lightning Network aim to enable faster and cheaper transactions. By 2030, these technologies could be mature enough to support widespread usage, including microtransactions and salary payments.

Improved scalability enhances Bitcoin’s utility, strengthening long-term price predictions by expanding real-world use cases.

Security and network resilience

Bitcoin’s security model continues to be one of its strongest features. As mining becomes more decentralized and energy-efficient, network resilience is expected to improve. This security underpins confidence in Bitcoin as a store of value and settlement asset.

Macroeconomic factors influencing Bitcoin price predictions

Inflation, interest rates, and monetary policy

Global monetary policy will significantly influence Bitcoin’s price between 2026 and 2030. Persistent inflation or currency debasement could drive demand for scarce assets like Bitcoin. Conversely, tight monetary conditions may temporarily suppress speculative interest while reinforcing Bitcoin’s long-term hedge narrative.

Geopolitical uncertainty and digital assets

Geopolitical tensions often push investors toward alternative assets. Bitcoin’s borderless nature makes it appealing during periods of instability. As global uncertainty persists, Bitcoin may increasingly be viewed as a neutral financial asset, supporting bullish long-term predictions.

Risks and challenges facing Bitcoin through 2030

Regulatory uncertainty

While progress has been made, regulatory risks remain. Governments may impose restrictions that affect adoption or liquidity. However, clearer regulations could also legitimize Bitcoin further, attracting institutional capital.

Competition from other digital assets

Bitcoin faces competition from other cryptocurrencies and emerging digital currencies, including central bank digital currencies. While Bitcoin’s first-mover advantage is significant, innovation elsewhere could influence its market share and growth rate.

How investors and professionals can prepare for 2026–2030

Understanding Bitcoin price predictions is not just about speculation; it’s about strategic planning. Investors should consider long-term fundamentals, while professionals exploring crypto salaries should assess risk tolerance and diversification strategies. Combining Bitcoin with stablecoins offers a balanced approach to volatility and stability.

Conclusion

Bitcoin price predictions 2026–2030 point toward a future where Bitcoin is deeply integrated into the global financial system. While price volatility will remain, structural factors such as scarcity, adoption, and technological innovation support a positive long-term outlook. At the same time, the growth of crypto salaries and stablecoins reflects Bitcoin’s expanding role beyond speculation into real economic activity.

As digital assets reshape how people earn, save, and transact, Bitcoin’s evolution will continue to influence global markets. Whether as a store of value, a settlement layer, or a component of crypto compensation, Bitcoin’s journey through 2030 promises to be transformative for the broader digital economy.

FAQs

Q. Are Bitcoin price predictions for 2026–2030 reliable?

Long-term predictions are inherently uncertain, but they are based on adoption trends, supply dynamics, and macroeconomic factors rather than short-term speculation.

Q. Will crypto salaries become mainstream by 2030?

Crypto salaries are likely to grow significantly, especially in remote work and global freelancing, supported by stablecoins and blockchain payroll systems.

Q. Why are stablecoins important alongside Bitcoin?

Stablecoins provide price stability for daily transactions and salaries, complementing Bitcoin’s role as a long-term store of value.

Q. Can Bitcoin replace traditional currencies by 2030?

Bitcoin is unlikely to fully replace fiat currencies but may coexist as a global reserve asset or alternative financial system component.

Q. Should professionals accept salaries in Bitcoin?

This depends on individual risk tolerance. Many professionals choose a hybrid approach, combining stablecoins for stability and Bitcoin for long-term growth.