In the fast-moving world of cryptocurrencies, sudden price swings are not uncommon, but every so often a move occurs that sends shockwaves across the entire market. That is exactly what happened when Bitcoin briefly trades at $24,000 on Binance’s USD1 pair in a flash move, catching traders, analysts, and investors off guard. Within moments, screenshots circulated across social media, trading desks rushed to analyze order books, and questions emerged about whether this was a glitch, a liquidity issue, or a sign of deeper structural stress.

Flash moves like this are significant not only because of the price level reached, but because of what they reveal about crypto market liquidity, exchange mechanics, and investor behavior during periods of heightened uncertainty. Even though the move was short-lived and Bitcoin quickly recovered, the implications extend far beyond a single trading pair.

This article provides a full breakdown of the event where Bitcoin briefly trades at $24,000 on Binance’s USD1 pair in a flash move. We will explore what triggered the sudden drop, how Binance’s USD1 pair works, the role of liquidity and order books, and what this incident means for the broader Bitcoin market going forward.

Flash Move on Binance’s USD1 Pair

What Happened When Bitcoin Briefly Hit $24,000

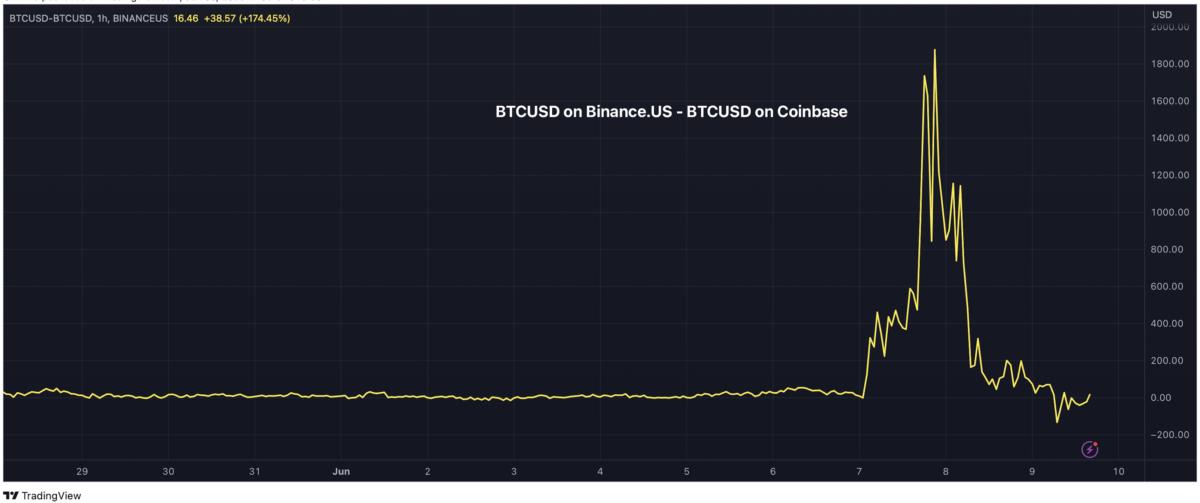

The crypto market experienced a moment of extreme volatility when Bitcoin briefly trades at $24,000 on Binance’s USD1 pair. This price was significantly below prevailing market levels on other major exchanges, making the move stand out instantly. The drop occurred rapidly, lasted only a short period, and was followed by a swift rebound, classic characteristics of a flash crash or flash move.

Such movements are typically caused by sudden imbalances between buyers and sellers rather than a fundamental change in Bitcoin’s value. In this case, the isolated nature of the price drop suggested a localized issue tied specifically to the USD1 trading pair rather than a market-wide sell-off.

Why the USD1 Pair Matters

Binance’s USD1 pair is less actively traded compared to Bitcoin pairs linked to major stablecoins or fiat-backed instruments. Lower trading volume often means thinner order books, which can amplify price movements when large orders hit the market. When Bitcoin briefly trades at $24,000 on Binance’s USD1 pair in a flash move, it highlights how low-liquidity trading pairs can experience exaggerated price swings.

Liquidity Conditions and Their Role in Flash Moves

Thin Order Books and Price Gaps

Liquidity plays a central role in understanding why Bitcoin briefly trades at $24,000 on Binance’s USD1 pair. In markets with thin order books, there are fewer buy orders at each price level. When a large sell order is executed, it can quickly consume available bids, causing the price to cascade downward until sufficient buy interest appears.

This phenomenon is not unique to crypto. Traditional financial markets have experienced similar flash crashes, but crypto’s 24/7 nature and fragmented liquidity make such events more frequent and visible.

Market Makers and Temporary Absences

Market makers typically provide liquidity by placing buy and sell orders close to the current price. However, during periods of uncertainty or low activity, market makers may widen spreads or temporarily pull orders. This absence of liquidity can worsen price moves, contributing to scenarios where Bitcoin briefly trades at $24,000 on Binance’s USD1 pair in a flash move.

Binance’s Role and Exchange Mechanics

How Binance Handles Extreme Price Movements

As one of the world’s largest crypto exchanges, Binance operates sophisticated risk management and monitoring systems. When unusual price movements occur, internal safeguards such as circuit breakers or trading pauses may be triggered depending on the situation.

In the case where Bitcoin briefly trades at $24,000 on Binance’s USD1 pair, the rapid recovery suggests that automated systems and arbitrage traders quickly corrected the imbalance. Binance later reviews such incidents to determine whether they stem from user behavior, liquidity gaps, or technical factors.

