The anticipation is palpable across trading desks, social media platforms, and crypto forums as Bitcoin hovers in a critical price zone between $90,000 and $92,000. This CPI data release represents one of the most significant macroeconomic events that could determine Bitcoin’s trajectory for the coming weeks. Understanding the relationship between inflation metrics and Bitcoin price movements has become essential for anyone participating in cryptocurrency markets, as these traditional economic indicators increasingly drive crypto volatility and investor sentiment.

Relationship Between CPI Data and Bitcoin Price

The connection between inflation reports and cryptocurrency valuations has evolved dramatically over recent years. The Bitcoin price CPI data correlation has become increasingly pronounced as institutional investors have entered the crypto space, bringing with them traditional market analysis frameworks and macro-driven trading strategies that respond directly to economic indicators.

Consumer Price Index data measures the average change in prices paid by consumers for goods and services over time, serving as the primary gauge of inflation in the United States economy. When CPI data comes in higher than expected, it signals rising inflation, which historically has had complex implications for Bitcoin. Some investors view Bitcoin as “digital gold” and an inflation hedge, which theoretically should boost demand when inflation rises. However, higher inflation also typically prompts the Federal Reserve to maintain or increase interest rates, making yield-bearing assets more attractive and potentially drawing capital away from non-yielding assets like Bitcoin.

The dual nature of Bitcoin’s response to inflation creates the volatility and uncertainty we’re seeing today. Traders must weigh whether the inflation hedge narrative will dominate market psychology or whether concerns about monetary tightening will drive selling pressure. This complex dynamic explains why Bitcoin price movements around CPI releases have become some of the most volatile and closely watched events in the cryptocurrency calendar.

