The cryptocurrency market is once again at a critical crossroads. As traders, investors, and analysts search for signs of the next big move, one metric has quietly drawn increasing attention: the Altcoin Season Index. Recently, this index climbed to 19, sparking widespread discussion about whether the market is beginning to pivot away from Bitcoin dominance and toward alternative cryptocurrencies. While a reading of 19 does not officially confirm an altcoin season, it does raise important questions about market momentum, investor sentiment, and the broader crypto cycle.

The Altcoin Season Index is often used as a barometer to determine whether altcoins are outperforming Bitcoin over a specific time frame. When the index rises, it suggests that capital may be slowly rotating into altcoins. For many investors, this shift can represent both opportunity and risk. Understanding what an index level of 19 really means requires a deeper look at market structure, historical cycles, macroeconomic factors, and current on-chain signals.

In this article, we will explore what the Altcoin Season Index is, why its climb to 19 matters, and whether this movement signals an early-stage crypto market shift. By examining Bitcoin dominance, altcoin performance, market cycles, and investor behavior, we aim to provide a clear and balanced perspective on what may lie ahead for the digital asset ecosystem.

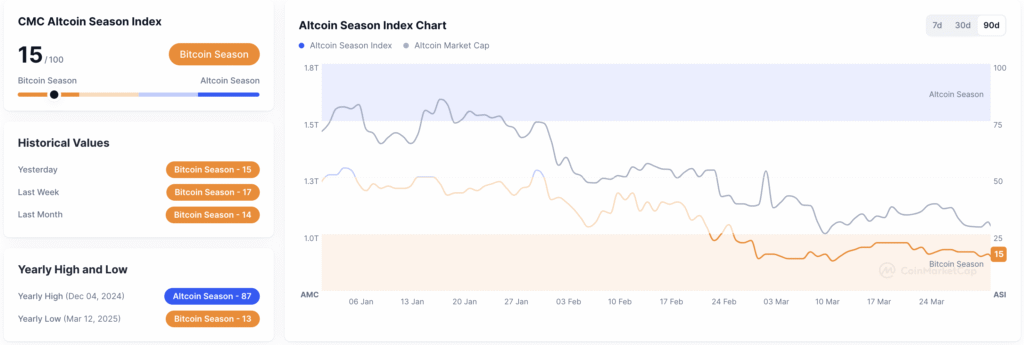

Altcoin Season Index

What Is the Altcoin Season Index?

The Altcoin Season Index is a data-driven metric designed to measure whether altcoins are outperforming Bitcoin over a defined period, typically the last 90 days. The index compares the performance of the top 50 altcoins against Bitcoin. If at least 75% of these altcoins outperform Bitcoin, the market is considered to be in “altcoin season.” Conversely, lower values indicate Bitcoin dominance.

An index reading of 0 suggests extreme Bitcoin outperformance, while a value closer to 100 reflects a strong altcoin market. With the Altcoin Season Index climbing to 19, the market remains firmly in Bitcoin season territory, yet the upward movement suggests early signs of change. This gradual increase often sparks speculation because many historical altcoin rallies began with similar early signals.

Why the Index Is Closely Watched by Investors

Investors follow the Altcoin Season Index because it helps identify shifts in capital flow. When Bitcoin leads the market, investors typically prioritize stability and store-of-value narratives. When altcoins begin to outperform, it often reflects increased risk appetite and speculation. A rising index can therefore indicate that traders are willing to explore higher-risk, higher-reward opportunities in the crypto market.

The Altcoin Season Index also provides context for portfolio allocation. Long-term holders and short-term traders alike use it to rebalance holdings between Bitcoin and altcoins, aiming to optimize returns while managing volatility.

Altcoin Season Index Climbs to 19 What Does It Signal?

