For years, crypto investors have relied on seed phrases—long strings of randomly generated words—to secure access to their digital assets. While effective, this method has led to lost funds, forgotten passwords, and costly security breaches. Now, seedless crypto wallets promise a more user-friendly and secure alternative. With Hanwha’s $13 million investment in seedless crypto wallets, the South Korean giant is positioning itself at the forefront of Web3 innovation. This article explores what it means that South Korea’s Hanwha makes a $13 million bet on seedless crypto wallets, how seedless technology works, and why this move could reshape the future of digital asset custody.

South Korea’s Hanwha Makes a $13 Million Bet on Seedless Crypto Wallets

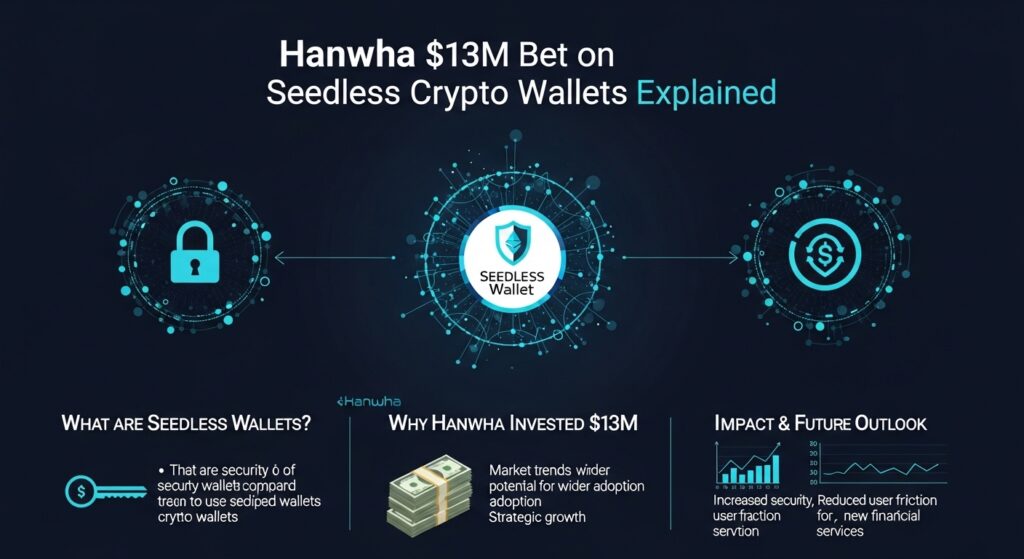

When South Korea’s Hanwha makes a $13 million bet on seedless crypto wallets, it highlights a major institutional shift toward blockchain-native infrastructure. Hanwha, one of South Korea’s largest conglomerates, has interests spanning aerospace, defense, finance, and technology. Its decision to invest in seedless wallet technology demonstrates confidence in the next evolution of crypto security. Hanwha Group is known for strategic investments in cutting-edge technologies. By backing seedless crypto wallet development, the company is signaling that digital asset security remains a priority for institutional players. The move comes at a time when user adoption of cryptocurrencies is increasing globally. However, one major barrier to mass adoption remains: complexity. Traditional wallets require users to store and protect seed phrases, often leading to mistakes. Seedless crypto wallets aim to solve this.

What Are Seedless Crypto Wallets?

To understand why South Korea’s Hanwha makes a $13 million bet on seedless crypto wallets, it’s important to first understand what seedless wallets are. Traditional cryptocurrency wallets generate a private key tied to a seed phrase, typically consisting of 12 or 24 words. If users lose this phrase, they permanently lose access to their funds. This model, while decentralized and secure in theory, is highly unforgiving. Rather than storing a single private key in one location, seedless wallets distribute key fragments across secure environments. This significantly reduces the risk of total loss. The appeal of seedless wallet technology lies in its simplicity. Users no longer need to write down and safeguard a fragile seed phrase. Instead, authentication can rely on biometrics, device verification, or trusted recovery networks.

