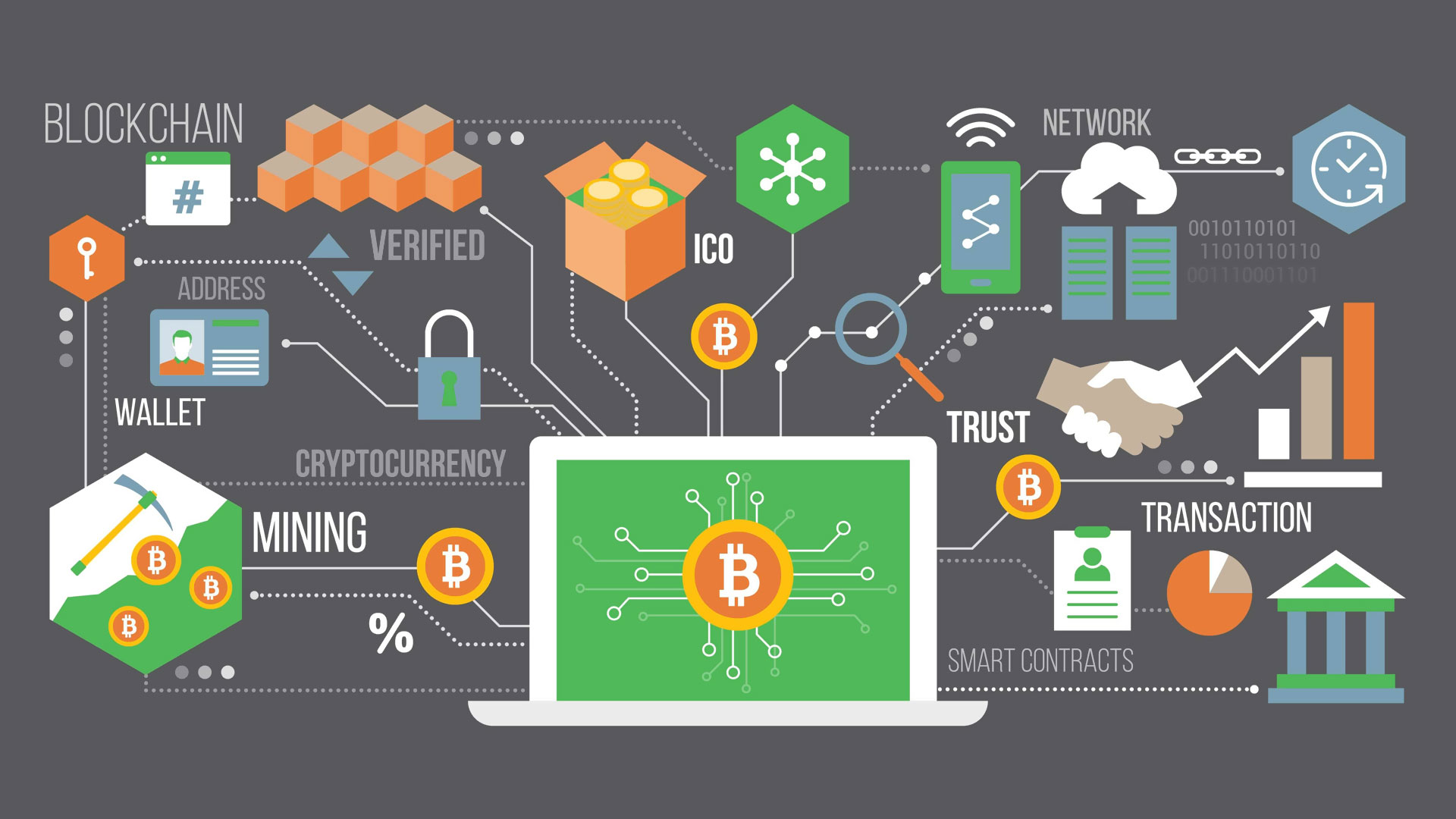

Blockchain Revolutionizing Systems of records and trust have traditionally defined the banking sector. Globally, ledgers kept by central banks, governments, and financial organisations have been the backbone of centuries-old trade. But blockchain technology is causing a dramatic change to this conventional approach. Blockchain transforms the globe from paper-based, centralised systems to digital and tokenised ecosystems by bringing a distributed, transparent, and safe way of recording transactions. Blockchain is becoming a pillar of a new financial age from our investments and movement of money to our compliance with laws and identity verification.

