Bitcoin has entered a bear market, according to many analysts, and this shift has sparked intense debate across the cryptocurrency world. After periods of optimism, strong rallies, and renewed mainstream attention, the market mood has turned cautious. Prices have pulled back from recent highs, trading volumes have cooled, and investor confidence appears more fragile than it was just months ago. For both seasoned crypto investors and newcomers, understanding why Bitcoin has entered a bear market is essential for navigating what comes next.

A bear market does not simply mean that prices are falling. It represents a broader change in sentiment, expectations, and market behavior. Analysts point to a combination of technical indicators, macroeconomic pressures, regulatory developments, and changing investor psychology as reasons behind this shift. While Bitcoin has survived multiple bear markets in the past, each cycle brings unique challenges and lessons.

This article explores in depth why analysts believe Bitcoin has entered a bear market, what signals support this view, and how this phase compares to previous downturns. We will also examine the broader implications for the crypto market, long-term investors, and the future of digital assets. By the end, readers will have a clearer, more grounded understanding of the current Bitcoin bear market and what it could mean moving forward.

What Does It Mean When Bitcoin Enters a Bear Market?

When analysts say Bitcoin has entered a bear market, they are referring to a sustained period of declining prices accompanied by negative sentiment and reduced risk appetite. In traditional financial markets, a bear market is often defined as a drop of 20% or more from recent highs. In the cryptocurrency market, where volatility is higher, the definition is more flexible but still centers on prolonged weakness rather than short-term corrections.

A Bitcoin bear market is typically characterized by lower highs, lower lows, and diminishing trading momentum. Optimism fades as rallies become weaker and sell-offs grow stronger. Long-term holders may remain confident, but short-term traders often exit positions, amplifying downward pressure. Analysts emphasize that this environment reflects not just price movement, but also changes in market psychology.

Understanding this distinction is important. Bitcoin has experienced many sharp pullbacks that later reversed into strong bull runs. However, when multiple indicators align and broader conditions deteriorate, analysts become more confident in labeling the phase as a bear market rather than a temporary dip.

Key Technical Indicators Signaling a Bitcoin Bear Market

Technical analysis plays a major role in why analysts say Bitcoin has entered a bear market. These indicators help identify trends, momentum, and potential turning points in price behavior.

Breakdown Below Key Support Levels

One of the strongest signals cited by analysts is Bitcoin’s failure to hold critical support levels. Support levels represent price zones where buying interest has historically been strong. When Bitcoin breaks below these areas and struggles to reclaim them, it suggests that sellers are in control.

In the current environment, Bitcoin has fallen below several long-term moving averages that previously acted as support. This shift has reinforced the narrative that the market trend has turned bearish. Analysts often view these breakdowns as confirmation that the broader uptrend has ended, at least for now.

Moving Averages and Trend Reversals

Moving averages are widely used to assess trend direction. When shorter-term moving averages cross below longer-term ones, it is often interpreted as a bearish signal. In recent months, such crossovers have appeared on Bitcoin charts, strengthening the case that Bitcoin has entered a bear market.

These signals are not foolproof, but when combined with declining volume and weak price recoveries, they carry more weight. Analysts stress that sustained trading below major moving averages reflects reduced confidence and lower demand.

Declining Trading Volume and Momentum

Another technical factor supporting the bear market thesis is declining trading volume. Healthy bull markets are usually accompanied by rising volume, as more participants enter the market. In contrast, the current phase shows shrinking volume during price rebounds, suggesting that buyers lack conviction.

Momentum indicators also point toward weakness. When momentum fades, it becomes harder for Bitcoin to stage meaningful recoveries, reinforcing the bearish outlook shared by analysts.

Macroeconomic Pressures Weighing on Bitcoin

Beyond charts and indicators, broader economic forces play a critical role in why Bitcoin has entered a bear market. Analysts increasingly view Bitcoin not as an isolated asset, but as part of the global financial ecosystem.

High Interest Rates and Tighter Monetary Policy

One of the most significant macroeconomic factors is the global environment of higher interest rates. Central banks have raised rates to combat inflation, reducing liquidity across financial markets. Risk assets, including Bitcoin, tend to struggle when borrowing becomes more expensive and capital is harder to access.

In previous years, abundant liquidity helped fuel speculative investments in crypto. Now, with tighter monetary policy, investors are more cautious. Analysts argue that this shift has directly contributed to Bitcoin’s current bear market.

Inflation Concerns and Changing Narratives

Bitcoin was once widely promoted as a hedge against inflation. However, during recent inflationary periods, Bitcoin has often moved in tandem with risk assets rather than acting as a safe haven. This has led some investors to question its role in their portfolios.

As inflation concerns evolve and economic uncertainty persists, analysts note that Bitcoin’s narrative is being reassessed. This uncertainty has dampened demand, further supporting the idea that Bitcoin has entered a bear market.

