Bitcoin price forecast indicates sustained momentum above the crucial $111,000 threshold. Despite facing significant challenges from heavy spot Bitcoin exchange-traded fund (ETF) outflows, BTC demonstrates remarkable resilience in its recovery trajectory. This Bitcoin price forecast analysis reveals critical insights into the world’s leading cryptocurrency as it navigates through volatile market conditions, institutional investment patterns, and evolving regulatory landscapes. Understanding these dynamics is essential for investors seeking to capitalize on Bitcoin’s price movements in the current market environment.

Current Bitcoin Price Movement

BTC’s Resilient Recovery Above $111,000

Bitcoin’s ability to maintain its position above $111,000 represents a significant technical achievement in the current market cycle. The Bitcoin price forecast suggests that this level has transformed from resistance into a robust support zone, indicating strong accumulation by long-term holders. Market data reveals that despite experiencing approximately $2.4 billion in net outflows from spot Bitcoin ETFs over recent weeks, BTC has demonstrated extraordinary strength.

The cryptocurrency’s recovery is particularly noteworthy considering the macroeconomic headwinds facing risk assets globally. Institutional investors appear to be maintaining their conviction in Bitcoin’s long-term value proposition, even as short-term trading positions are being adjusted. This divergence between ETF flows and price action suggests that on-chain activity and direct Bitcoin purchases through exchanges are compensating for institutional profit-taking.

Technical indicators paint a bullish picture for the Bitcoin price forecast in the near term. The Relative Strength Index (RSI) remains in healthy territory between 55-65, suggesting room for further upside before entering overbought conditions. Additionally, the 50-day moving average has crossed above the 200-day moving average, forming a “golden cross” pattern that historically precedes extended bullish periods.

The ETF Outflow Paradox

The phenomenon of Bitcoin maintaining its price momentum despite substantial ETF outflows has puzzled many market analysts. Over the past three weeks, spot Bitcoin ETFs have experienced net outflows totaling billions of dollars, yet BTC prices have remained remarkably stable and even appreciated. This Bitcoin price forecast anomaly can be attributed to several factors working in tandem.

First, the outflows primarily represent profit-taking by early ETF investors who entered positions at significantly lower price points. When these shares are redeemed, authorized participants don’t necessarily sell the underlying Bitcoin immediately, particularly if they anticipate future demand. Second, the outflows are being offset by increased accumulation from high-net-worth individuals and corporations purchasing Bitcoin directly through over-the-counter (OTC) desks and cryptocurrency exchanges.

Furthermore, on-chain metrics reveal that long-term holder supply continues to increase, with wallet addresses holding Bitcoin for more than six months reaching all-time highs. This accumulation by conviction-driven investors provides a natural floor for Bitcoin prices, supporting the bullish Bitcoin price forecast despite temporary institutional rebalancing.

Bitcoin Price Forecast: Technical Analysis and Key Levels

Critical Support and Resistance Zones

The current Bitcoin price forecast identifies several crucial technical levels that will determine BTC’s trajectory in the coming weeks. The primary support zone lies between $108,500 and $110,000, a region that has been tested multiple times and held firmly. This area represents the convergence of the 21-day exponential moving average (EMA) and the 0.382 Fibonacci retracement level from the recent swing low to high.

On the upside, immediate resistance appears at $113,500, where previous price action encountered selling pressure. A decisive break above this level could open the path toward $118,000, aligning with the 1.618 Fibonacci extension target. The Bitcoin price forecast suggests that sustained volume above 25,000 BTC per hour would be necessary to confirm a breakout above current resistance levels.

Traders should also monitor the $106,000 level as a critical invalidation point for the current bullish structure. A daily close below this threshold would likely trigger cascading liquidations of leveraged long positions and potentially shift the Bitcoin price forecast to a more neutral or bearish outlook in the short term.

Momentum Indicators and Market Sentiment

Multiple momentum indicators support the positive Bitcoin price forecast scenario. The Moving Average Convergence Divergence (MACD) indicator has recently crossed bullish on the daily timeframe, with the MACD line moving above the signal line. This crossover, combined with expanding histogram bars, suggests increasing bullish momentum that could drive prices higher.

