Entering the world of cryptocurrency mining can feel overwhelming, especially when you’re searching for the best Bitcoin mining rig for beginners 2025. With Bitcoin’s continued growth and mainstream adoption, more newcomers are looking to participate in the mining ecosystem. However, choosing the right mining equipment requires understanding hardware specifications, profitability calculations, and setup requirements.

The cryptocurrency mining landscape has evolved significantly, making it crucial for beginners to make informed decisions. Whether you’re interested in generating passive income or learning about blockchain technology, selecting the appropriate mining rig is your first step toward success. This comprehensive guide will walk you through everything you need to know about Bitcoin mining hardware, from budget-friendly options to professional-grade equipment.

Bitcoin mining has become increasingly competitive, but with the right approach and equipment, beginners can still find profitable opportunities in 2025. The key lies in understanding market dynamics, electricity costs, and choosing hardware that balances performance with affordability.

Understanding Bitcoin Mining Hardware in 2025

Bitcoin mining requires specialised computer hardware called ASICs (Application-Specific Integrated Circuits) designed specifically for cryptocurrency mining. Unlike general-purpose computers, these machines are built to solve complex mathematical problems that secure the Bitcoin network.

The mining industry has seen tremendous technological advancements in recent years. Modern mining rigs offer significantly better hash rates while consuming less electricity compared to older models. This efficiency improvement is crucial for maintaining profitability as Bitcoin’s mining difficulty continues to increase.

For beginners, understanding the relationship between hash rate, power consumption, and electricity costs is fundamental. Hash rate measures how many calculations your mining rig can perform per second, while power consumption determines your operational costs. The most profitable mining rigs achieve the optimal balance between these factors.

Key Components of Mining Rigs

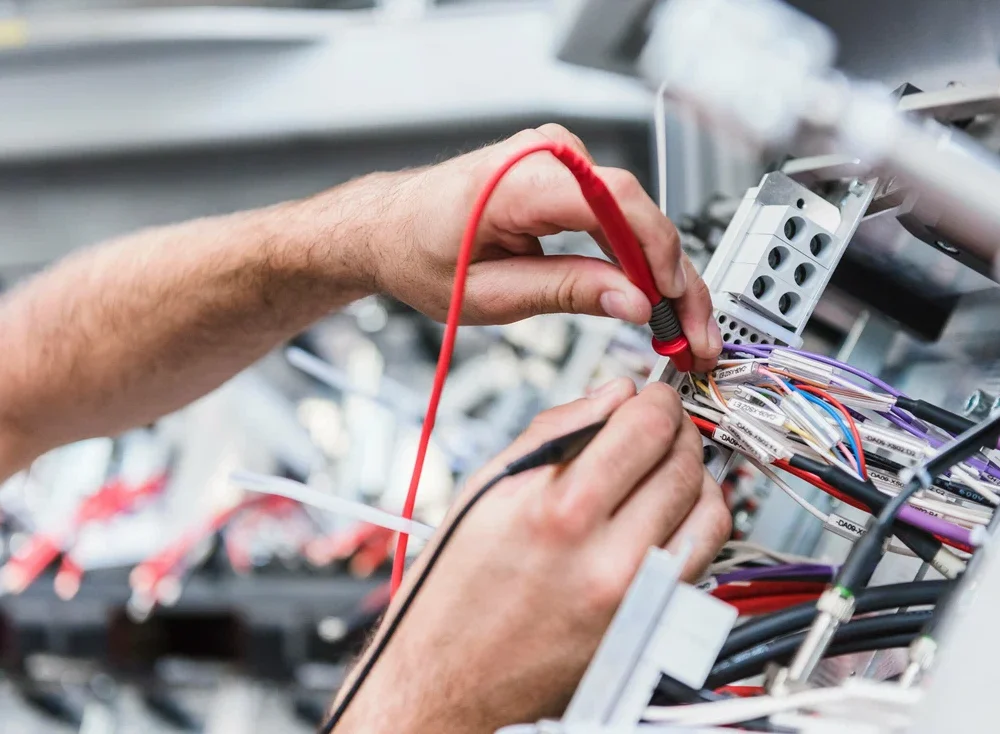

Modern Bitcoin mining setups consist of several essential components. The ASIC miner itself is the heart of the operation, containing specialised chips designed for Bitcoin’s SHA-256 algorithm. These miners require adequate cooling systems, typically built-in fans or external cooling solutions. Power supply units (PSUs) are equally important, as mining rigs consume significant electricity.