Historical Performance of Bitcoin During CPI Announcements

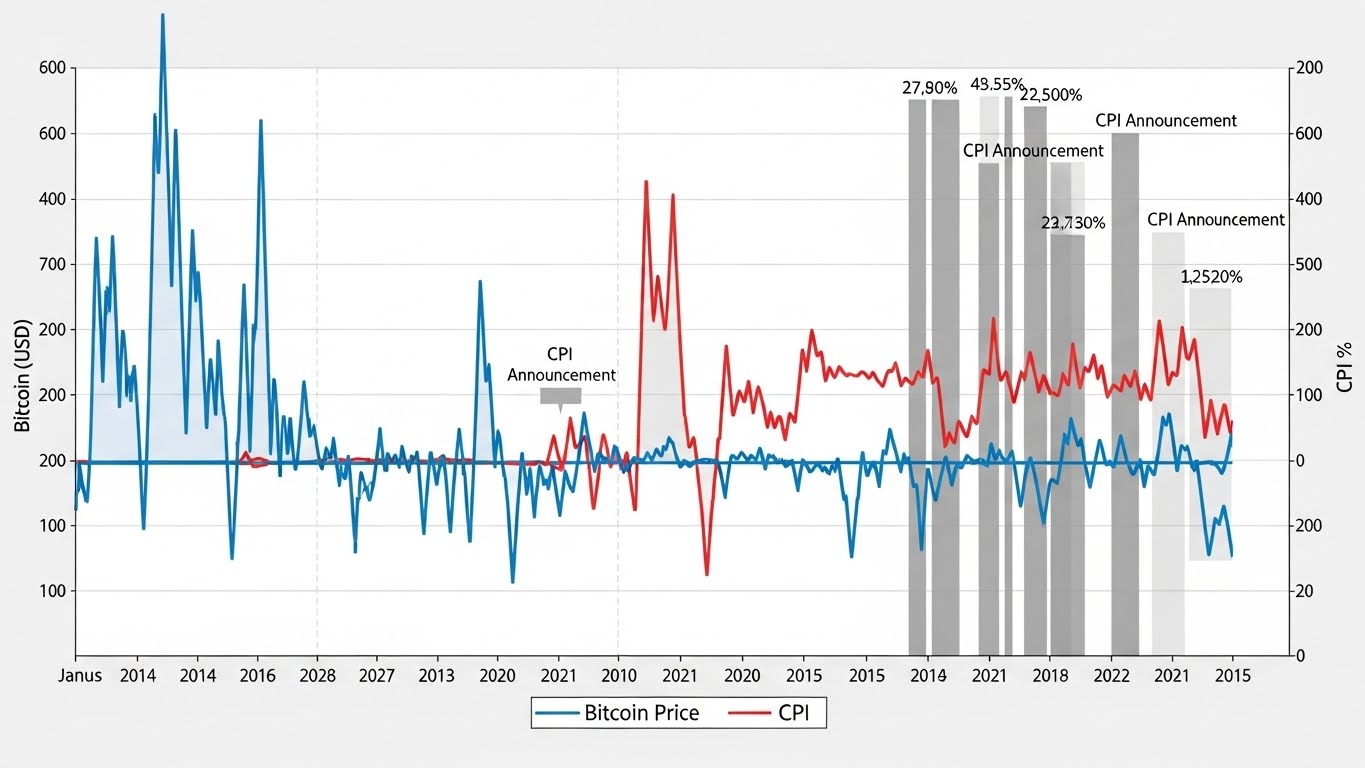

Examining past Bitcoin price reactions to CPI data reveals fascinating patterns that help inform today’s expectations. Over the past two years, Bitcoin has demonstrated heightened volatility in the hours immediately following CPI releases, with price swings of 3-5% being common and occasional moves exceeding 8-10% during particularly surprising data points.

Examining past Bitcoin price reactions to CPI data reveals fascinating patterns that help inform today’s expectations. Over the past two years, Bitcoin has demonstrated heightened volatility in the hours immediately following CPI releases, with price swings of 3-5% being common and occasional moves exceeding 8-10% during particularly surprising data points.

When CPI data has come in significantly lower than expectations, signaling cooling inflation, Bitcoin has generally responded positively. The logic behind this reaction centers on expectations that lower inflation gives the Federal Reserve room to pause rate hikes or even consider rate cuts, which would improve liquidity conditions and risk appetite across financial markets, including cryptocurrencies.

Conversely, when CPI figures exceed expectations, Bitcoin has often experienced immediate selling pressure as traders anticipate continued monetary tightening. However, these initial reactions don’t always persist, and Bitcoin has sometimes recovered within hours or days as the inflation hedge narrative reasserts itself among longer-term holders who view rising inflation as validation of Bitcoin’s value proposition.

Current Market Conditions and Bitcoin Price Levels

As we approach today’s CPI data release, Bitcoin finds itself in a technically significant position that makes the upcoming price movement particularly consequential. Trading in the $90,000 to $92,000 range, Bitcoin is testing resistance levels that could either confirm a bullish breakout or trigger a correction back toward support zones.

The $92,000 level represents a psychological and technical barrier that Bitcoin has tested several times in recent sessions without successfully breaking through. This resistance zone has accumulated significant sell orders from traders who believe this price represents fair value or who are taking profits after substantial gains. A decisive break above $92,000 for Bitcoin would likely trigger stop-loss orders from short sellers and activate buy orders from breakout traders, potentially accelerating upward momentum.

On the downside, the $90,000 level has emerged as critical support that has held firm during recent pullbacks. This price zone represents a confluence of technical factors including previous resistance turned support, a key Fibonacci retracement level, and a psychological round number that attracts defensive buying. If today’s CPI data triggers Bitcoin selling that breaks below $90,000, it could open the door to a deeper correction toward the $87,000-$88,000 range where stronger support levels await.

Technical Indicators Heading Into CPI Release

Technical analysis of Bitcoin price charts before the CPI announcement reveals a market in equilibrium, with neither bulls nor bears holding clear control. The Relative Strength Index sits near neutral territory around 50-55, suggesting Bitcoin is neither overbought nor oversold heading into this critical event. This positioning means the market has room to move significantly in either direction based on how traders interpret the inflation data.

Volume patterns have been declining over the past several sessions, a common occurrence as traders reduce position sizes and wait for clarity from major economic releases. This compression of volatility often precedes explosive moves, as the coiled spring of reduced trading activity releases once a catalyst provides directional conviction. Today’s CPI data certainly qualifies as such a catalyst.