Global Economic Slowdown

Signs of a slowing global economy also influence crypto markets. Reduced consumer spending, cautious corporate investment, and geopolitical tensions all contribute to a risk-off environment. In such conditions, speculative assets like Bitcoin often face selling pressure.

Analysts emphasize that until macroeconomic conditions stabilize, Bitcoin may continue to face headwinds consistent with a bear market.

Regulatory Uncertainty and Its Impact on Bitcoin

Regulation remains one of the most influential external factors affecting Bitcoin’s price and sentiment. Analysts frequently cite regulatory uncertainty as a reason why Bitcoin has entered a bear market.

Increased Scrutiny from Governments

Around the world, governments and regulators have increased their focus on cryptocurrencies. New rules targeting exchanges, stablecoins, and decentralized platforms have created uncertainty for investors. While regulation can bring legitimacy in the long run, short-term uncertainty often leads to market pullbacks.

When regulatory actions are unclear or perceived as restrictive, investors may reduce exposure to Bitcoin. Analysts note that this cautious behavior has contributed to the current bearish environment.

Legal Challenges and Market Confidence

High-profile legal cases involving crypto companies have also shaken confidence. Even when Bitcoin itself is not directly involved, negative headlines can affect the entire market. Analysts argue that repeated shocks to confidence reinforce bearish sentiment and discourage new capital from entering the market.

Investor Psychology and Market Sentiment

Market psychology is a powerful force, and it plays a central role in why analysts believe Bitcoin has entered a bear market. Sentiment often drives price action as much as fundamentals.

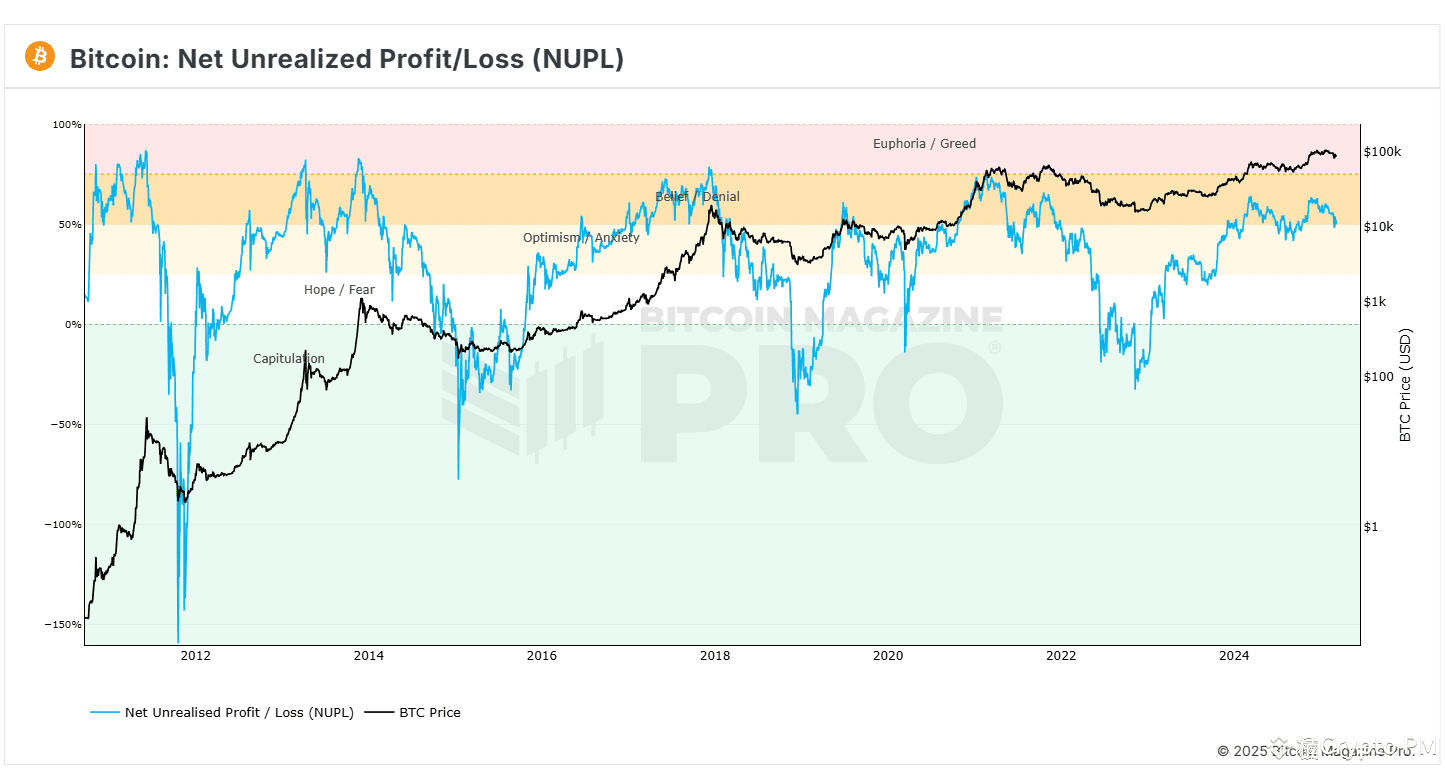

From Euphoria to Caution

During bull markets, optimism can border on euphoria. Expectations rise, and investors become more willing to take risks. In contrast, the current environment is marked by caution and skepticism. Analysts observe that many investors are now focused on preserving capital rather than chasing gains.