Interpreting a Reading of 19

At first glance, an index value of 19 may not seem particularly impressive. It is still far from the threshold that signals a full altcoin season. However, the importance lies not just in the number itself, but in the direction of movement. A climb from lower levels suggests that more altcoins are beginning to show relative strength compared to Bitcoin.

Historically, the early stages of an altcoin cycle often start with subtle changes. Bitcoin typically rallies first, followed by large-cap altcoins, and eventually smaller-cap tokens. A reading of 19 may indicate that this process is just beginning, especially if supported by other market indicators such as decreasing Bitcoin dominance or rising altcoin trading volumes.

The Psychological Impact on the Market

Market psychology plays a significant role in crypto price movements. As the Altcoin Season Index climbs, even modestly, it can influence investor sentiment. Traders may start reallocating funds in anticipation of broader altcoin gains, creating a self-reinforcing cycle. This psychological shift is often as important as technical data, particularly in a market driven by narratives and momentum.

Bitcoin Dominance and Its Relationship to Altcoins

How Bitcoin Dominance Shapes Market Cycles

Bitcoin dominance refers to Bitcoin’s share of the total cryptocurrency market capitalization. When dominance is high, Bitcoin is outperforming altcoins, and capital tends to flow toward perceived safety. When dominance declines, it often signals that investors are diversifying into altcoins.

A rising Altcoin Season Index often correlates with a gradual decline in Bitcoin dominance. While dominance remains relatively strong at present, even small shifts can have outsized effects on altcoin prices. Monitoring this relationship helps investors understand whether the market is entering a new phase of its cycle.

Historical Patterns Between Bitcoin and Altcoins

Looking back at previous bull markets, Bitcoin typically leads the initial rally. Once Bitcoin establishes a strong uptrend or consolidates, capital flows into Ethereum and other large-cap altcoins. Eventually, this momentum spreads to mid-cap and small-cap projects. The Altcoin Season Index climbing to 19 may reflect the earliest stages of this familiar pattern, though confirmation requires sustained movement over time.

Market Cycles and the Timing of Altcoin Seasons

Where We Are in the Crypto Market Cycle

Crypto markets are cyclical, influenced by factors such as Bitcoin halving events, macroeconomic conditions, and technological adoption. Many analysts believe the market is currently in a transitional phase, moving from accumulation to early expansion. In such periods, Bitcoin often consolidates after strong gains, allowing altcoins to catch up.

The Altcoin Season Index climbing to 19 fits this narrative. It suggests that while Bitcoin remains dominant, altcoins are beginning to show resilience and relative strength. This phase can last weeks or even months before a full altcoin season emerges.

Why Altcoin Seasons Rarely Start Overnight

Altcoin seasons are rarely sudden. They tend to develop gradually as confidence builds and capital rotates. Early signals like a rising Altcoin Season Index are often overlooked by retail investors, who typically enter later when prices have already surged. Understanding these early indicators can provide a strategic advantage, though it also requires patience and risk management.

The Role of Ethereum and Large-Cap Altcoins

Ethereum as a Market Bellwether

Ethereum plays a pivotal role in any discussion about altcoin performance. As the largest altcoin by market capitalization, Ethereum often acts as a bridge between Bitcoin and the broader altcoin market. When Ethereum begins to outperform Bitcoin, it frequently signals a broader shift toward altcoins.

Recent movements in Ethereum’s price relative to Bitcoin have shown signs of stabilization, which may support the Altcoin Season Index’s gradual climb. Strong activity in DeFi, NFTs, and layer-2 solutions also contributes to Ethereum’s influence on the wider market.

Large-Cap Altcoins and Investor Confidence

Beyond Ethereum, other large-cap altcoins such as Solana, Cardano, and Avalanche often benefit first when capital begins rotating. These assets are perceived as less risky than smaller projects, making them attractive during the early stages of an altcoin market shift. Their performance can significantly impact the Altcoin Season Index and shape broader market sentiment.