Moving averages present a mixed picture that reflects the current indecision. The 50-day moving average is trending upward and currently sits just below current prices, providing potential support if Bitcoin price drops after the CPI release. However, the 200-day moving average remains below that, and Bitcoin hasn’t yet established the kind of decisive uptrend that would provide confidence to buyers during periods of uncertainty.

Analyst Predictions for Bitcoin Price After CPI Data

The cryptocurrency analyst community has offered divergent views on how today’s Bitcoin price will react to CPI data, reflecting the genuine uncertainty surrounding both the data itself and Bitcoin’s likely response. These varying perspectives provide valuable insights into the different scenarios traders are preparing for.

Bullish analysts point to several factors supporting a move toward or above $92,000. They note that Bitcoin has already absorbed considerable selling pressure in recent weeks and that many weak hands have been shaken out of positions. These optimists believe that if CPI data comes in at or below expectations, showing continued progress on inflation, it will validate the Federal Reserve’s current stance and potentially open discussions about rate cuts later in the year. Such a backdrop would be highly favorable for risk assets including Bitcoin.

Additionally, bullish analysts emphasize Bitcoin’s improving fundamentals, including growing institutional adoption, the ongoing success of Bitcoin ETFs, and strengthening on-chain metrics that suggest long-term holders are accumulating rather than distributing. From this perspective, today’s CPI release could simply provide the catalyst that unlocks upward momentum that was already building beneath the surface.

Bearish Scenarios and Risk Factors

Bearish analysts offer a contrasting view, warning that Bitcoin remains vulnerable to a pullback that could take prices below $90,000 and potentially toward the $85,000-$87,000 range. These cautious voices point to elevated valuations relative to realized price and other on-chain metrics, suggesting Bitcoin has run ahead of fundamental support levels.

The bearish case for Bitcoin after CPI data centers on the possibility that inflation remains stickier than anticipated, forcing the Federal Reserve to maintain restrictive monetary policy for longer than markets currently expect. If today’s CPI print comes in hot, showing reaccelerating inflation, it could trigger a broader risk-off move across financial markets that would likely drag Bitcoin lower along with stocks and other risk assets.

Bears also note that Bitcoin’s correlation with traditional markets, particularly the Nasdaq and tech stocks, has remained elevated. This means that negative reactions in equity markets to inflation data would likely spill over into cryptocurrency markets, potentially overwhelming any specific narratives about Bitcoin’s value as an inflation hedge.

The Federal Reserve’s Stance and Its Impact on Bitcoin

Federal Reserve’s current monetary policy position is crucial for interpreting how today’s CPI data will influence Bitcoin price. The central bank has maintained a data-dependent approach to policy decisions, repeatedly emphasizing that future rate moves will be determined by incoming economic information rather than following a predetermined path.

Fed officials have indicated they want to see sustained evidence that inflation is moving back toward their 2% target before considering rate cuts. This means that a single CPI print, whether positive or negative, may not dramatically alter the policy trajectory. However, markets often react to individual data points before taking this longer-term perspective, which explains why we can expect significant Bitcoin price volatility around today’s release even if the Fed’s actual policy stance changes little.

The relationship between Federal Reserve policy and Bitcoin has evolved considerably since the cryptocurrency’s early days. In Bitcoin’s first decade, monetary policy had relatively little direct impact on its price, which was driven more by adoption narratives, technological developments, and crypto-specific news. However, as institutional participation has grown and Bitcoin has become increasingly integrated into broader financial markets, Fed policy has emerged as a primary driver of short to medium-term price movements.

Interest Rates and Bitcoin’s Opportunity Cost

The mechanism through which Federal Reserve policy affects Bitcoin price largely operates through the concept of opportunity cost. When interest rates are low or falling, the opportunity cost of holding non-yielding assets like Bitcoin decreases. Investors face less attractive alternatives, making Bitcoin’s potential for appreciation more appealing despite its volatility and lack of income generation.

Conversely, when rates are high or rising, yield-bearing alternatives become more attractive. Traditional savings accounts, Treasury bills, and money market funds offering 4-5% risk-free returns present compelling competition for investor capital. This dynamic helps explain why Bitcoin struggled during the Federal Reserve’s aggressive rate hiking campaign and why anticipation of eventual rate cuts has contributed to Bitcoin’s recent strength.