This shift in mindset affects behavior. Fewer buyers step in during dips, and rallies are met with selling pressure. Such dynamics are hallmarks of a bear market.

Fear, Uncertainty, and Doubt in the Crypto Market

Periods of declining prices often bring increased fear, uncertainty, and doubt. Negative news tends to have a stronger impact, while positive developments are often ignored. Analysts point out that this imbalance in perception reinforces bearish trends.

When Bitcoin has entered a bear market, sentiment can remain negative for extended periods, even in the face of technological progress or adoption milestones.

Comparing the Current Bear Market to Past Bitcoin Cycles

Bitcoin has experienced several bear markets since its creation, and analysts often compare the current phase to previous cycles to gain perspective.

Similarities to Previous Bitcoin Bear Markets

Past bear markets were also marked by sharp declines, reduced volume, and widespread pessimism. In each case, Bitcoin eventually stabilized and began a new growth phase. Analysts note that the current bear market shares many of these characteristics, including prolonged consolidation and waning retail interest.

These similarities suggest that while the current downturn is challenging, it is not unprecedented.

Key Differences in Market Structure

However, there are also important differences. Today’s Bitcoin market is more mature, with institutional participants, derivatives markets, and broader global exposure. Analysts argue that this maturity could influence how the bear market unfolds.

While increased adoption provides long-term support, it also means Bitcoin is more sensitive to macroeconomic trends. This duality makes the current bear market unique compared to earlier cycles.

What the Bitcoin Bear Market Means for Investors

For investors, understanding that Bitcoin has entered a bear market is crucial for setting expectations and strategies.

Long-Term Investors and Accumulation

Some long-term investors view bear markets as opportunities to accumulate assets at lower prices. Analysts often point out that historically, periods of pessimism have preceded strong recoveries. However, they also caution that timing the market is difficult and requires patience.

Short-Term Traders and Risk Management

For short-term traders, a bear market demands stricter risk management. Volatility remains high, but the overall trend favors sellers. Analysts emphasize the importance of discipline and realistic expectations during such periods.

The Broader Crypto Market and Bitcoin’s Influence

Bitcoin’s role as the leading cryptocurrency means its bear market has ripple effects across the entire crypto ecosystem.

Altcoins and Market Correlation

When Bitcoin has entered a bear market, altcoins often experience even greater declines. Analysts note that capital tends to flow out of smaller, riskier assets first, amplifying losses across the market.

Innovation Continues Despite Price Declines

Despite falling prices, development and innovation in the crypto space continue. Analysts stress that bear markets often lay the groundwork for future growth by filtering out unsustainable projects and encouraging stronger fundamentals.

Conclusion

Bitcoin has entered a bear market, say analysts, due to a combination of technical breakdowns, macroeconomic pressures, regulatory uncertainty, and shifting investor psychology. This phase reflects more than just falling prices; it represents a broader change in sentiment and market dynamics.

While bear markets can be uncomfortable, they are also a recurring part of Bitcoin’s history. Each downturn has tested investor confidence while ultimately contributing to the asset’s long-term evolution. By understanding why this bear market has emerged, investors and observers can approach the future with greater clarity and realism.

Whether this phase proves to be a prolonged downturn or a transitional period, one thing remains clear: Bitcoin continues to adapt within an ever-changing global financial landscape.

Frequently Asked Questions

Q.Is a Bitcoin bear market the same as a crash?

A Bitcoin bear market refers to a prolonged period of declining prices and negative sentiment, while a crash usually describes a sudden and sharp drop. A bear market can include multiple smaller crashes over time.

Q.How long do Bitcoin bear markets usually last?

The duration varies. Some Bitcoin bear markets have lasted months, while others extended over a year. Analysts note that recovery depends on broader economic conditions and market confidence.

Q.Can Bitcoin recover after entering a bear market?

Historically, Bitcoin has recovered after every bear market. While past performance does not guarantee future results, many analysts believe recovery is possible over the long term.

Q.Should new investors avoid Bitcoin during a bear market?

This depends on individual risk tolerance and goals. Analysts suggest that understanding the risks and having a long-term perspective is essential before investing during a bear market.

Q.Does a Bitcoin bear market mean the end of cryptocurrency growth?

No. Analysts widely agree that bear markets are part of market cycles. Innovation, adoption, and development often continue even when prices are falling.