The Chaikin Money Flow (CMF) indicator remains positive, indicating that accumulation is occurring despite the ETF outflows mentioned earlier. This divergence between institutional fund flows and actual market accumulation patterns reinforces the resilient nature of the current Bitcoin rally. Volume profile analysis reveals strong support building at current levels, with significant trading activity establishing a value area between $109,000 and $112,000.

Social sentiment metrics compiled from cryptocurrency-focused platforms show retail investor optimism reaching elevated but not extreme levels. The Crypto Fear & Greed Index currently sits at 68, indicating “greed” but not excessive euphoria that typically marks major tops. This measured sentiment supports a continuation of the current Bitcoin price forecast trajectory without immediate risk of a major correction.

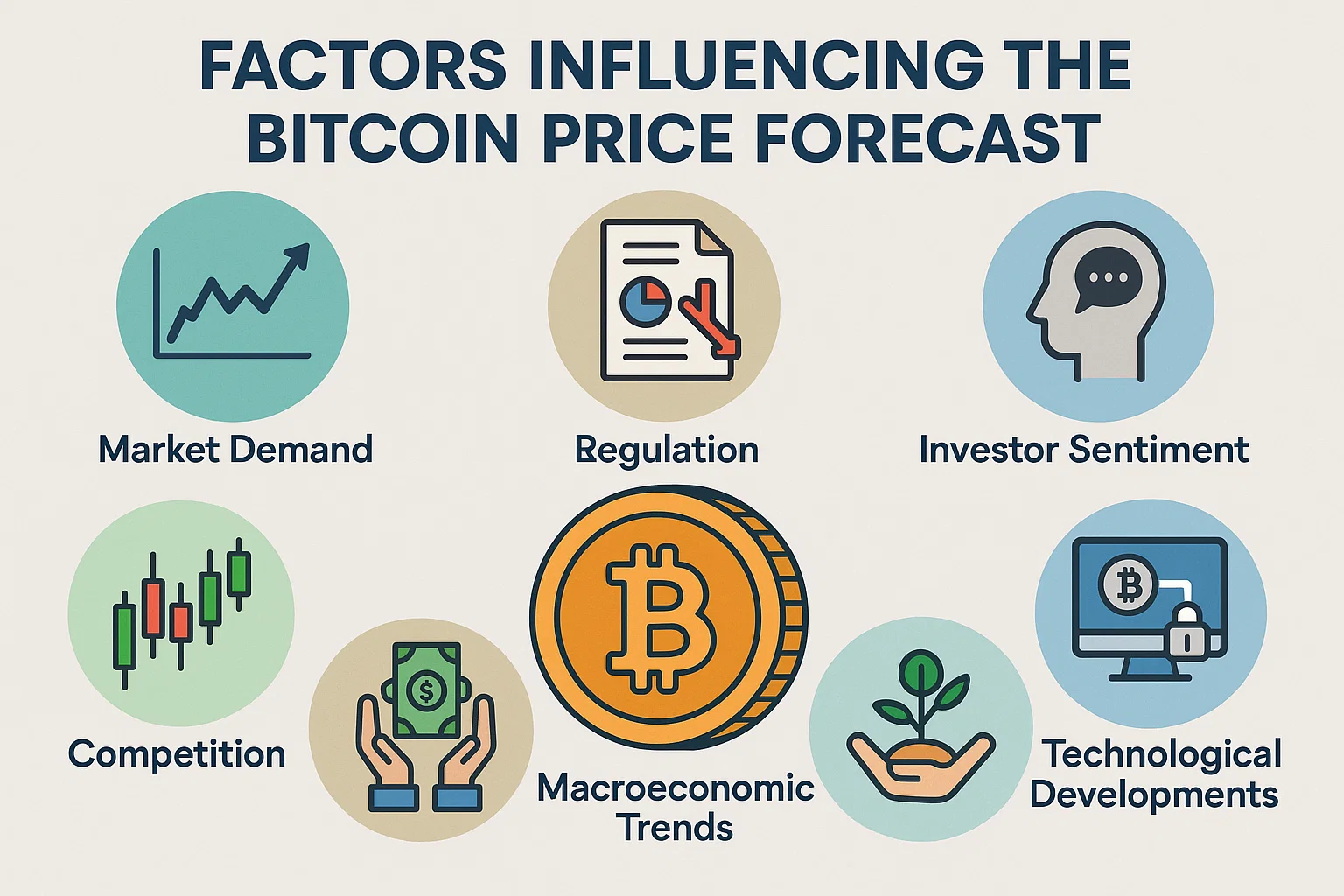

Factors Influencing the Bitcoin Price Forecast

Macroeconomic Environment and Monetary Policy

The broader macroeconomic landscape plays a pivotal role in shaping the Bitcoin price forecast for the remainder of 2025. Central bank policies, particularly those of the Federal Reserve, continue to influence risk asset valuations significantly. Current market expectations suggest that interest rate decisions will remain data-dependent, with inflation trends serving as the primary determinant for monetary policy adjustments.

Bitcoin’s correlation with traditional risk assets like technology stocks has decreased somewhat in recent months, suggesting that the cryptocurrency is beginning to establish its own fundamental drivers. This decoupling is particularly evident during periods of banking sector stress, where Bitcoin has demonstrated its utility as a non-correlated asset and potential safe haven during financial instability.

The ongoing discussions around national Bitcoin reserves and strategic stockpiling by sovereign nations add another dimension to the Bitcoin price forecast. Several countries have publicly announced intentions to accumulate Bitcoin as part of their national reserves, potentially creating sustained demand that supports higher price levels over the long term.

Institutional Adoption and Corporate Treasury Strategies

Corporate adoption of Bitcoin as a treasury reserve asset continues to gain traction, providing fundamental support for the bullish Bitcoin price forecast. Companies across various sectors are allocating portions of their cash reserves to Bitcoin, viewing it as a hedge against currency devaluation and a means to preserve purchasing power over extended timeframes.

The approval and launch of spot Bitcoin ETFs earlier this year marked a watershed moment for institutional access to cryptocurrency exposure. Despite recent outflows, the total assets under management in these products remain substantial, providing a permanent bid in the market through authorized participant creation and redemption mechanisms. This infrastructure supports long-term price stability and contributes to the positive Bitcoin price forecast.

