The cryptocurrency market is once again undergoing a familiar yet powerful shift as altcoin season emerges as Bitcoin underperforms in Q3. For much of the year, Bitcoin has struggled to maintain strong upward momentum, weighed down by macroeconomic uncertainty, institutional profit-taking, and reduced volatility. While Bitcoin continues to dominate headlines and market capitalization, its muted performance during the third quarter has opened the door for altcoins to take center stage.

Historically, periods of Bitcoin consolidation or underperformance often trigger a rotation of capital into alternative cryptocurrencies. This dynamic appears to be unfolding once more. Investors searching for higher returns are increasingly allocating funds into altcoins, driving sharp rallies across multiple sectors including decentralized finance, layer-2 scaling solutions, artificial intelligence tokens, gaming, and real-world asset tokenization. As a result, market participants are beginning to ask whether a sustained altcoin season is truly underway.

This article explores how and why altcoin season emerges as Bitcoin underperforms in Q3, examining market indicators, investor psychology, sector performance, and broader implications for the crypto ecosystem. By understanding the forces behind this shift, traders and long-term investors alike can better navigate one of the most dynamic phases of the digital asset market.

Bitcoin’s Underperformance in Q3

Bitcoin has long been considered the anchor of the crypto market, often setting the tone for broader price action. However, in Q3, Bitcoin’s performance has lagged relative to expectations. While it has avoided a major breakdown, it has also failed to deliver the explosive rallies seen in previous cycles. This stagnation has played a critical role in setting the stage for altcoin outperformance.

Several factors explain why Bitcoin underperforms in Q3. Reduced institutional inflows, lower spot trading volumes, and a lack of immediate catalysts have limited upside momentum. Additionally, Bitcoin’s increasing correlation with traditional markets has dampened speculative enthusiasm, particularly as global investors remain cautious amid interest rate uncertainty and geopolitical tensions.

This environment has encouraged investors to look beyond Bitcoin. As capital seeks higher beta opportunities, the conditions become ripe for an altcoin season, where smaller-cap assets outperform the market leader.

