The cryptocurrency market has evolved far beyond its early years of unpredictable boom-and-bust cycles. As the industry matures, analysts look beyond simple metrics like daily trading volume or Bitcoin price swings to evaluate market health. One of the most important yet misunderstood indicators is speculative leverage stability, a measure of how consistently traders are using borrowed capital to amplify positions in digital assets. When leverage remains stable, even during periods of heightened volatility, it often signals confidence, structural maturity, and a healthier long-term outlook for the crypto market.

Understanding speculative leverage stability is not just beneficial for institutional investors or advanced traders. Retail participants, long-term holders, and newcomers can all use this metric to better understand market sentiment, predict potential price movements, and avoid common pitfalls associated with excessive speculation. Throughout this article, we break down what speculative leverage stability means, why it has emerged as a bullish signal for crypto market health, and how investors can incorporate it into their broader market analysis.

By the end of this comprehensive guide, readers will have a deep, nuanced understanding of how leverage shapes crypto market cycles, how stability reflects improving investor behavior, and why this trend could support continued growth across digital assets.

Speculative Leverage in Crypto Markets

Speculative leverage refers to borrowing capital to enter larger trading positions than one’s actual account balance would allow. In crypto, leverage is embedded deeply in the ecosystem, with many exchanges offering derivatives, perpetual futures, and margin trading that give investors exposure far beyond their equity. Unlike traditional markets, where leverage is heavily regulated, crypto provides easy access to multipliers ranging from 5x to 100x or even more.

High leverage amplifies both profits and losses, making it a double-edged sword. The presence of leveraged positions can dramatically influence price movements, often accelerating trends due to liquidations. When price drops cause traders’ positions to be automatically closed, it can trigger a cascading effect known as a “liquidation event,” sending prices lower at astonishing speed. Conversely, bullish liquidations (short squeezes) can drive prices upward.

What Is Speculative Leverage Stability and Why Does It Matter?

Speculative leverage stability refers to the consistency in the amount of leverage used across market participants. When leverage usage remains relatively unchanged despite market shifts, it suggests investors are not overly reactive or panicking. Stability signals that the market is driven by informed decision-making rather than emotional trading. When leverage is stable, volatility tends to be more contained because liquidation cascades are less likely. This fosters healthier market conditions, smoother uptrends, and more sustainable price action.

Why Speculative Leverage Stability Is a Bullish Signal

Speculative leverage stability is widely recognized as a bullish indicator because it reflects confidence and financial discipline. Unlike unsustainable leverage spikes seen during euphoric phases, stable leverage suggests investors are building long-term positions without exposing themselves to unnecessary liquidation risks.

Confidence in Market Structure

Stable leverage shows that investors trust the underlying market structure. Traders are no longer reacting impulsively to news events or short-term fluctuations. This behavioral evolution indicates growing sophistication throughout the ecosystem, especially as institutional investors play a larger role.

Reduced Probability of Liquidation Cascades

Mass liquidations often signal excessive greed or fear. When leverage remains stable, the market is less susceptible to sharp, unexpected crashes triggered by cascading liquidations. This stability allows for more predictable price action and reduces the likelihood of catastrophic corrections.

Sustainable Growth Patterns

Cryptocurrencies have long been associated with dramatic boom-and-bust cycles. When speculative leverage remains stable, it suggests the market is moving toward sustainable growth rather than irrational exuberance. Assets like Bitcoin and Ethereum benefit from steady accumulation, which helps build solid support levels.

Institutional Influence and Risk Management

As more institutions enter the digital asset space, the overall quality of risk management improves. Stable leverage reflects this shift, showing that the market is no longer primarily driven by retail gamblers chasing quick profits. Institutional investors typically use moderate leverage and hedge positions appropriately, promoting healthier market conditions.

How Leverage Influences Volatility and Market Psychology

The relationship between leverage and volatility cannot be overstated. High leverage amplifies emotional trading patterns, while stability tempers them. When traders rely excessively on leverage, even minor price swings can have catastrophic outcomes. This creates a feedback loop where volatility increases dramatically, and fear spreads quickly.