High-quality PSUs ensure stable power delivery and protect your investment from electrical issues. Many beginners overlook this component, but choosing a reliable PSU is crucial for long-term success. Additional elements include networking equipment for internet connectivity, monitoring software for tracking performance, and proper electrical infrastructure. Some miners also invest in noise reduction solutions, as ASIC miners can be quite loud during operation.

Top Bitcoin Mining Rigs for Beginners in 2025

Selecting the right mining hardware depends on your budget, technical expertise, and electricity costs. Entry-level miners should focus on user-friendly options that don’t require extensive technical knowledge while still offering reasonable profitability potential. The Antminer S19j Pro represents an excellent balance of performance and efficiency for newcomers. With a hash rate of 100 TH/s and power consumption of 3,050W, it provides competitive mining performance while remaining relatively accessible for beginners.

The setup process is straightforward, with comprehensive documentation and community support available. Another popular choice is the WhatsMiner M30S++, offering 112 TH/s with 3,472W power consumption. This model features improved cooling design and enhanced reliability, making it suitable for continuous operation. The manufacturer provides excellent customer support, which is valuable for first-time miners.

Budget-Friendly Options for New Miners

For beginners with limited budgets, older-generation miners can provide an entry point into Bitcoin mining. The Antminer S17+ offers 73 TH/s at 2,920W, representing good value for those starting with smaller investments. While not the most efficient option, it allows newcomers to learn mining fundamentals without a significant financial commitment.

The AvalonMiner 1246 is another budget-conscious choice, delivering 90 TH/s with 3,420W power consumption. This miner features robust construction and reliable performance, making it suitable for extended operation. The lower initial cost makes it attractive for beginners testing the waters of cryptocurrency mining.

Used mining equipment can offer additional savings, but buyers should exercise caution. Scrutinise hardware, verify warranty status, and purchase from reputable sellers. While used miners can provide cost savings, they may have reduced lifespans and limited support options.

Setting Up Your First Mining Operation

Installing and configuring your first Bitcoin mining rig requires careful planning and attention to detail. Start by selecting an appropriate location with adequate ventilation, stable electricity supply, and reliable internet connectivity. Mining rigs generate significant heat and noise, so choose your setup location accordingly.

Electrical requirements are crucial considerations for beginners. Most modern mining rigs require 220V power connections and draw substantial current. Consult with qualified electricians to ensure your electrical system can safely handle the load. Proper electrical installation prevents fire hazards and equipment damage.

Network connectivity is equally important, as mining rigs must maintain constant communication with mining pools. Use wired Ethernet connections whenever possible, as they provide more stable connectivity than wireless solutions. Configure network settings properly to ensure optimal mining performance.

Initial Configuration and Pool Selection

After physical installation, configuring your mining rig involves setting up mining pool connections and wallet addresses. Mining pools allow individual miners to combine their computing power and share rewards proportionally. Popular pools include F2Pool, Antpool, and Slush Pool, each offering different fee structures and payout methods.

Configure your mining software with the appropriate pool URLs, worker names, and wallet addresses. Most modern miners feature web-based interfaces that simplify configuration for beginners. Follow manufacturer guidelines carefully to avoid configuration errors that could impact mining performance.

Monitor your mining operation regularly during the initial weeks to ensure stable performance. Check hash rates, temperatures, and error rates frequently. Address any issues promptly to maintain optimal mining efficiency and protect your hardware investment.

Profitability Analysis and Cost Considerations

Understanding the economics of Bitcoin mining is essential for beginners evaluating potential returns. Mining profitability depends on several factors: hardware costs, electricity rates, Bitcoin price, network difficulty, and pool fees. Use online calculators to estimate potential earnings based on your specific circumstances.