Major financial institutions have expanded their cryptocurrency service offerings, with several large banks now providing Bitcoin custody, trading, and advisory services to their high-net-worth clients. This institutional infrastructure development creates network effects that should support Bitcoin adoption and, by extension, price appreciation over time.

Bitcoin Price Forecast: Short-Term vs. Long-Term Outlook

Near-Term Price Predictions (1-3 Months)

The short-term Bitcoin price forecast suggests continued consolidation and potential upside toward the $115,000-$120,000 range over the next one to three months. This projection is based on historical seasonal patterns, which show that the fourth quarter typically brings increased volatility and often positive returns for Bitcoin.

Technical patterns emerging on the 4-hour and daily charts suggest that Bitcoin is forming an ascending triangle formation, a bullish continuation pattern that typically resolves to the upside. The measured move from this pattern projects a target of approximately $118,500, aligning with Fibonacci extension levels discussed earlier in this Bitcoin price forecast analysis.

However, investors should remain cognizant of potential pullbacks to the $108,000-$110,000 support zone, which would represent healthy consolidation rather than a reversal of the broader uptrend. Such dips often present accumulation opportunities for those following the Bitcoin price forecast with a strategic investment approach.

Medium to Long-Term Projections (6-12 Months)

Looking further ahead, the extended Bitcoin price forecast for the next six to twelve months presents multiple scenarios based on different macro and fundamental conditions. The base case scenario suggests Bitcoin reaching the $135,000-$150,000 range, driven by continued institutional adoption, positive regulatory developments, and sustained retail interest.

The bullish case for the Bitcoin price forecast envisions Bitcoin breaking through $150,000 and potentially reaching $175,000-$200,000 if several catalysts align. These would include aggressive monetary easing by central banks, major corporate treasury adoptions, or the approval of Bitcoin as a strategic reserve asset by a G7 nation. The network’s fundamental metrics, including hash rate growth and active address expansion, support the infrastructure for such price levels.

Conversely, the bearish scenario for the Bitcoin price forecast would see Bitcoin retesting the $95,000-$100,000 zone if macroeconomic conditions deteriorate significantly or if major regulatory headwinds emerge. However, the strong support structure that has been built at current levels suggests that any significant decline would likely attract substantial buying interest from both institutional and retail participants.

