Why Bitcoin price is crashing today (Jan. 31) has become the key question on traders’ and analysts’ minds as BTC slips from recent highs and tests critical support levels. Bitcoin’s price action over the past 24-48 hours reflects not just short-term trading dynamics but broader macroeconomic shifts, changes in risk sentiment, and technical liquidations that have accelerated the downturn. Understanding these factors is essential for both active traders and long-term Holder’s seeking clarity amid market turmoil.

Today’s drop isn’t isolated—it’s part of a larger narrative where global markets are re-pricing risk assets, central bank leadership shifts dominate headlines, and leveraged positions unwind in rapid succession. From Federal Reserve policy implications to sentiment indicators showing “fear” across crypto markets, there are multiple contributing forces. Below, we explore the core reasons behind the Bitcoin price crash and provide insight into what might come next in this evolving market environment.

The Macro Backdrop: Why Bitcoin Price Is Crashing Today

As of Jan. 31, macroeconomic uncertainty is one of the most prominent drivers of the downturn in the broader crypto market. Recent events in global finance, particularly in the U.S., have influenced investor behavior across asset classes, including Bitcoin.

Central to this is the nomination of Kevin Wars as the prospective new Chair of the U.S. Federal Reserve. Markets reacted strongly to the news, as Wash’s reputation as a potential hawk on interest rates suggests continued tight monetary policy. Higher interest rates make risk assets like Bitcoin less attractive compared to yield-bearing investments and strengthen the U.S. dollar, diminishing demand for non-yielding assets such as BTC. This shift in monetary expectations has pressured Bitcoin and other cryptocurrencies.

Global markets are also grappling with increased uncertainty. Geopolitical tensions, tariff disputes, and political instability have heightened risk aversion, encouraging capital flows toward safe-haven assets like gold and cash equivalents while reducing appetite for volatile digital assets. Investors’ retreat from riskier positions has played a key role in Bitcoin’s recent decline.

Central Bank Policy: A Major Catalyst

Federal Reserve policy has long had a profound effect on financial markets, and Bitcoin is no exception. Expectations of future interest rate decisions weigh heavily on BTC traders, especially given the cryptocurrency’s status as a risk-correlated asset. Historically, when interest rates are high or expected to remain elevated, investors tend to reduce exposure to assets lacking intrinsic yield, including cryptocurrencies. This dynamic has contributed to Bitcoin’s renewed downward pressure heading into Jan. 31.

Recent data showing strong macroeconomic indicators have also reduced the likelihood of imminent rate cuts, further cementing a “higher for longer” rate scenario in traders’ expectations. A strong dollar makes Bitcoin comparatively less appealing, especially for international capital flows.

Over-Leverage and Liquidations: A Technical Downturn

Another key reason why Bitcoin price is crashing today stems from the crypto market’s internal technical dynamics. A wave of leveraged positions—particularly long positions on derivatives exchanges—has been forcefully unwound due to declining prices, triggering a cascade of liquidations.

Large scale liquidations occur when leveraged traders fail to meet margin requirements, prompting exchanges to automatically close their positions. In the past 24 hours, derivatives markets have seen significant BTC long-position liquidations, amplifying downward momentum. This “domino effect,” where one forced sell triggers further selling, exacerbates price declines and can quickly spiral into sharp corrections.

This behavior is typical in markets experiencing rapid sentiment shifts—a small downtrend turns into a larger sell-off as traders rush to exit positions. With Bitcoin recently losing key support levels, these technical triggers have contributed significantly to today’s crash.

Market Sentiment: Fear and Risk Aversion Are Rising

Sentiment plays a pivotal role in cryptocurrency price movements. When optimism dominates, prices rise as fear of missing out (FOMO) drives buyers. Conversely, when fear spreads, as measured by metrics like the Crypto Fear & Greed Index, selling pressure intensifies.

As of late January 2026, sentiment indicators across major exchanges and market trackers are signaling heightened fear. The prolonged decline from October 2025 highs, combined with macroeconomic trepidations and institutional caution, has gradually shifted sentiment from bullish to defensive. This psychological transition intensifies sell-offs and contributes to further declines in price as traders and investors capitulate or hedge their exposure.