Why Hanwha’s $13 Million Bet Matters

When South Korea’s Hanwha makes a $13 million bet on seedless crypto wallets, it validates the technology’s long-term potential. Institutional backing often serves as a catalyst for broader adoption and regulatory clarity. Institutional capital flowing into crypto infrastructure indicates maturation within the industry. Rather than focusing solely on speculative tokens, investors are targeting core infrastructure like wallet security. This shift mirrors the broader trend of institutional crypto adoption, where companies focus on sustainable, user-centric blockchain solutions.

The Problem With Seed Phrases

The cryptocurrency industry has long struggled with usability. While decentralization empowers users, it also places responsibility entirely on individuals. This vulnerability is precisely why South Korea’s Hanwha makes a $13 million bet on seedless crypto wallets. By removing seed phrase dependency, wallet providers can dramatically reduce human error risks.

How Seedless Crypto Wallets Improve Security

Multi-Party Computation (MPC)

Many seedless crypto wallets rely on multi-party computation technology. MPC divides private keys into multiple encrypted parts stored in different environments. No single entity controls the entire key. This system ensures that even if one component is compromised, the wallet remains secure.

Biometric Authentication

Modern seedless wallets integrate fingerprint scanning, facial recognition, or hardware authentication. These features make crypto access resemble online banking, reducing friction for new users.

Social Recovery Models

Some wallets allow users to designate trusted contacts who can help recover access if devices are lost. This approach maintains decentralization while improving recoverability. Hanwha’s backing of these innovations demonstrates faith in advanced blockchain security solutions that balance safety and convenience.

Institutional Adoption of Crypto Infrastructure

The fact that South Korea’s Hanwha makes a $13 million bet on seedless crypto wallets aligns with a broader wave of institutional involvement in blockchain infrastructure. This trend is crucial because infrastructure investments are typically long-term plays. It signals that corporate leaders believe crypto and blockchain technologies will remain integral to global finance.

South Korea’s Growing Role in Crypto Innovation

South Korea has long been a major player in the cryptocurrency market. The country boasts high digital literacy rates and strong fintech adoption. From blockchain startups to crypto exchanges, South Korea’s ecosystem remains vibrant.

Regulatory developments have further strengthened investor protections while encouraging innovation. When South Korea’s Hanwha makes a $13 million bet on seedless crypto wallets, it reinforces the nation’s leadership in blockchain innovation.

Implications for Web3 and DeFi

Seedless wallets play a critical role in Web3 ecosystems. Decentralized finance applications require secure wallet connections, yet onboarding remains complex for newcomers. Hanwha’s investment may accelerate the development of next-generation Web3 infrastructure, making decentralized applications more accessible.

Market Impact and Investor Confidence

Whenever a major conglomerate invests in crypto infrastructure, it boosts market confidence. The announcement that South Korea’s Hanwha makes a $13 million bet on seedless crypto wallets sends a signal that blockchain security remains a priority even during volatile market cycles. Such investments suggest that the future of digital assets depends not just on token prices, but on robust infrastructure.

The Future of Crypto Wallet Technology

Wallet technology continues to evolve. While hardware wallets and software wallets remain popular, seedless models represent the next stage. As more corporations recognize the need for seamless crypto access, seedless wallets could become standard. The fact that South Korea’s Hanwha makes a $13 million bet on seedless crypto wallets may mark a turning point in how digital asset security is perceived.

Conclusion

The announcement that South Korea’s Hanwha makes a $13 million bet on seedless crypto wallets represents more than a simple investment. It underscores a fundamental shift in how institutions approach blockchain security and digital asset management.

Seedless wallets address one of crypto’s biggest usability challenges: the fragile seed phrase system. By investing heavily in this innovation, Hanwha is supporting safer, more accessible crypto adoption.

See more: Crypto Trends 2025 The Future of Bitcoin DeFi and AI