Navigating ETF Dynamics in Your Bitcoin Investment Strategy

Understanding ETF Flow Patterns

The relationship between spot Bitcoin ETF flows and BTC price action requires nuanced interpretation within any comprehensive Bitcoin price forecast. While outflows might initially appear bearish, they often represent portfolio rebalancing, profit-taking, or tactical repositioning rather than wholesale abandonment of Bitcoin exposure.

Savvy investors recognize that ETF flows lag actual market sentiment by 1-2 days due to the creation and redemption process mechanics. This timing difference means that price-sensitive traders often react to on-chain data and exchange flows before ETF movement becomes apparent in public filings. Understanding these dynamics provides an edge when interpreting the Bitcoin price forecast in real-time.

Moreover, ETF outflows during price strength (as we’re currently experiencing) often indicate strong underlying demand from direct Bitcoin buyers who are absorbing the selling pressure. This pattern actually reinforces the bullish Bitcoin price forecast by demonstrating that conviction-driven buyers are willing to accumulate at higher prices.

Diversified Exposure Strategies

Investors following the Bitcoin price forecast should consider implementing diversified exposure strategies that balance ETF convenience with direct Bitcoin ownership. While ETFs offer simplicity and regulatory clarity, direct ownership provides complete control, the ability to participate in network activities, and eliminates counterparty risk associated with financial intermediaries.

A balanced approach might involve maintaining a core position in self-custodied Bitcoin for long-term holding, supplemented by tactical ETF positions that can be more easily adjusted based on short-term Bitcoin price forecast developments and market conditions. This hybrid strategy captures the benefits of both approaches while managing the unique risks associated with each.

For those specifically interested in the ETF market, monitoring net flow trends across all available Bitcoin ETFs provides valuable insights into institutional sentiment. Divergences between individual fund flows and overall market movement can signal shifts in the competitive landscape among providers and may inform tactical allocation decisions within the broader Bitcoin price forecast framework.

Regulatory Landscape and Its Impact on Bitcoin Prices

Global Regulatory Developments

The regulatory environment continues to evolve as a critical factor in any credible Bitcoin price forecast. Jurisdictions worldwide are progressing at varying speeds toward comprehensive cryptocurrency frameworks, with some embracing innovation while others maintain cautious or restrictive approaches.

The United States has seen meaningful progress in regulatory clarity, particularly following the successful launch of spot Bitcoin ETFs and ongoing discussions around potential strategic Bitcoin reserves. These developments remove significant uncertainty that previously weighed on institutional participation and support the positive Bitcoin price forecast for the coming quarters.

European markets continue implementing the Markets in Crypto-Assets (MiCA) regulation, providing a harmonized framework across EU member states. This regulatory standardization is expected to facilitate institutional adoption and could serve as a catalyst for increased Bitcoin demand from European investors, reinforcing the global Bitcoin price forecast trajectory.

Compliance and Market Infrastructure

Improvements in market infrastructure and compliance capabilities directly support the bullish Bitcoin price forecast by reducing operational risks and barriers to entry for traditional financial institutions. Major cryptocurrency exchanges have invested heavily in licensing, surveillance systems, and compliance teams that meet or exceed traditional financial market standards.

The development of qualified custodian services, insurance products, and audit frameworks specifically designed for digital assets addresses previous concerns that inhibited institutional participation. These infrastructure developments create a more mature market environment that supports higher valuations and reduced volatility premiums in the Bitcoin price forecast models.

Additionally, the integration of Bitcoin trading into existing financial market infrastructure, including options and futures exchanges, provides sophisticated hedging tools that attract a broader spectrum of market participants. This depth and sophistication in derivative markets contributes to improved price discovery and typically supports more efficient and stable spot market valuations.

On-Chain Metrics Supporting the Bitcoin Price Forecast

Network Fundamentals and Hash Rate

Bitcoin’s network fundamentals provide essential context for evaluating the Bitcoin price forecast beyond pure price action and technical analysis. The network hash rate has reached consecutive all-time highs, demonstrating that miners continue investing in infrastructure despite fluctuating profitability conditions. This long-term commitment from miners signals confidence in Bitcoin’s future value proposition.