Macroeconomic Factors Influencing the Crypto Market

Interest Rates, Inflation, and Risk Assets

Macroeconomic conditions play a crucial role in shaping crypto market trends. Interest rate policies, inflation data, and global liquidity all influence investor appetite for risk assets, including cryptocurrencies. When financial conditions loosen, investors are more likely to explore speculative investments such as altcoins.

The Altcoin Season Index climbing to 19 may partially reflect improving macro sentiment. If global markets stabilize and liquidity increases, altcoins could benefit disproportionately due to their higher volatility and growth potential.

Regulatory Developments and Market Confidence

Regulatory clarity remains a major factor affecting crypto markets. Positive developments, such as clearer guidelines for exchanges or institutional adoption, can boost confidence and encourage capital inflows. Conversely, uncertainty can slow or reverse altcoin momentum. Monitoring regulatory trends is therefore essential when interpreting signals like the Altcoin Season Index.

On-Chain Data and Investor Behavior

What On-Chain Metrics Reveal

On-chain data provides valuable insight into investor behavior. Metrics such as active addresses, transaction volumes, and token distribution can indicate whether interest in altcoins is growing. Increases in on-chain activity often precede price movements, reinforcing the significance of a rising Altcoin Season Index.

Recent data suggests a gradual uptick in activity across several altcoin networks. While not definitive, this trend supports the idea that market participants are beginning to diversify beyond Bitcoin.

Retail vs Institutional Participation

Institutional investors tend to favor Bitcoin due to its liquidity and regulatory recognition. Retail investors, on the other hand, are more likely to explore altcoins in search of higher returns. A rising Altcoin Season Index can therefore indicate growing retail participation, which historically plays a major role in driving altcoin rallies.

Risks and Realistic Expectations for Altcoin Investors

Why a Reading of 19 Is Not a Guarantee

While the Altcoin Season Index climbing to 19 is noteworthy, it does not guarantee an imminent altcoin season. Markets can reverse quickly, and false signals are common in periods of consolidation. Overconfidence based on a single metric can lead to poor investment decisions.

Investors should consider the index as one tool among many, combining it with technical analysis, fundamental research, and broader market context.

Volatility and Portfolio Management

Altcoins are inherently volatile. Even during strong altcoin seasons, sharp corrections are common. Managing risk through diversification and disciplined strategies is essential. The current market environment calls for cautious optimism rather than unchecked enthusiasm.

Conclusion: Is the Crypto Market Really Shifting?

The Altcoin Season Index climbing to 19 does not yet confirm a full-fledged altcoin season, but it does suggest that subtle changes may be underway in the crypto market. This movement reflects early signs of capital rotation, shifting investor sentiment, and growing interest in alternative cryptocurrencies. While Bitcoin remains dominant, history shows that such periods often precede broader altcoin participation.

For investors, the key takeaway is balance. The current data encourages awareness and preparation rather than aggressive speculation. By understanding market cycles, monitoring supporting indicators, and managing risk carefully, participants can position themselves thoughtfully as the crypto landscape continues to evolve.

(FAQs)

Q. What does the Altcoin Season Index measure?

The Altcoin Season Index measures how many top altcoins outperform Bitcoin over a specific period, typically 90 days, helping identify market trends.

Q. Is an Altcoin Season Index of 19 bullish?

A reading of 19 is not strongly bullish but indicates early signs of altcoin strength. It suggests a possible transition phase rather than a confirmed altcoin season.

Q. How does Bitcoin dominance affect altcoins?

High Bitcoin dominance usually means Bitcoin is outperforming altcoins. A decline in dominance often allows altcoins to gain momentum and attract capital.

Q. Should investors buy altcoins when the index rises?

Investors should not rely solely on the index. It is best used alongside other indicators, research, and risk management strategies.

Q. Can the Altcoin Season Index fall again?

Yes, the index can fluctuate frequently. Market conditions, macro factors, and investor sentiment can all cause the index to rise or fall quickly.