Bitcoin (BTC) has been the talk of the town in the financial world for over a decade. As the first and most well-known cryptocurrency, it consistently grabs headlines with its volatile price swings, creating both excitement and fear among investors. Recently, Bitcoin’s price has shown signs of either stabilizing or undergoing a potential breakthrough. But with so many factors affecting its price movements, what can we expect for BTC in the next few days?

In this detailed Bitcoin price analysis, we’ll explore the most likely scenarios for BTC, taking into account both technical and fundamental factors. Whether you’re a seasoned investor or just starting with Bitcoin, understanding these dynamics will help you make better decisions in the coming days.

Current Bitcoin Market Conditions

Bitcoin’s price is driven by a mix of factors including market sentiment, macroeconomic events, technological advancements, and regulatory changes. At the time of writing, Bitcoin has been experiencing a moderate level of volatility, a common occurrence for this leading cryptocurrency. The most recent price fluctuations have been influenced by:

Global Economic Factors

Global economic conditions play a major role in the movement of Bitcoin prices. Economic uncertainty, such as rising inflation rates, stock market instability, or shifts in interest rates, often pushes investors toward alternative assets like Bitcoin.

Institutional Adoption

Institutional investment continues to play a critical role in Bitcoin’s price trajectory. The recent influx of institutional funds, alongside growing Bitcoin adoption by major corporations, indicates a long-term bullish outlook for Bitcoin. Major financial institutions are increasingly viewing Bitcoin not only as a store of value but also as a hedge against inflation.

Technical Indicators

On the technical side, Bitcoin’s price movements can be analyzed using a variety of indicators like moving averages, Relative Strength Index (RSI), and Bollinger Bands. These tools help investors gauge market sentiment and predict possible price trends.

Market Sentiment and Social Media

The psychological aspect of investing in Bitcoin is powerful. News, social media activity, and influential figures in the crypto space can trigger sharp price changes. Positive sentiment, fueled by announcements or predictions from high-profile figures, can push Bitcoin’s price upward, while negative news or regulatory threats can cause a rapid decline.

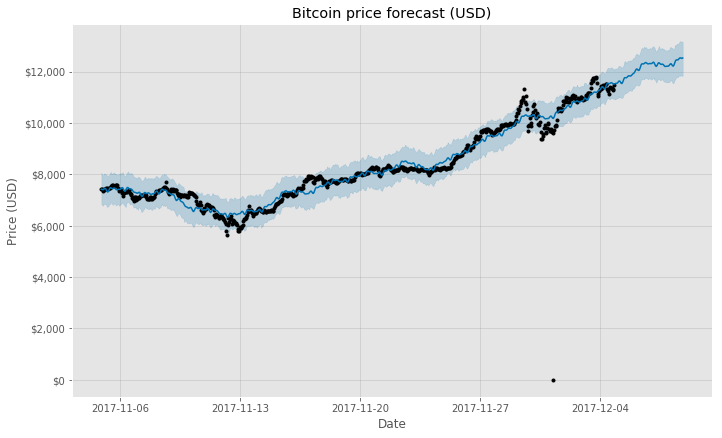

What Does the Chart Say About Bitcoin Price in the Coming Days?

To predict Bitcoin’s price in the next few days, it’s essential to take a closer look at the charts. When analyzing Bitcoin’s price movements, traders often rely on several key technical analysis tools to spot trends and potential reversal points.

Key Support and Resistance Levels

Bitcoin’s price movements are often governed by established support and resistance levels. These are price points where the asset has historically had difficulty breaking through (resistance) or tends to bounce higher (support).

For example, in the current market cycle, Bitcoin has recently been testing the $30,000 mark as a support level. This has been a critical level for BTC in the past few months, and many traders are watching this closely. If Bitcoin drops below this support level, it could signal further bearish pressure.

On the other hand, the resistance level is hovering just above $35,000. If Bitcoin is able to break past this price, we could see a strong rally toward $40,000 or even higher.

Moving Averages

The 50-day and 200-day moving averages are two of the most commonly used indicators for analyzing Bitcoin’s price trends. Currently, Bitcoin is trading between these two moving averages, which suggests that the market is uncertain. However, a strong breakout above the 50-day moving average could signal a bullish shift, while a drop below the 200-day moving average would indicate a potential downtrend.

RSI and Market Sentiment

The Relative Strength Index (RSI) is another useful tool for predicting Bitcoin’s price movements. The RSI measures whether an asset is overbought or oversold, indicating potential reversal points. As of now, Bitcoin’s RSI is showing signs of overbought conditions, which could suggest that a short-term correction might be in the cards.