Today’s CPI data factors into this equation by influencing expectations about the Fed’s future rate path. Data showing cooling inflation would support the case for rate cuts, potentially reducing opportunity costs and benefiting Bitcoin. Conversely, hot inflation data suggesting rates will stay higher for longer could increase those opportunity costs and pressure Bitcoin price downward.

Trading Strategies Around CPI Data Release

Navigating Bitcoin price volatility during CPI releases requires careful planning and disciplined execution. Both professional traders and retail investors employ various strategies to manage risk and capitalize on opportunities that arise from these high-impact economic events.

One common approach involves reducing position sizes ahead of major data releases to limit exposure to unpredictable volatility. Many traders will close leveraged positions or move to cash, preferring to wait for the dust to settle after the CPI announcement before re-entering the market with greater clarity about trend direction. This conservative approach prioritizes capital preservation over attempting to profit from the immediate price swing.

More aggressive traders may attempt to trade the volatility itself, using options strategies or setting up positions designed to profit regardless of direction. These approaches acknowledge the difficulty of predicting which way Bitcoin price will move after CPI data and instead focus on capturing movement itself. However, such strategies require sophisticated understanding of derivatives and carry substantial risk, particularly given the tendency for initial price reactions to reverse as traders digest the implications of the data.

Long-Term Holders vs. Short-Term Traders

The CPI data release also highlights the different perspectives and strategies of long-term Bitcoin holders versus short-term traders. Long-term holders, often called “holders” in crypto parlance, typically view daily or weekly price fluctuations as noise within a broader multi-year bullish thesis. For these investors, today’s CPI print may have little impact on their conviction or holdings.

This long-term perspective is rooted in beliefs about Bitcoin’s fundamental value proposition as a scarce digital asset, decentralized store of value, and potential hedge against currency debasement. From this viewpoint, whether Bitcoin price reacts to CPI data by moving to $92,000 or $90,000 matters little compared to where it might be in years to come. Long-term holders often view volatility around economic releases as opportunities to accumulate more Bitcoin at temporarily discounted prices.

Short-term traders operate with an entirely different timeframe and methodology. For day traders and swing traders, the Bitcoin price movement around CPI data represents one of the best opportunities each month to capture significant profits from predictable volatility spikes. These traders rely on technical analysis, order flow data, and rapid execution to enter and exit positions based on price action rather than long-term fundamental beliefs.

On-Chain Metrics and Market Sentiment

Beyond traditional technical analysis, on-chain metrics provide unique insights into Bitcoin holder behavior and market dynamics that help contextualize today’s CPI data anticipation. These blockchain-based indicators offer transparency into investor actions that would be impossible to observe in traditional markets.

Exchange balance data shows a continued trend of Bitcoin flowing off exchanges and into cold storage wallets, suggesting long-term accumulation rather than preparation for selling. This pattern typically indicates confidence among holders and reduces available supply for immediate selling, which could help support Bitcoin price if buying pressure emerges after favorable CPI data. Conversely, this reduced exchange liquidity can also exacerbate downward moves if selling does materialize, as fewer coins available for trading can amplify price impact.

The MVRV ratio, which compares market value to realized value, currently sits in a zone that historically has preceded either consolidation or continued upward movement rather than major corrections. This metric suggests that while Bitcoin isn’t dramatically undervalued, it’s also not in the extremely overextended territory that often precedes significant crashes. This positioning means that today’s CPI data reaction could break either direction without contradicting on-chain fundamentals.

Funding Rates and Derivatives Market Signals

Futures funding rates provide another window into market sentiment heading into the CPI release. Currently neutral to slightly positive, funding rates indicate that leveraged traders are relatively balanced between long and short positions, with neither extreme greed nor fear dominating. This equilibrium suggests the market is genuinely uncertain about outcomes, setting the stage for the data itself to drive substantial moves in Bitcoin price.

