The financial landscape in the Caribbean is undergoing a remarkable transformation, and Barbados is positioning itself at the forefront of this revolution. The emergence of a Blockchain Bank Barbados initiative represents more than just another financial institution—it signals a fundamental shift in how Caribbean businesses can access, manage, and leverage digital assets. For Barbadian entrepreneurs and established companies alike, this innovative banking solution addresses long-standing challenges in international transactions, currency exchange, and financial inclusion. As traditional banking systems struggle to keep pace with the digital economy, the Blockchain Bank Barbados concept offers a bridge between conventional finance and the cryptocurrency ecosystem, creating unprecedented opportunities for growth and global competitiveness.

Blockchain Bank Concept in Barbados

What Makes a Blockchain Bank Different?

A Blockchain Bank Barbados operates fundamentally differently from traditional financial institutions. Unlike conventional banks that rely on centralized ledgers and intermediary-heavy processes, blockchain-based banking utilizes distributed ledger technology to create transparent, secure, and efficient financial transactions. This revolutionary approach allows businesses to conduct cross-border payments in minutes rather than days, reduces transaction fees significantly, and provides real-time settlement capabilities that traditional banks simply cannot match.

The cryptocurrency banking Barbados infrastructure enables businesses to hold, transfer, and manage both fiat currencies and digital assets within a single regulated framework. This hybrid approach is particularly valuable for companies engaged in international trade, digital services, or e-commerce operations that require fast, cost-effective payment solutions.

Regulatory Framework Supporting Blockchain Banking

Barbados has distinguished itself in the Caribbean region by developing progressive regulations that support fintech innovation while maintaining robust consumer protections. The digital asset banking Barbados framework provides legal clarity for cryptocurrency operations, ensuring that businesses can engage with blockchain technology without regulatory uncertainty. This forward-thinking approach has positioned Barbados as a preferred jurisdiction for blockchain-based financial services in the Caribbean.

The regulatory environment addresses critical concerns around anti-money laundering (AML) and know-your-customer (KYC) requirements while allowing flexibility for technological innovation. This balanced approach gives businesses confidence that their blockchain banking operations are fully compliant with international standards.

Key Benefits for Barbadian Businesses

Reducing Transaction Costs and Processing Times

One of the most compelling advantages of Blockchain Bank Barbados’ services is the dramatic reduction in transaction costs. Traditional international wire transfers often carry fees ranging from 3% to 7% of the transaction value, plus additional currency conversion charges. With blockchain-based banking, these costs can be reduced to fractions of a percent, saving businesses thousands of dollars annually.

Processing times represent another critical improvement. While conventional bank transfers can take three to five business days for international payments, crypto-friendly banking in Barbados can process transactions in minutes. For businesses operating on tight cash flow margins, this acceleration of payment settlement can significantly improve working capital management and business operations.

Access to Global Markets and Digital Assets

The Blockchain Bank Barbados framework opens doors to global cryptocurrency markets and decentralized finance (DeFi) opportunities. Barbadian businesses can now participate in international digital commerce without the limitations imposed by traditional banking correspondent relationships. This is particularly valuable for companies in sectors like software development, digital marketing, tourism, and professional services that serve international clients.

Businesses can accept payments in various cryptocurrencies, including Bitcoin, Ethereum, and stablecoins, then convert these assets to Barbadian dollars or maintain them as digital holdings. This flexibility provides hedging opportunities against currency fluctuations and access to appreciation potential in digital asset markets.

Enhanced Financial Inclusion and Accessibility

Many small and medium-sized enterprises (SMEs) in Barbados face challenges accessing traditional banking services due to stringent requirements or limited credit histories. Blockchain banking solutions in Barbados can lower these barriers by utilizing alternative credit assessment methods and reducing operational costs for financial institutions. This democratization of financial services enables more entrepreneurs to participate in the formal economy and access the capital needed for business growth.

The technology also facilitates microfinance and peer-to-peer lending platforms that can serve underbanked segments of the Barbadian business community, creating new opportunities for entrepreneurship and economic development.