Digital Tokenisation Opening Up Investment

Tokenisation is one of the most transformative effects of blockchain technology in finance. These tokens enable fractional ownership, making assets more accessible to a wider range of investors. This technology is lowering the barriers to entry, allowing everyday people to invest in markets that were once out of reach. With tokenisation, financial opportunities are now available to a much larger portion of the global population. It offers a new way for individuals and smaller investors to access high-value assets.

The process is changing the way people think about ownership and investment, shifting from exclusive to more inclusive. Blockchain-based tokenisation is challenging traditional financial systems and rethinking who can participate in the investment world. By democratizing access to assets, tokenisation is creating a more equitable investment environment. This breakthrough is reshaping global finance and offering new pathways for wealth creation and economic growth.

Globally Faster and Cheaper Transactions

Slowness in processing periods, expensive costs, and several middlemen have always plagued cross-border transfers. By allowing peer-to–peer transactions on a distributed network—often completing in seconds rather than days—blockchain alters this Blockchain substantially cuts the time and expenses involved with international money transfers without the necessity of clearinghouses or correspondent banks. Businesses running worldwide supply chains or migratory workers returning remittances back home may especially benefit from this.

Moreover, stablecoins based on blockchain technology—digital currencies linked to fiat money—offer a consistent means of exchange, therefore lowering volatility in worldwide transactions. Blockchain technology is redefining how money flows across borders by removing inefficiencies and implementing openness; it is a more inclusive, efficient, transparent standard than ever before.

Changing Our Approach to Loan and Capital Raising

DeFi systems automate financial agreements using smart contracts, therefore eliminating banks or brokers. While borrowers may access loans by offering security, all in a distributed manner, individuals can lend their digital assets and earn interest. This opens credit markets to those who, either geographically, economically, or legally, might not have access to conventional banking services.

Blockchain also facilitates creative crowdsourcing ideas such token launches and initial coin offers (ICOs), therefore enabling entrepreneurs to raise money worldwide free from the constraints of conventional venture financing. Especially in underprivileged areas, these systems save expenses, speed up access to finance, and increase financial involvement. Blockchain is thus changing not only our borrowing behaviour but also the worldwide financing of innovation.

Addressing Identity and Compliance Transparency

Long a difficult and expensive feature of financial operations, regulatory compliance has Blockchain presents a fresh degree of auditability and openness that would greatly enhance this process. Its unchangeable ledger guarantees tamper-proof and clearly traceable transaction histories, therefore facilitating financial institutions’ compliance with anti-money laundering (AML) and know-your-customer (KYC) rules. Blockchain also makes possible reliable, safe digital identity systems.

People can keep control over their personal data and disclose just what is required with banks or authorities, therefore improving both efficiency and privacy. Along with helping banking institutions simplify onboarding and verification procedures, this lowers fraud and cyber risk. The financial industry may create more reliable and user-friendly solutions by including blockchain into compliance and identity management, therefore turning trust into a technical rather than a manual process.

Overcoming Integration Challenges with Blockchain

Blockchain has problems even if it seems promising. Technical problems include scalability and the energy consumption of some blockchain systems still cause criticism. Another challenge is interoperability between several blockchains since scattered systems might complicate acceptance and restrict user experience. Moreover, the regulatory surroundings is still changing. Blockchain is embraced by certain nations while others are more wary or even antagonistic towards it, therefore confusing businesses and investors both.

Another aspect is organisational opposition to change, particularly in conventional institutions strongly committed in legacy systems. Still, many of these challenges are being resolved by creative ideas, standardising initiatives, and more cooperation among tech companies, authorities, and banks. Once these obstacles are solved, blockchain’s road to fully realise its potential in revolutionising banking gets more obvious.

Final Thoughts

Blockchain is aggressively changing the basis of world finance, not only a buzzword. Blockchain presents faster, more transparent, fair processes from the way we invest and transmit money to how we borrow, check identities, and follow rules. Its capacity to cut intermediaries, Cryptocurrency Market lower expenses, and empower people is generating a new, more inclusive and strong financial paradigm. Although technical and legal obstacles abound on the path to broad acceptance, the trend is clear. Blockchain will grow not only a tool for innovation but also a necessary infrastructure supporting the future of world banking as it develops and matures.