Behavioral Patterns in High-Leverage Environments

When leverage is too high, traders often behave irrationally. They may overtrade, increase position sizes during losing streaks, or succumb to panic selling. These behaviors contribute to sudden price swings that deter long-term investors and weaken overall market structure.

Long-Term Investor Impact

Investors who prioritize long-term growth prefer stable environments. Excessive leverage volatility can deter new entrants, as large drawdowns become more common. By contrast, speculative leverage stability supports a more predictable environment, encouraging long-term capital inflows.

Key Indicators Used to Measure Speculative Leverage Stability

Several metrics help investors analyze leverage usage and stability across the crypto market. While no single indicator tells the full story, combining multiple data points provides a clearer picture of market health.

Funding Rates

Funding rates show whether long or short traders are paying a premium to hold leveraged positions. Stable funding rates indicate balanced sentiment. Sudden spikes suggest growing speculation or directional imbalance.

Open Interest Levels

Open interest tracks the total number of outstanding derivative contracts. When open interest rises gradually with stable prices, it signifies healthy positioning. Sharp surges often indicate reckless speculation.

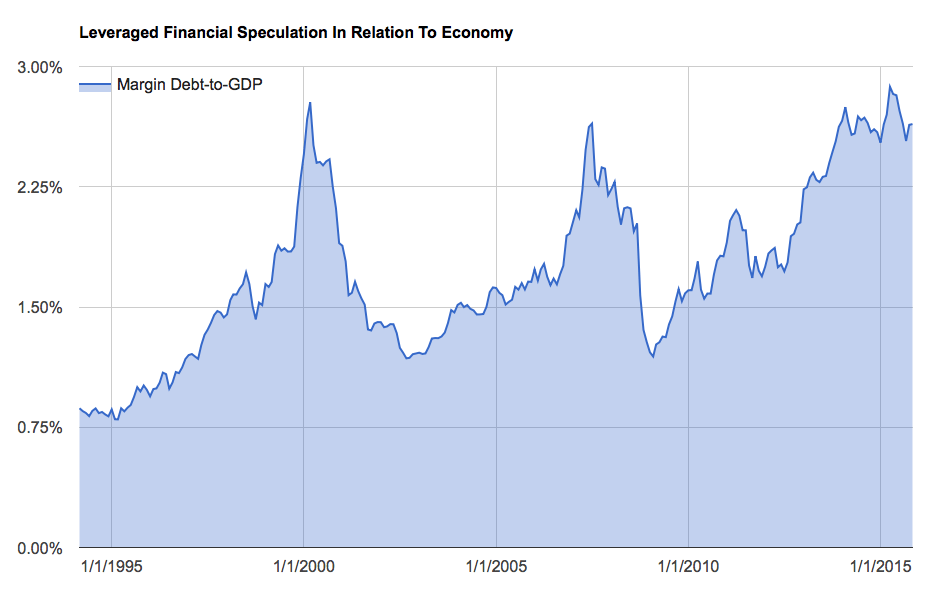

Leverage Ratio Metrics

Many analytics platforms offer leverage ratio data that compare open interest to market capitalization. A stable ratio suggests traders are using leverage responsibly, while sharp increases indicate rising risk levels.

The Role of Derivatives in Crypto Market Stability

Derivatives, including perpetual futures and options, play a crucial role in influencing leverage stability. They allow traders to hedge positions, express directional views, and manage risk effectively. When used properly, derivatives strengthen the overall market structure.

Perpetual Futures and Liquidation Dynamics

Perpetual futures are unique to the cryptocurrency market. They enable continuous trading without expiration dates. However, improper use of high leverage in perpetual futures can lead to liquidation spirals. Stable leverage in perpetual markets indicates reduced liquidation risk.