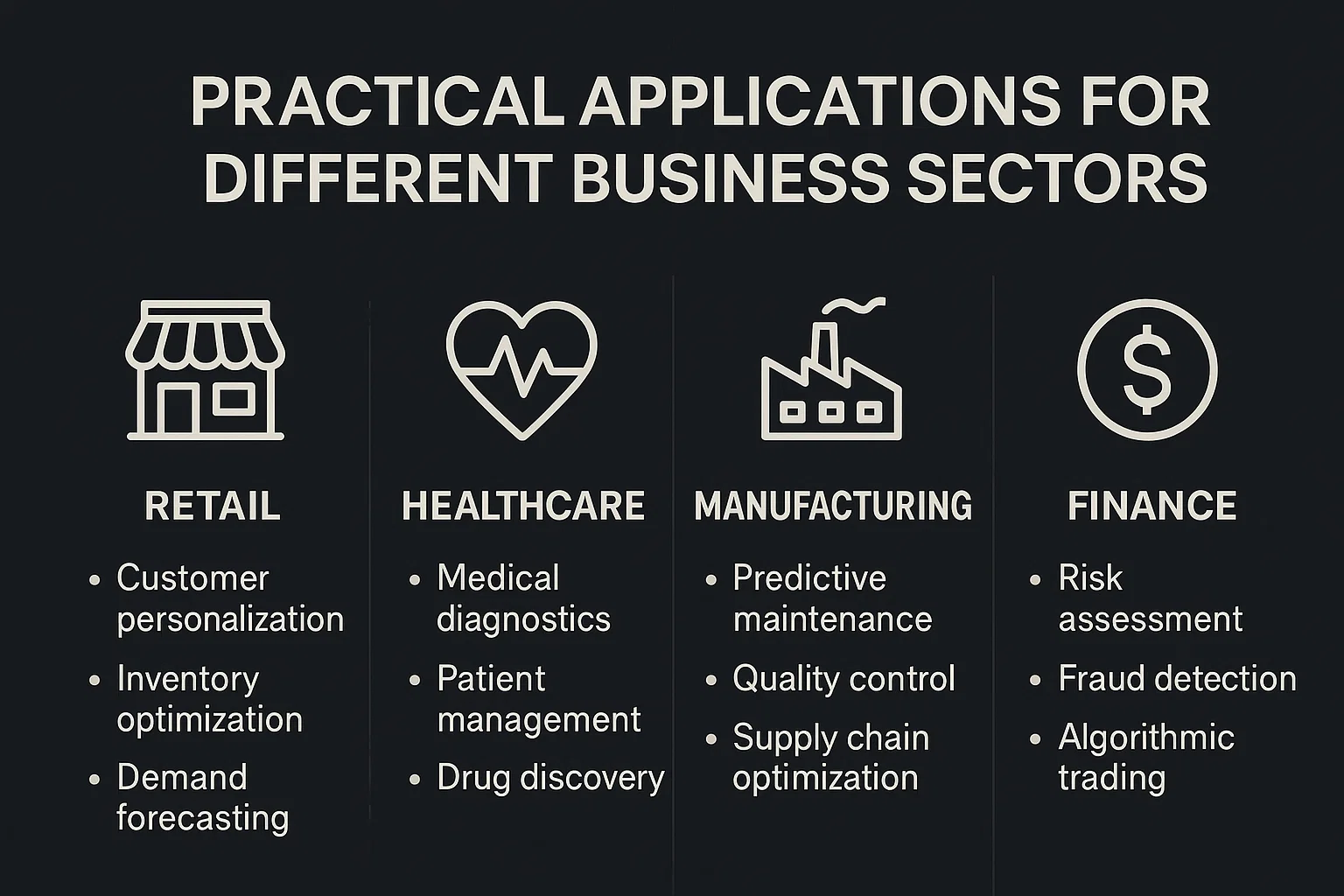

Practical Applications for Different Business Sectors

Tourism and Hospitality Industry

Barbados’ tourism sector, a cornerstone of the national economy, stands to benefit significantly from Blockchain Bank Barbados’ services. Hotels, restaurants, tour operators, and vacation rental properties can accept cryptocurrency payments from international travelers, eliminating currency conversion hassles and reducing payment processing fees. Some forward-thinking establishments are already promoting themselves as crypto-friendly destinations, attracting a growing demographic of digital nomads and cryptocurrency enthusiasts.