What Is Altcoin Season and Why It Matters

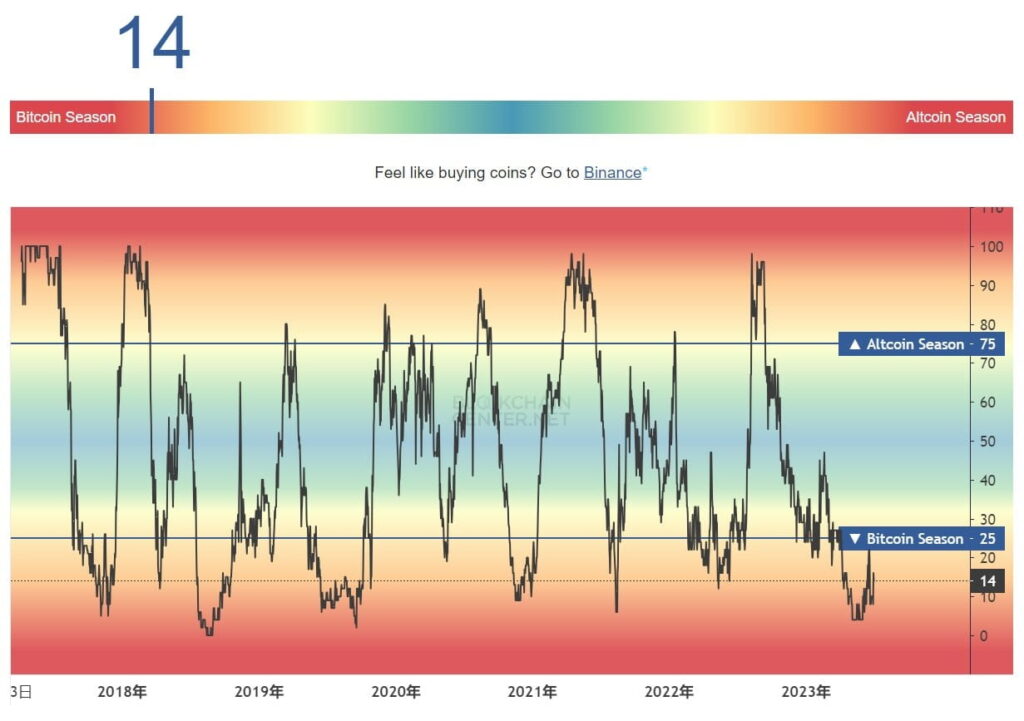

Defining Altcoin Season

Altcoin season refers to a period when the majority of alternative cryptocurrencies outperform Bitcoin over a sustained timeframe. This phenomenon is often measured using indicators such as Bitcoin dominance, which tracks Bitcoin’s share of the total crypto market capitalization. When dominance declines, it usually signals that capital is flowing into altcoins.

As altcoin season emerges as Bitcoin underperforms in Q3, this shift reflects changing investor priorities. Instead of prioritizing capital preservation through Bitcoin, market participants become more willing to embrace risk in pursuit of higher returns.

The Importance of Market Cycles

Altcoin seasons are a natural part of crypto market cycles. They tend to occur after Bitcoin establishes a strong base or enters a consolidation phase. Understanding this cyclical behavior is crucial, as it helps investors avoid emotional decision-making and recognize broader structural trends.

Bitcoin Dominance and Capital Rotation

Declining Bitcoin Dominance

One of the clearest signs that altcoin season emerges as Bitcoin underperforms in Q3 is the steady decline in Bitcoin dominance. As dominance falls, it indicates that altcoins are capturing a larger share of total market value. This does not necessarily mean Bitcoin is collapsing; rather, it suggests that altcoins are growing at a faster rate.

A declining dominance environment often fuels optimism across altcoin communities, reinforcing momentum and attracting additional speculative capital.

How Capital Rotation Works

Capital rotation typically begins with large-cap altcoins such as Ethereum, before spreading to mid-cap and eventually small-cap tokens. Early movers benefit from increased liquidity, while later-stage rallies can become highly volatile. This pattern highlights both the opportunities and risks associated with altcoin season.

Ethereum’s Role in the Emerging Altcoin Season

Ethereum as the Gateway Altcoin

Ethereum often leads the charge when altcoin season begins. As the largest altcoin by market capitalization, Ethereum serves as a bridge between Bitcoin and the broader altcoin market. In Q3, Ethereum has shown relative strength compared to Bitcoin, reinforcing the narrative that altcoin season emerges as Bitcoin underperforms in Q3.

Ethereum’s ecosystem continues to expand, driven by decentralized applications, staking, and layer-2 adoption. These fundamentals make it a preferred choice for investors rotating out of Bitcoin while still seeking relative stability.

Network Activity and Investor Confidence

Rising on-chain activity, increased staking participation, and ongoing protocol upgrades have supported Ethereum’s performance. This strength often spills over into the wider altcoin market, boosting sentiment and encouraging risk-taking.

Sector Performance Driving Altcoin Momentum

Decentralized Finance Regains Attention

Decentralized finance has re-emerged as a major driver of altcoin performance. As yields stabilize and innovation resumes, DeFi tokens have attracted renewed interest. Investors view these assets as leveraged plays on blockchain adoption, making them attractive during periods when altcoin season emerges.

AI, Gaming, and Emerging Narratives

Artificial intelligence-related tokens, blockchain gaming projects, and metaverse platforms have also contributed to the momentum. These narratives resonate strongly with retail investors, amplifying speculative demand. As Bitcoin underperforms in Q3, capital flows into these high-growth sectors accelerate.

Real-World Asset Tokenization

Another notable trend is the rise of real-world asset tokenization. Projects focused on bridging traditional finance with blockchain technology have gained traction, further diversifying the altcoin landscape and reinforcing the breadth of the current rally.

Investor Psychology During Altcoin Season

From Caution to Speculation

Investor psychology shifts dramatically during altcoin season. When Bitcoin stagnates, frustration sets in, pushing traders toward assets with greater upside potential. As early gains materialize, confidence grows, often leading to increased leverage and speculative behavior.

This psychological transition is a key reason why altcoin season emerges as Bitcoin underperforms in Q3. It reflects a collective willingness to embrace risk in search of outsized returns.