The distribution of hash rate across mining pools shows healthy decentralization, with no single entity controlling more than 20% of network security. This distributed security model reinforces Bitcoin’s value proposition as a censorship-resistant asset and supports the long-term Bitcoin price forecast by reducing systemic vulnerabilities that could threaten the network’s integrity.

Transaction throughput and fee markets provide additional insights into network utilization and demand for Bitcoin block space. Current fee levels suggest moderate but consistent demand for transactions, indicating sustained economic activity on the network. The Lightning Network’s continued growth in capacity and channel count demonstrates scaling solution adoption that supports the Bitcoin price forecast by improving Bitcoin’s utility for smaller transactions.

Holder Behavior and Supply Dynamics

On-chain analysis of holder behavior reveals compelling patterns that support the bullish Bitcoin price forecast. The percentage of Bitcoin supply that hasn’t moved in over one year has reached 70%, indicating that a substantial portion of the circulating supply is held by long-term investors with high conviction in Bitcoin’s value appreciation potential.

The distribution of Bitcoin across different holder cohorts shows accumulation by addresses holding between 100 and 10,000 BTC, typically associated with institutional investors and high-net-worth individuals. This accumulation pattern differs significantly from retail-driven rallies and suggests a more sustainable foundation for the current Bitcoin price forecast trajectory.

Exchange balances continue their multi-year declining trend, with Bitcoin flowing from exchanges to self-custody solutions and institutional custody platforms. This reduction in readily available supply creates natural scarcity that supports price appreciation and validates the positive Bitcoin price forecast based on fundamental supply-demand dynamics.

Risk Factors and Potential Challenges

Market Volatility and Leverage

While the Bitcoin price forecast presents multiple bullish scenarios, investors must acknowledge significant risk factors that could disrupt these projections. Bitcoin’s inherent volatility, amplified by leverage in derivatives markets, can produce rapid price swings that challenge even well-researched investment theses and risk management frameworks.

Current open interest in Bitcoin futures and perpetual contracts remains elevated, suggesting that leveraged positions comprise a significant portion of market participants. Sudden liquidation cascades triggered by adverse price movement could temporarily override fundamental factors and create opportunities for both losses and strategic accumulation for those following the Bitcoin price forecast with appropriate risk controls.

Geopolitical events, unexpected regulatory announcements, or technical vulnerabilities discovered in major cryptocurrency infrastructure could produce volatility that tests investor conviction. The Bitcoin price forecast must be viewed as a probability-weighted expectation rather than a certainty, with risk management strategies appropriate for an asset class still establishing its maturity.

Competition and Technological Evolution

The cryptocurrency ecosystem continues evolving rapidly, with new technologies and competing assets potentially affecting Bitcoin’s market dominance and price trajectory. While Bitcoin maintains its position as the leading cryptocurrency by market capitalization and network security, innovations in competing protocols could influence the long-term Bitcoin price forecast if they successfully attract developer activity and user adoption.

Additionally, quantum computing advances, while not an immediate threat, represent a long-term consideration for any extended Bitcoin price forecast. The Bitcoin development community actively monitors these developments and has discussed potential upgrades to ensure long-term security, but technological uncertainty remains an inherent aspect of any digital asset investment.

Changes in energy markets and environmental policy could affect Bitcoin mining economics, particularly in regions with strict carbon regulations. While the industry has made substantial progress in renewable energy adoption and mining efficiency, evolving environmental standards represent an ongoing consideration in the comprehensive Bitcoin price forecast analysis.

Conclusion: Strategic Positioning for Bitcoin’s Continued Growth

The Bitcoin price forecast for the remainder of 2025 and beyond presents a compelling case for continued price appreciation, supported by resilient technical structure, improving fundamental adoption metrics, and maturing market infrastructure. Bitcoin’s ability to extend its recovery above $111,000 despite substantial ETF outflows demonstrates the underlying strength of conviction-driven buying and long-term holder accumulation.

Investors seeking to capitalize on this Bitcoin price forecast should approach the market with a balanced strategy that acknowledges both the significant upside potential and the inherent risks associated with cryptocurrency investments. Dollar-cost averaging into positions during consolidation phases, maintaining appropriate position sizing relative to overall portfolio risk tolerance, and implementing disciplined risk management protocols remain essential practices regardless of market outlook.