The blockchain infrastructure also enables innovative loyalty programs and tokenized rewards systems that can differentiate Barbadian tourism businesses in a competitive Caribbean market. Smart contracts can automate refund processes, travel insurance claims, and booking confirmations, creating smoother experiences for both businesses and customers.

E-Commerce and Digital Services

For Barbadian companies offering digital products or services globally, crypto banking Barbados solutions eliminate many pain points associated with international payments. Software developers, graphic designers, consultants, and other service providers can receive payments instantly without waiting for traditional bank clearances or paying excessive merchant processing fees.

The ability to participate in global e-commerce platforms that support cryptocurrency payments expands market reach beyond traditional geographic limitations. This is particularly valuable for businesses in niche markets where cryptocurrency adoption is high among target customers.

Import-Export and International Trade

Companies engaged in international trade face numerous challenges, including currency exchange risks, letter of credit complexities, and delayed payment settlements. Blockchain Bank Barbados services can streamline these processes through smart contracts that automate payment releases upon shipment verification, reduce documentary requirements through blockchain-verified credentials, and eliminate intermediary banks that add cost and delay.

Trade finance solutions built on blockchain technology provide transparency throughout the supply chain, reducing fraud risks and enabling better inventory management. For Barbadian businesses importing goods or exporting local products, these efficiencies translate directly to improved profit margins and competitive advantages.

Professional Services and Remote Work

The rise of remote work and global talent marketplaces has created opportunities for Barbadian professionals to offer services internationally. Blockchain banking services facilitate seamless payment collection from clients worldwide without the complications of traditional cross-border banking. Freelancers, consultants, legal professionals, and accountants can operate truly global practices from Barbados while maintaining banking relationships that support their business models.

The technology also enables innovative business structures like decentralized autonomous organizations (DAOs,s) where Barbadian professionals can participate in international collaborative ventures with transparent, automated governance and payment systems.

Overcoming Traditional Banking Limitations

Addressing Correspondent Banking Challenges

Caribbean banks, including those in Barbados, have faced increasing difficulties with correspondent banking relationships over the past decade. International banks have reduced their correspondent relationships with Caribbean institutions due to perceived compliance risks, making international transactions more difficult and expensive for local businesses. The Blockchain Bank Barbados model bypasses these correspondent banking requirements entirely, using cryptocurrency networks that operate independently of traditional banking infrastructure.

This independence provides resilience against external banking policy changes and ensures that Barbadian businesses maintain reliable access to international payment systems regardless of correspondent banking trends.

Reducing Currency Exchange Inefficiencies

Businesses dealing with multiple currencies face constant exchange rate fluctuations and conversion spreads that erode profit margins. Digital currency banking solutions allow companies to hold multiple currencies, including stablecoins pegged to major fiat currencies, reducing exposure to exchange rate volatility. Businesses can time currency conversions strategically or maintain natural hedges through diversified currency holdings.

The transparency of blockchain-based exchange rates also ensures businesses receive fair conversion rates without hidden spreads or markups that traditional banks often embed in foreign exchange transactions.

Risk Management and Security Considerations

Cybersecurity and Asset Protection

While Blockchain BankBarbados’s operations offer enhanced security through cryptographic protocols and distributed verification systems, businesses must still implement proper security practices. Multi-signature wallets, cold storage solutions, and robust cybersecurity policies are essential components of blockchain banking risk management. Reputable blockchain banking providers offer institutional-grade security measures, including insurance coverage for digital assets and advanced authentication protocols.

The immutable nature of blockchain transactions provides enhanced fraud protection compared to the traditional banking system, where transactions can be reversed or accounts compromised through social engineering attacks. However, this permanence also means businesses must exercise caution with transaction verification before execution.

Regulatory Compliance and Reporting

Barbadian businesses using blockchain banking solutions must maintain compliance with tax reporting requirements and financial regulations. Reputable blockchain banks provide transaction histories and reporting tools that integrate with accounting systems, ensuring businesses can meet their regulatory obligations. The transparency of blockchain technology actually simplifies many compliance processes by creating auditable transaction trails that are more difficult to manipulate than traditional accounting records.