The Role of Social Media and Sentiment

Social media plays a powerful role in amplifying altcoin narratives. Viral success stories, influencer commentary, and community-driven hype can rapidly accelerate price movements. While this dynamic creates opportunity, it also increases volatility and the risk of sharp corrections.

Risks Associated With Altcoin Season

Volatility and Liquidity Challenges

Altcoins are inherently more volatile than Bitcoin. While gains can be substantial, losses can be equally severe. Liquidity constraints in smaller-cap tokens exacerbate price swings, making risk management essential.

As altcoin season emerges, inexperienced investors may underestimate these risks, leading to emotional decision-making and poor outcomes.

Overvaluation and Speculative Excess

Rapid price appreciation often leads to overvaluation. Projects with weak fundamentals can experience unsustainable rallies driven purely by speculation. When sentiment shifts, these assets are typically the first to collapse.

How Long Can Altcoin Season Last?

Historical Perspectives

Historically, altcoin seasons vary in duration. Some last only a few weeks, while others extend for several months. Their longevity depends on factors such as Bitcoin’s price stability, macroeconomic conditions, and the strength of underlying narratives.

In the current environment, the fact that altcoin season emerges as Bitcoin underperforms in Q3 suggests that the trend could persist as long as Bitcoin remains range-bound.

Key Indicators to Watch

Market participants closely monitor Bitcoin dominance, trading volumes, and on-chain data to gauge the health of altcoin season. A sudden resurgence in Bitcoin momentum often marks the end of widespread altcoin outperformance.

Strategic Approaches for Investors

Balancing Opportunity and Risk

Successful navigation of altcoin season requires balance. While the potential for high returns is appealing, disciplined position sizing and diversification are essential. Investors should focus on projects with strong fundamentals, active development, and real-world use cases.

Long-Term vs Short-Term Strategies

Some investors view altcoin season as a trading opportunity, while others see it as a chance to accumulate long-term positions. Understanding personal risk tolerance and investment goals is crucial when participating in a market where altcoin season emerges as Bitcoin underperforms in Q3.

Broader Implications for the Crypto Market

Market Maturation and Capital Efficiency

The rotation into altcoins reflects a maturing market where capital flows more efficiently toward innovation and growth. Rather than concentrating solely on Bitcoin, investors are increasingly willing to explore diverse blockchain applications.

Reinforcing Crypto’s Cyclical Nature

The current shift reinforces the cyclical nature of crypto markets. Periods of Bitcoin dominance are often followed by phases of altcoin outperformance, highlighting the importance of adaptability and market awareness.

Conclusion

The narrative that altcoin season emerges as Bitcoin underperforms in Q3 captures a defining moment in the current crypto cycle. Bitcoin’s relative stagnation has created fertile ground for altcoins to outperform, driven by capital rotation, evolving narratives, and renewed investor risk appetite. While this environment offers significant opportunity, it also demands caution, discipline, and a clear understanding of market dynamics.

As history has shown, altcoin seasons can be both rewarding and unforgiving. Investors who remain informed, manage risk effectively, and focus on fundamentals are best positioned to benefit from this phase. Whether the current trend evolves into a sustained rally or a shorter-lived burst, it underscores the dynamic and ever-changing nature of the cryptocurrency market.

Frequently Asked Questions (FAQs)

Q. What does it mean when altcoin season emerges?

It means that altcoins collectively outperform Bitcoin over a sustained period, often due to capital rotation and increased risk appetite.

Q. Why is Bitcoin underperforming in Q3?

Bitcoin underperforms due to reduced volatility, lack of strong catalysts, and increased correlation with traditional financial markets.

Q. Is altcoin season risky for new investors?

Yes, altcoin season involves higher volatility and speculative behavior, making risk management especially important.

Q. How can investors identify altcoin season early?

Key indicators include declining Bitcoin dominance, rising altcoin volumes, and strong performance across multiple altcoin sectors.

Q. Will altcoin season end if Bitcoin starts rising again?

Often yes. A strong Bitcoin rally typically draws capital back into BTC, reducing altcoin outperformance and ending altcoin season.