Electricity costs typically represent the most significant ongoing expense for mining operations. Research local utility rates and consider time-of-use pricing if available. Some regions offer special rates for large industrial users, which could benefit serious mining operations. Calculate break-even periods based on current market conditions, but remember that cryptocurrency markets are volatile. Bitcoin prices and network difficulty can change rapidly, affecting profitability calculations. Maintain realistic expectations and prepare for market fluctuations.

Long-term Financial Planning

Successful Bitcoin mining requires long-term financial planning beyond initial hardware purchases. Budget for ongoing electricity costs, potential hardware failures, and equipment upgrades. Mining difficulty adjustments occur every two weeks, potentially affecting your earnings. Consider the tax implications of mining income in your jurisdiction.

Many countries classify mining rewards as taxable income, requiring accurate record-keeping and reporting. Consult with tax professionals familiar with cryptocurrency regulations to ensure compliance. Plan for hardware obsolescence, as mining technology advances rapidly. Newer, more efficient miners regularly enter the market, potentially making older equipment less competitive. Factor equipment lifecycle costs into your financial projections.

Common Mistakes to Avoid as a Beginner

New miners often make costly mistakes that could have been avoided with proper preparation. Underestimating electricity requirements is a common error that can lead to circuit overloads and fire hazards. Always verify electrical capacity before installing mining equipment. Inadequate cooling is another frequent mistake that can damage expensive hardware. Mining rigs generate substantial heat that must be properly managed.

Invest in adequate ventilation and cooling solutions to protect your equipment and maintain optimal performance. Choosing inappropriate mining pools can impact profitability significantly. Research pool fees, payout methods, and reliability before committing your hash power. Some pools charge higher fees but offer additional services, while others prioritise low costs.

Technical Troubleshooting Tips

Learn basic troubleshooting techniques to address common mining issues independently. Hardware monitoring software can help identify performance problems before they cause significant damage. Monitor temperatures, hash rates, and error logs regularly. Maintain spare parts inventory for critical components like fans and power supplies.

Mining operations generate income continuously, so minimising downtime is crucial for profitability. Having replacement parts available reduces repair delays. Join mining communities and forums to learn from experienced miners. Online communities provide valuable troubleshooting assistance and share best practices. Participate actively to build knowledge and network with other miners.

Future-Proofing Your Mining Investment

The cryptocurrency mining landscape continues evolving rapidly, making future-proofing considerations important for beginners. Choose hardware with upgrade potential and scalability options. Some mining rigs allow firmware updates that can improve performance or add new features. Stay informed about technological developments in mining hardware.

Manufacturers regularly announce new products with improved efficiency and performance. Understanding market trends helps you make informed decisions about equipment upgrades and expansions. Consider the environmental impact of your mining operation. Sustainable mining practices are becoming increasingly important as the industry matures. Explore renewable energy options and efficient cooling solutions to reduce your environmental footprint.

Emerging Technologies and Trends

Next-generation mining technologies promise improved efficiency and reduced environmental impact. Immersion cooling systems can significantly improve thermal management while reducing noise levels. These technologies are becoming more accessible to smaller mining operations. Artificial intelligence and machine learning applications are being integrated into mining operations for optimisation.

Smart mining systems can automatically adjust settings based on market conditions and hardware performance. These technologies may become standard features in future mining equipment. Regulatory developments continue shaping the mining industry globally. Stay informed about local regulations and compliance requirements. Some jurisdictions are implementing specific rules for cryptocurrency mining operations that could affect your business.

Conclusion

Choosing the best Bitcoin mining rig for beginners in 2025 requires careful consideration of multiple factors, including budget, electricity costs, technical expertise, and long-term goals. While the mining landscape has become more competitive, opportunities still exist for newcomers willing to invest time in research and planning.

Success in Bitcoin mining depends on making informed decisions about hardware selection, understanding operational costs, and maintaining realistic expectations about profitability. The miners discussed in this guide offer excellent starting points for beginners, but remember that market conditions and technology continue evolving rapidly.