Businesses should work with accountants and legal advisors familiar with cryptocurrency taxation and blockchain banking regulations to ensure full compliance with Barbadian and international requirements.

Volatility Management Strategies

The cryptocurrency market’s volatility presents both opportunities and risks for businesses. Companies using Blockchain Bank Barbados services should develop clear policies regarding digital asset holdings, conversion timing, and risk tolerance levels. Many businesses adopt strategies like immediate conversion of cryptocurrency receipts to stablecoins or fiat currency to minimize exposure to price fluctuations, while maintaining a small percentage in growth-oriented digital assets for potential appreciation.

Sophisticated treasury management approaches can leverage blockchain banking capabilities to optimize cash flow while managing volatility through diversified holdings and strategic timing of conversions.

Implementation Strategies for Barbadian Businesses

Getting Started with Blockchain Banking

Businesses interested in adopting crypto-friendly banking solutions should begin with education and planning. Understanding the basic concepts of cryptocurrency, blockchain technology, and digital asset management provides the foundation for successful implementation. Many blockchain banks offer educational resources, onboarding support, and consultation services to help businesses transition smoothly.

Starting with limited use cases, such as accepting cryptocurrency payments from select customers or making specific international payments, allows businesses to gain experience while managing risk. Gradual expansion based on positive results creates sustainable adoption paths.

Integration with Existing Systems

Modern Blockchain Bank Barbados platforms offer APIs and integrations with popular accounting software, e-commerce platforms, and business management systems. This compatibility allows businesses to incorporate blockchain banking capabilities without completely replacing existing infrastructure. Payment processors that support both traditional and cryptocurrency transactions provide transitional solutions that maintain business continuity during adoption phases.

Businesses should evaluate integration requirements early in the selection process to ensure chosen blockchain banking solutions align with their existing technology stack and operational workflows.

Staff Training and Change Management

Successful adoption of blockchain banking solutions in Barbados requires investment in staff training and change management. Employees handling financial transactions need education on cryptocurrency fundamentals, security protocols, and operational procedures specific to blockchain banking. Many institutions offer certification programs and training modules designed for business users rather than technical specialists.

Creating clear policies and procedures documents helps standardize blockchain banking operations and ensures consistency across teams. Designating blockchain banking champions within the organization can facilitate knowledge sharing and troubleshooting.

The Competitive Advantage for Early Adopters

Market Differentiation and Brand Positioning

Barbadian businesses that embrace Blockchain Bank Barbados services early can differentiate themselves as innovative, forward-thinking organizations. This positioning appeals to tech-savvy customers, international clients familiar with cryptocurrency, and partners seeking modern business relationships. Marketing materials highlighting cryptocurrency acceptance and blockchain banking capabilities create distinctive brand identities in crowded markets.

The association with cutting-edge financial technology enhances brand perception across multiple stakeholder groups, including customers, investors, and potential business partners.

Operational Efficiency Gains

Beyond marketing benefits, crypto banking Barbados adoption delivers tangible operational improvements. Automated reconciliation through blockchain transaction records reduces accounting workload. Faster payment settlements improve cash flow management. Lower transaction fees directly enhance profit margins. These efficiency gains compound over time, creating sustainable competitive advantages that are difficult for competitors to overcome without similar technological adoption.

Businesses that establish blockchain banking expertise early position themselves to capitalize on emerging opportunities as the technology matures and adoption broadens.

Access to Investment and Capital

The blockchain and cryptocurrency ecosystem includes venture capital firms, angel investors, and funding platforms specifically focused on businesses operating in this space. Barbadian companies utilizing Blockchain Bank Barbados services become eligible for these funding sources, which may offer more favorable terms or be more accessible than traditional financing options. Additionally, innovative funding mechanisms like tokenization of business assets or revenue-sharing tokens create new capital formation possibilities.

Demonstrating blockchain literacy and operational capability signals to potential investors that a business is positioned for success in the digital economy.