Options markets tell a similar story through implied volatility metrics. Option premiums have increased heading into today’s CPI announcement, reflecting traders’ expectations of larger-than-normal price swings. The distribution of strike prices and put-call ratios shows hedging activity on both sides, with traders protecting against moves in either direction rather than positioning strongly for one outcome.

These derivatives signals align with the technical analysis suggesting a market in balance, waiting for a catalyst to break the equilibrium. The lack of extreme positioning in one direction means that today’s Bitcoin price movement following CPI data won’t be amplified or dampened by forced liquidations of overextended positions, allowing the actual data to drive authentic price discovery.

Global Economic Context Beyond CPI

While today’s US CPI data takes center stage, understanding the broader global economic context helps frame Bitcoin’s positioning and potential trajectories beyond this single data point. Bitcoin operates in a global 24/7 market influenced by economic conditions and policies across multiple jurisdictions, not just American inflation figures.

European inflation dynamics have shown different patterns than US inflation, with energy prices playing a particularly significant role given Europe’s dependence on imported energy. The European Central Bank’s policy responses have followed a somewhat different timeline than the Federal Reserve, creating divergences in monetary conditions across major economies. These variations affect global capital flows and risk appetite in ways that ultimately influence Bitcoin price even when the immediate catalyst is US economic data.

China’s economic trajectory also plays a crucial role despite the country’s restrictive stance on cryptocurrency trading. As the world’s second-largest economy, Chinese economic health influences global growth expectations, commodity prices, and risk sentiment in ways that ripple through all financial markets. Recent stimulus measures from Chinese authorities aimed at supporting growth could provide a tailwind for risk assets including Bitcoin, potentially offsetting negative reactions to disappointing CPI data if global growth optimism remains intact.

Geopolitical Factors and Safe Haven Narratives

Geopolitical tensions and uncertainties contribute another layer to Bitcoin’s value proposition that intersects with but extends beyond inflation concerns. In regions experiencing currency instability, political upheaval, or banking system stress, Bitcoin adoption has accelerated as individuals and businesses seek alternatives to local financial systems. These dynamics operate independently of US CPI data but can amplify or dampen reactions to such releases depending on the broader environment.

The safe haven narrative around Bitcoin becomes particularly relevant during periods of heightened uncertainty. While Bitcoin’s volatility makes it an imperfect safe haven compared to traditional options like gold or Swiss francs, segments of the market increasingly view it as offering protection against specific risks including currency debasement, capital controls, and financial system instability. Today’s CPI release may reinforce or challenge this narrative depending on how the data influences broader market risk perception.

Institutional Adoption and Market Maturation

The growing institutional presence in Bitcoin markets has fundamentally changed how the cryptocurrency responds to macroeconomic data like today’s CPI release. When Bitcoin was primarily traded by retail investors and crypto enthusiasts, its price movements were driven largely by crypto-specific news and sentiment. Today’s market features significant participation from hedge funds, family offices, corporations, and even traditional financial institutions, bringing macro-sensitive capital that responds directly to economic indicators.

Bitcoin ETF flows have become a crucial metric for understanding institutional sentiment and capital allocation. Since the approval of spot Bitcoin ETFs in the United States, these products have accumulated substantial assets, providing a new channel for traditional investors to gain Bitcoin exposure. The investment decisions driving these flows are often influenced by macroeconomic assessments including inflation trends, making today’s CPI data directly relevant to continued ETF inflows or potential outflows.

This institutional participation brings both benefits and challenges for Bitcoin price stability. On the positive side, institutional capital provides deeper liquidity and potentially more rational, fundamentals-driven price discovery. Professional investors are less likely to panic sell based on short-term noise and more likely to view Bitcoin through long-term portfolio allocation frameworks. However, institutional participation also means Bitcoin becomes more correlated with traditional markets and more responsive to macro factors, potentially reducing its diversification benefits and increasing volatility around events like CPI announcements.

Corporate Treasury Adoption

The trend of corporations adding Bitcoin to their balance sheets represents another dimension of institutional adoption with implications for how Bitcoin price responds to economic data. Companies holding Bitcoin as a treasury reserve asset bring long-term holding horizons that can absorb short-term volatility, providing price support during turbulent periods like today’s CPI release. However, corporate Bitcoin holdings also create new considerations around accounting treatment, shareholder reactions, and potential pressure to sell if volatility impacts quarterly earnings reports.