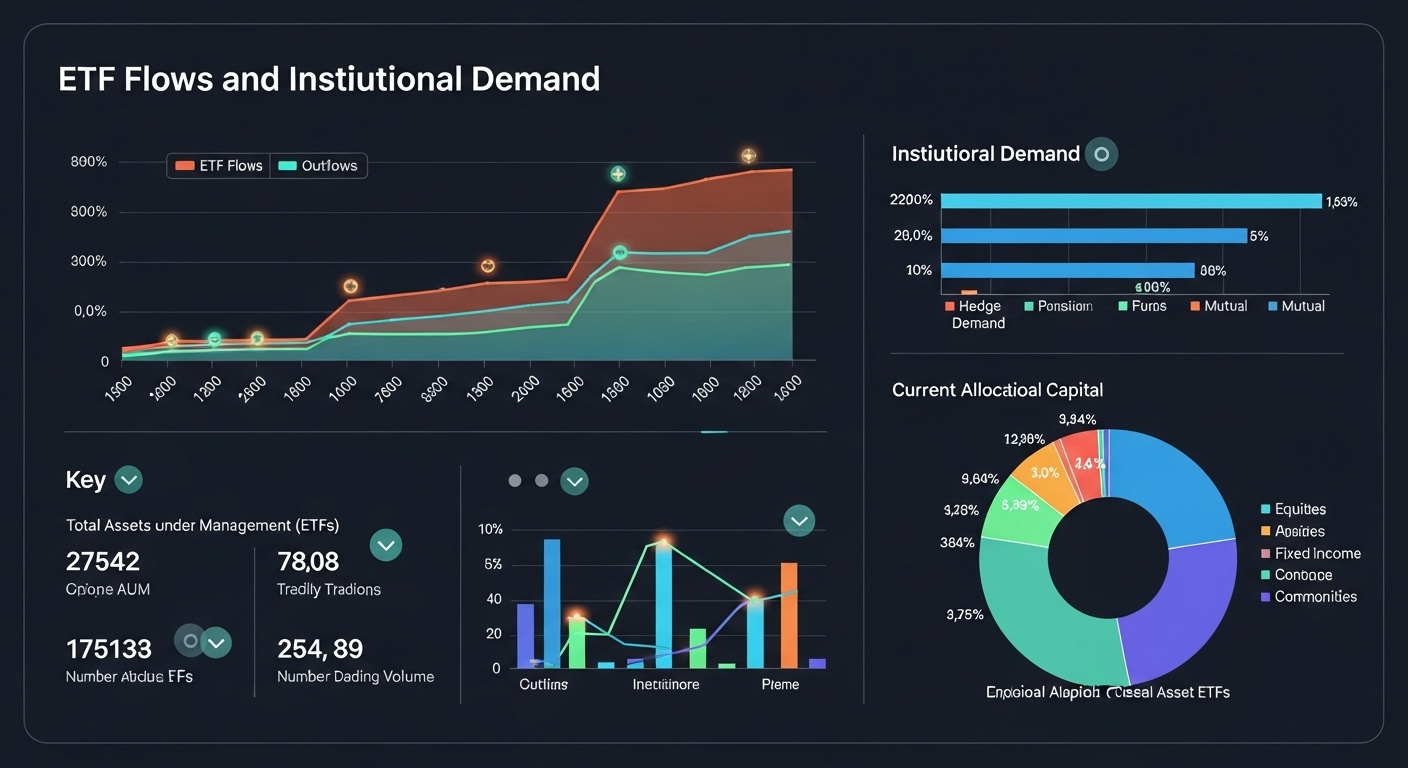

ETF Flows and Institutional Demand

Institutional involvement in Bitcoin, particularly through exchange-traded funds (ETFs), has been a double-edged sword. While ETF inflows once supported Bitcoin’s rally, recent sessions have seen outflows and cooling interest from institutional players. This reduction in demand weakens one of the key pillars that supported Bitcoin’s price during earlier rallies, contributing to today’s downward pressure.

Outflows signal hesitation among large capital allocators and can indicate a broader reassessment of risk in the financial markets. When institutional appetite wanes, price support erodes and volatility tends to increase.

Technical Analysis: Support Breaks and Sell-offs

From a purely technical perspective, the breakdown of key support levels has triggered algorithmic and momentum-based selling. Once psychological and technical supports are breached, market algorithms often contribute to accelerated declines as automated systems execute sell orders tied to these levels.

For Bitcoin, breaking below key price bands near critical support figures has prompted alarm among traders, sparking a wave of stop-loss triggers and additional downward thrusts. These technical shifts compound macro and sentiment-driven forces, creating a powerful combination that pushes price lower in short timeframes.

Geopolitical Tensions and Risk Markets

Geopolitical uncertainties and trade disputes have influenced global risk sentiment. Investors tend to flee high-risk assets like Bitcoin when conflicts or economic disputes escalate. With ongoing concerns about trade barriers and geopolitical unrest, global risk appetite remains muted. This context makes Bitcoin and other cryptocurrencies susceptible to steeper price corrections as capital flows toward perceived safe havens or liquid assets.

Conclusion

The reason why Bitcoin price is crashing today on Jan. 31 is not a single isolated event but a convergence of macroeconomic, technical, and sentiment-driven factors. Fed policy expectations, leverage unwinding, institutional flows, and risk aversion have all played a role in driving prices lower. As markets continue to digest these inputs, Bitcoin’s price may remain volatile in the near term.

Understanding these dynamics is crucial for any investor or trader navigating this slump—stay informed, monitor key macroeconomic indicators, and use disciplined risk management. If you’re curious about how why Bitcoin price is crashing today might affect your portfolio or want deeper insights into future price trends, keep following market updates and expert analyses.

See mare: Crypto Market Crash Explained Why Bitcoin and Altcoins Are Down