Options Markets as a Stabilizing Force

Options markets, particularly for Bitcoin and Ethereum, help stabilize volatility by enabling structured hedging strategies. The maturity of the options market contributes to speculative leverage stability by reducing dependence on overly leveraged futures positions.

What Stable Leverage Means for Bitcoin and Altcoins

Speculative leverage stability impacts different sectors of the crypto market in unique ways. While Bitcoin often leads overall sentiment, altcoins respond differently to leverage behaviors.

Bitcoin’s Role as a Benchmark

Bitcoin is often viewed as the anchor for the entire crypto ecosystem. Stable leverage around Bitcoin suggests institutions and professional traders maintain a balanced outlook, creating favorable conditions for long-term growth.

Why Stable Leverage Supports Bull Markets

Bull markets are not created by speculation alone; they are fueled by consistent demand, healthy liquidity, and responsible trading behavior. Speculative leverage stability is a cornerstone of these conditions.

Gradual Price Appreciation

Stable leverage contributes to slow, steady price increases rather than erratic pumps. This reduces the likelihood of blow-off tops and encourages sustained growth.

Stronger Support Levels

When investors accumulate positions without excessive leverage, support levels become stronger and harder to break. These foundations are essential during consolidation periods.

Institutional Confidence

Institutions monitor risk indicators closely. When leverage is stable, they are more comfortable deploying capital, leading to larger inflows that reinforce bullish momentum.

How Retail Traders Can Use Leverage Stability as a Strategy Tool

Retail investors can benefit immensely from monitoring leverage stability. While advanced metrics may seem intimidating, the signals they provide are straightforward.

Identifying Safer Entry Points

Stable leverage environments reduce the risk of sudden liquidation-driven crashes. Retail traders can use these conditions to identify safer entry zones.

Avoiding Overly Speculative Phases

When metrics show leverage spikes, it often precedes corrections. Recognizing these patterns helps retail traders avoid buying tops.

Building Long-Term Positions

Long-term investors seeking accumulation can rely on leverage stability signals to avoid volatile periods and build positions during calm, constructive phases.

The Future of Speculative Leverage in Crypto Markets

As the crypto industry continues to mature, leverage is likely to become even more stable thanks to better regulation, advanced trading tools, and the growing influence of institutions.

Regulatory Changes and Risk Controls

Government oversight and improved exchange risk controls can limit extreme leverage offerings, promoting more disciplined market conditions. As institutional market makers expand their presence, liquidity deepens and volatility reduces. This helps maintain stable leverage levels across exchanges. Advanced analytics, AI-driven trading systems, and improved risk management platforms can further strengthen leverage stability.

Conclusion

Speculative leverage stability is one of the most powerful yet underappreciated indicators of crypto market health. Its presence signals maturity, disciplined trading behavior, and a shift toward sustainable long-term growth. As traders, investors, and institutions continue to evolve, stable leverage will remain a fundamental pillar supporting future bull markets.

Understanding and monitoring this indicator empowers investors to make more informed decisions, avoid unnecessary risks, and capitalize on favorable market conditions. In a rapidly developing industry like crypto, knowledge of leverage dynamics can offer a decisive edge.

FAQs

Q. What is speculative leverage stability in crypto?

It refers to the consistency of leverage usage among traders. Stable leverage suggests disciplined behavior and healthier market conditions.

Q. Why is leverage stability considered bullish?

Stable leverage reduces the risk of liquidation cascades, supports sustainable price growth, and reflects long-term investor confidence.

Q. How can traders monitor leverage stability?

Indicators like funding rates, open interest, and leverage ratios help reveal how stable leverage is across the market.

Q. Does stable leverage affect Bitcoin differently than altcoins?

Yes. Bitcoin tends to benefit most from leverage stability, but altcoins also gain from reduced volatility and healthier liquidity.

Q. Can leverage stability predict bull markets?

While not foolproof, stable leverage often aligns with the early stages of major bull market cycles, making it a valuable leading indicator.