The decision-making process for corporate Bitcoin investment often includes explicit considerations of inflation protection and currency diversification. This means that CPI data actually factors directly into corporate treasurers’ assessments of Bitcoin’s value proposition. Sustained high inflation could encourage more corporate adoption, while cooling inflation might reduce the urgency of seeking alternative stores of value. These longer-term adoption decisions don’t typically change based on a single CPI data point, but the cumulative trend in inflation certainly influences corporate appetite for Bitcoin exposure.

Preparing for Multiple Scenarios

Given the genuine uncertainty surrounding both the CPI data itself and Bitcoin’s potential reactions, preparing for multiple scenarios represents the most prudent approach for cryptocurrency investors and traders. Rather than making binary bets on one outcome, sophisticated market participants consider various possibilities and have plans for each.

The bullish scenario envisions CPI data coming in at or below expectations, signaling continued progress on inflation. In this case, Bitcoin price could surge toward and potentially beyond $92,000 as traders price in improving conditions for risk assets. The move might occur quickly, creating a short squeeze if significant short interest has accumulated. Longer-term implications could include renewed discussions of Federal Reserve rate cuts, further institutional capital allocation to Bitcoin, and validation of the inflation hedge narrative. Investors positioned for this scenario would want to have capital ready to deploy or already be holding spot positions.

The bearish scenario imagines CPI data exceeding expectations, showing sticky or reaccelerating inflation. This outcome could trigger selling pressure that breaks Bitcoin price below the $90,000 support level, potentially leading to a correction toward $85,000-$87,000 or deeper. Risk-off sentiment might dominate across financial markets, and concerns about extended monetary tightening could pressure all speculative assets. Traders preparing for this scenario might hold cash, maintain short positions, or use options to hedge long-term holdings.

The Range-Bound Scenario

A third possibility that often gets overlooked is the range-bound scenario where CPI data comes in roughly in line with expectations and Bitcoin price remains trapped between $90,000 and $92,000. In this outcome, the data fails to provide clear directional conviction, and the market continues its current consolidation pattern. This scenario might frustrate traders seeking volatility and profit opportunities but could allow long-term investors to continue accumulating at stable prices.

Range-bound markets often resolve eventually with significant breakouts in one direction, meaning that today’s CPI data might simply extend the current consolidation rather than immediately resolving it. Subsequent data releases, corporate earnings reports, or crypto-specific developments might ultimately provide the catalyst that breaks Bitcoin out of this range. Traders navigating this scenario would focus on range trading strategies, selling near resistance and buying near support until a clear breakout occurs.

Conclusion

As we await today’s critical CPI data release, the cryptocurrency market stands at a pivotal juncture where Bitcoin price could break decisively in either direction. The technical positioning between $90,000 and $92,000, combined with balanced sentiment and the significance of inflation data for Federal Reserve policy, creates an environment where substantial volatility is virtually guaranteed. Whether Bitcoin surges above $92,000 or drops below $90,000 will depend not just on the headline CPI number but on how traders interpret its implications for monetary policy, economic growth, and Bitcoin’s value proposition as both an inflation hedge and risk asset.

The evolving relationship between Bitcoin price and CPI data reflects the cryptocurrency’s maturation and integration into broader financial markets. No longer isolated from traditional economic indicators, Bitcoin now dances to macro rhythms alongside stocks, bonds, and commodities. Understanding this connection has become essential for anyone seeking to navigate cryptocurrency markets successfully, whether as a long-term investor, active trader, or curious observer of this revolutionary asset class.

Ultimately, today’s CPI announcement represents just one data point in Bitcoin’s ongoing journey toward mainstream adoption and price discovery. While short-term volatility will create winners and losers among traders, the longer-term trajectory of Bitcoin will be determined by fundamental factors including adoption rates, regulatory developments, technological improvements, and macroeconomic trends that unfold over months and years rather than hours and days.

See more: Bitcoin Price Forecast What’s Next for BTC in the Coming Days?