Future Developments and Opportunities

Central Bank Digital Currency Integration

The Central Bank of Barbados has explored central bank digital currency (CBDC) concepts that could integrate with blockchain banking infrastructure. When implemented, CBDCs would provide government-backed digital currencies with the efficiency of blockchain technology, creating a seamless bridge between traditional and digital finance. Businesses already operating with blockchain banking capabilities will be positioned to adopt CBDC solutions immediately upon availability.

This convergence of government-backed digital currency and private blockchain banking services will create a comprehensive digital financial ecosystem that benefits all Barbadian businesses.

Expanded Services and Product Offerings

As the Blockchain Bank Barbados ecosystem matures, businesses can expect increasingly sophisticated services, including blockchain-based trade finance, tokenized securities, decentralized identity solutions, and automated compliance tools. Smart contract-enabled lending platforms will provide alternative financing options with automated underwriting and collateral management. These advanced capabilities will transform how Barbadian businesses access capital and manage financial operations.

The continuous innovation in blockchain technology ensures that early adopters will have access to cutting-edge financial tools that enhance competitiveness in global markets.

Regional Integration and Caribbean Collaboration

Barbados’ leadership in blockchain banking could catalyze regional cooperation in digital financial services across the Caribbean. A Caribbean blockchain banking network would facilitate intra-regional trade, reduce remittance costs, and create economic integration opportunities that transcend traditional banking limitations. Barbadian businesses positioned at the center of this network would gain significant advantages in regional market access and partnership opportunities.

The potential for Barbados to become a Caribbean fintech hub through blockchain banking innovation presents enormous economic development opportunities for the entire nation.

Addressing Common Concerns and Misconceptions

“Cryptocurrency is Too Risky for Business”

While cryptocurrency markets exhibit volatility, Blockchain Bank Barbados services offer risk management too, including immediate conversion to stablecoins or fiat currency, limiting exposure to price fluctuations. The operational benefits of blockchain banking—reduced costs, faster settlements, global accessibility—provide value independent of cryptocurrency price movements. Businesses can leverage blockchain banking advantages while managing digital asset exposure according to their risk tolerance.

Moreover, the regulatory framework in Barbados provides protections that reduce many risks associated with unregulated cryptocurrency operations.

“Traditional Banking is Sufficient”

Many businesses operate successfully with traditional banking but face unnecessary costs and limitations. The blockchain banking approach doesn’t require abandoning traditional banking relationships but rather supplements them with additional capabilities. For businesses with international operations, high transaction volumes, or digital-first business models, blockchain banking delivers measurable improvements that traditional banks cannot match.

The complementary nature of blockchain and traditional banking allows businesses to optimize their financial infrastructure rather than choosing one approach exclusively.

“The Technology is Too Complex”

While blockchain technology involves sophisticated concepts, Blockchain Bank Barbados platforms are designed for business users without technical expertise. User interfaces resemble traditional online banking systems with additional features for cryptocurrency management. Onboarding support, educational resources, and customer service teams help businesses navigate the learning curve. Most companies find the operational aspects of blockchain banking intuitive after initial orientation.

The complexity exists in the underlying technology, but businesses interact through accessible, user-friendly interfaces that require no specialized technical knowledge.

Conclusion

The emergence of a Blockchain Bank Barbados represents a watershed moment for Barbadian businesses seeking competitive advantages in an increasingly digital global economy. This innovative financial infrastructure addresses fundamental limitations of traditional banking while opening new opportunities for growth, efficiency, and international engagement. From reduced transaction costs and faster payment settlements to access to global digital markets and enhanced financial inclusion, the benefits span across all business sectors and sizes.

Barbadian entrepreneurs and established companies that embrace blockchain banking solutions position themselves at the forefront of financial innovation in the Caribbean. The regulatory clarity, technological infrastructure, and growing ecosystem support make this an ideal time for businesses to explore blockchain banking capabilities. As the digital economy continues to expand and cryptocurrency adoption becomes mainstream, early adopters will enjoy substantial first-mover advantages in operational efficiency, market positioning, and access to emerging opportunities.

Read More: Best Enterprise Blockchain Analytics Software 2025 Guide