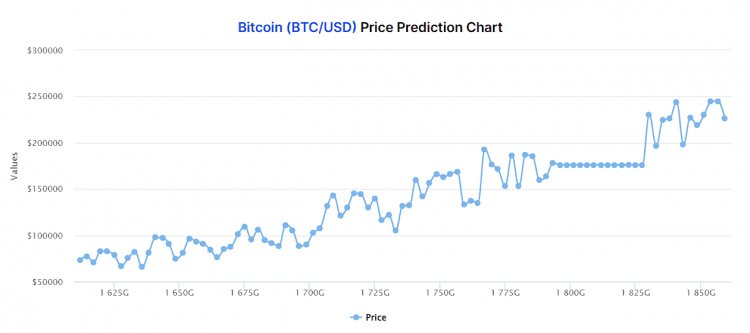

Potential Bullish Scenario for Bitcoin

Despite Bitcoin’s volatility, there are some key indicators that suggest a bullish scenario in the next few days. A number of technical and fundamental factors align to present a positive outlook for BTC.

Positive News Catalysts

Bitcoin’s price is heavily influenced by news events. In recent months, positive developments such as Bitcoin ETF approvals and the growing acceptance of Bitcoin as a payment method by major corporations have fueled bullish sentiment.

If Bitcoin receives another positive news catalyst, such as a favorable regulatory announcement or institutional investment, it could trigger a strong upward movement in price.

Institutional Buying Pressure

As mentioned earlier, institutional investors are increasingly moving into the Bitcoin space. Many major financial institutions, hedge funds, and even central banks are starting to treat Bitcoin as a legitimate asset class. This increasing institutional demand could push Bitcoin’s price upward in the short term.

Additionally, if Bitcoin continues to gain adoption by well-known companies and financial institutions, it could further solidify its status as a store of value and hedge against inflation. This, in turn, could lead to continued upward price momentum.

Halving Cycle Influence

Bitcoin’s halving event, which occurs approximately every four years, has historically been followed by major price increases. The most recent halving took place in May 2020, and we’re currently in the post-halving period, where the effects of reduced mining rewards begin to kick in.

Although we’re still some time away from the next halving (scheduled for 2024), historical trends suggest that Bitcoin’s price tends to rise in anticipation of these events, which could cause a bullish rally in the coming months.

Potential Bearish Scenario for Bitcoin

While there are many factors pointing toward a bullish scenario, it’s important to consider the possibility of a short-term bearish move. Bitcoin’s price is highly volatile, and sudden drops are not uncommon.

Regulatory Concerns

Regulation is one of the largest threats to Bitcoin’s price. Governments around the world are still debating how to regulate Bitcoin and other cryptocurrencies. Negative regulatory news, such as crackdowns or stringent restrictions on Bitcoin trading and use, could cause a significant price drop in the short term.

Market Correction

Bitcoin has experienced significant gains over the past few months, and many analysts believe the market is due for a correction. If Bitcoin’s RSI continues to remain in overbought territory, a short-term pullback could be imminent. A price correction could see Bitcoin fall to key support levels around $28,000 or even lower.

Negative Market Sentiment

Just as positive news can drive Bitcoin’s price higher, negative news can trigger sharp price declines. If a major social media influencer or market figure shares a pessimistic view about Bitcoin’s future, it could result in a sudden sell-off.

What’s Next for Bitcoin? Key Takeaways

Looking ahead, Bitcoin’s price is at a critical juncture. The market is currently experiencing a tug-of-war between bullish and bearish factors. While institutional demand, positive news catalysts, and the effects of the halving cycle point toward a potential upward trend, risks remain in the form of regulatory concerns and market corrections.

In the next few days, we expect Bitcoin to test key support and resistance levels. A breakthrough above the $35,000 resistance level would likely signal a continuation of the bullish trend, while a drop below $30,000 could lead to a bearish scenario.

Ultimately, Bitcoin’s price remains unpredictable in the short term, but the long-term outlook for the cryptocurrency remains strong, driven by growing institutional adoption and global economic uncertainty.

Conclusion

Bitcoin’s price is in a delicate position as it faces both bullish and bearish pressures. In the short term, the next few days could see Bitcoin testing key levels of support and resistance, with either a bullish or bearish outcome possible depending on various factors. Investors should stay informed about market developments, paying close attention to both technical indicators and external news events that could influence Bitcoin’s price. As always, caution and vigilance are essential when navigating the volatile cryptocurrency market.

FAQs About Bitcoin’s Price and Market Trends

Q. What is the current price trend of Bitcoin?

Bitcoin’s price has shown signs of consolidation around the $30,000 to $35,000 range, with potential for either an upward or downward movement in the near future.

Q. What are the key factors influencing Bitcoin’s price right now?

The main factors include global economic conditions, institutional adoption, regulatory developments, and market sentiment driven by news and social media.

Q. Is Bitcoin a good investment for the short term?

Given Bitcoin’s volatility, short-term investments can be risky. It’s important to stay updated with market conditions and use technical analysis to make informed decisions.

Q. How do halving events affect Bitcoin’s price?

Bitcoin’s halving events have historically led to price increases due to reduced mining rewards, leading to greater scarcity and increased demand.

Q. What should I do if Bitcoin breaks below $30,000?

A drop below $30,000 could signal a bearish trend, and investors may want to consider reducing their exposure or closely monitoring the market for further signals of a recovery or continued decline.