Arbitrage and Price Normalization

One reason flash moves are often short-lived is the presence of arbitrage traders. When Bitcoin briefly trades at $24,000 on Binance’s USD1 pair while trading significantly higher elsewhere, arbitrage opportunities emerge instantly. Traders buy Bitcoin at the discounted price and sell it on other exchanges, pushing the price back toward equilibrium.

Market Reaction to the Flash Move

Trader Sentiment and Short-Term Panic

Moments like these can trigger brief panic, especially among leveraged traders. Seeing Bitcoin suddenly drop to $24,000, even on a single pair, can cause automated stop-loss orders to activate, further increasing volatility.

However, experienced traders often recognize these moves as liquidity-driven anomalies rather than genuine market collapses. As a result, panic is usually short-lived when prices recover quickly.

Social Media Amplification

When Bitcoin briefly trades at $24,000 on Binance’s USD1 pair in a flash move, social media platforms amplify the event almost instantly. Screenshots, speculation, and rumors spread rapidly, sometimes exaggerating the significance of the move. This highlights how perception can momentarily influence sentiment even when fundamentals remain unchanged.

Comparing This Event to Past Bitcoin Flash Crashes

Historical Context of Flash Moves

Bitcoin has experienced several notable flash crashes over the years, often tied to exchange-specific issues or sudden liquidity shortages. Comparing this incident to past events shows a common pattern: rapid drop, intense scrutiny, and swift recovery.

The fact that Bitcoin briefly trades at $24,000 on Binance’s USD1 pair fits within this historical context, reinforcing the idea that such moves are structural quirks rather than existential threats to the asset.

Lessons Learned from Previous Incidents

Past flash crashes have led to improvements in exchange infrastructure, better risk controls, and more sophisticated trading strategies. Each new incident adds to the collective understanding of how crypto markets behave under stress.

Broader Implications for Bitcoin’s Price Stability

Does This Signal Weakness in Bitcoin?

Despite alarming headlines, the answer is largely no. When Bitcoin briefly trades at $24,000 on Binance’s USD1 pair in a flash move, it does not reflect a broad loss of confidence. Bitcoin’s price on other exchanges remained stable, underscoring the localized nature of the event.

Bitcoin’s long-term price trends are driven by adoption, macroeconomic factors, and investor demand, not momentary liquidity gaps on individual trading pairs.

Institutional Perspective on Flash Moves

Institutional investors are well aware of these anomalies and typically factor them into risk management strategies. For institutions, such events highlight the importance of execution quality and diversified liquidity access rather than undermining confidence in Bitcoin itself.

The Role of Automated Trading and Algorithms

How Bots Can Exacerbate Volatility

Automated trading bots can both stabilize and destabilize markets. When Bitcoin briefly trades at $24,000 on Binance’s USD1 pair, some bots may react by selling aggressively, while others step in to buy the dip. The interaction between these systems can amplify short-term volatility.

Speed of Recovery Through Automation

At the same time, automation enables rapid recovery. Arbitrage bots operate within milliseconds, helping correct mispricings faster than human traders ever could. This explains why flash moves often resolve quickly.

Risk Management Lessons for Traders

Importance of Understanding Trading Pairs

One key takeaway is the importance of understanding the liquidity profile of specific trading pairs. The incident where Bitcoin briefly trades at $24,000 on Binance’s USD1 pair shows that not all pairs behave the same way, even on major exchanges.

Stop-Loss Placement and Volatility Awareness

Traders using stop-loss orders should consider the risk of flash moves triggering unintended exits. Placing stops too close to current prices on low-liquidity pairs can result in unnecessary losses during temporary anomalies.

Regulatory and Market Structure Considerations

Growing Scrutiny of Exchange Stability

Events like this often attract regulatory attention, especially as crypto markets integrate more closely with traditional finance. Regulators may examine how exchanges handle extreme volatility and protect retail investors.

Toward More Resilient Crypto Markets

As the market matures, improvements in liquidity provision, transparency, and risk controls are expected to reduce the frequency and severity of flash moves. However, complete elimination is unlikely given crypto’s decentralized and global nature.

Conclusion

The incident where Bitcoin briefly trades at $24,000 on Binance’s USD1 pair in a flash move serves as a reminder of the unique dynamics that define cryptocurrency markets. While dramatic in appearance, the move was driven by localized liquidity conditions rather than a fundamental shift in Bitcoin’s value.

The rapid recovery, strong arbitrage response, and stability across other exchanges all point to a resilient market structure that can absorb shocks efficiently. For traders and investors, the event underscores the importance of liquidity awareness, disciplined risk management, and a long-term perspective in navigating crypto volatility.

Frequently Asked Questions (FAQs)

Q. Why did Bitcoin briefly trade at $24,000 on Binance’s USD1 pair?

The move was caused by low liquidity and sudden selling pressure on that specific trading pair, leading to a temporary price gap.

Q. Was this a market-wide Bitcoin crash?

No, the drop was isolated to Binance’s USD1 pair, while prices on other exchanges remained significantly higher.

Q. Are flash moves common in crypto markets?

Yes, flash moves occur occasionally, especially on low-liquidity pairs or during periods of reduced market activity.

Q. Did Binance experience a technical failure?

There is no indication of a system failure; the move appears to be driven by market mechanics rather than technical issues.

Q. What can traders learn from this event?

Traders should understand liquidity differences between pairs, use cautious stop-loss strategies, and avoid overreacting to short-term anomalies.